EX-99.2

Published on May 10, 2022

Dear Shareholders, Building off our excellent momentum and performance in 2021, we started this year strong and delivered very positive first quarter 2022 results. Our growth trended robustly in the first quarter of 2022. Revenue reached $44.3 million, which exceeded our expectations, and grew 51% year-over-year. Our customer base increased to 3,664 accounts as of March 31, 2022, representing growth of 27% from last year at this time. The average revenue per account was approximately $49,500 and increased nearly 18% compared to Q1 last year. 1 Similarweb Q1 2022 Shareholder Letter

Importantly, we achieved a record overall net revenue retention rate, or NRR, of 115% in the quarter and a rate of 127% for our $100K+ annual recurring revenue (ARR) customer segment, the fifth consecutive quarter of expansion. In summary, we completed our first year as a public company with excellent growth and increasing momentum. While this is quite an achievement, these are still very early days for us. We believe there is the opportunity for the long term durability of demand for our growth platform, as companies continue to invest in digital transformation and increasingly rely on digital means to operate and grow. Favorable Global Trends We see three worldwide trends that are beneficial to the growth of our company. First, the Digital Transformation Age has arrived. We have become an “online first society” when searching for information, shopping for nearly everything and seeking recreation. The more our world becomes digital first, brands will be increasingly dependent on digital as their source of customer and revenue growth. We believe Similarweb is the leading solution and compass to help brands win and grow in the digital world. Second, businesses have become more and more data-driven and reliant on data to drive their operations, as technology today enables them to collect and analyze more data faster and easier. And companies spend billions to collect and analyze data on their own 2 Similarweb Q1 2022 Shareholder Letter

operations, but being data-driven is not enough. They need a solution that gives them the context, and helps them make sense of and benchmark their performance against market data, to see what “good” looks like, and seize untapped opportunities. We believe Similarweb has the best and most accurate data to help companies make the right strategic decisions. Third, we are entering a new era where privacy and security concerns take center stage. The increasing number of walled gardens of the digital world are making it harder on brands to access critical audience data about their own audience. As third party cookies are eliminated, and control of identifiers for advertisers (IDFAs) moves into the hands of consumers, companies will become increasingly dependent on market research and market data to gain visibility into their performance within the digital world. As a result, we believe Similarweb solutions are becoming more mission critical than ever. We are positioned to benefit from these trends, as our customers' growth challenges represent our opportunities. Strategy Execution As we enter 2022, we have powerful momentum and are focused on driving consistent growth in pursuit of our three-year objectives. Our sights are set on reaching $450 million to $500 million in ARR when we exit 2024. To stay on that trajectory this year, our performance will need to originate from: 1) substantial data and technology advantages we seek to maintain and enhance, 2) outstanding return on investment that we offer our customers through our digital intelligence solutions, and 3) successful execution of our go-to-market strategies, catalyzed by smart investments. Uplifting our efforts are the powerful undercurrents of digital transformation trends impacting the industries we serve globally. Our web-and-app intelligence solutions reveal the competitive landscape in the digital world. The actionable data and insights we deliver enable our customers to optimize their digital performance and ignite their growth. Our customers are excited about our solutions because we help them achieve a distinct competitive edge. We provide timely, highly valuable, market-based digital signals to company decision-makers who are responsible for driving revenue growth. Our digital 3 Similarweb Q1 2022 Shareholder Letter

intelligence solutions are designed to enable our customers to understand their markets better than their competitors, to take action faster, and to win in the digital world. The combination of our proprietary artificial intelligence with our deep bench of talented data scientists and engineers helps our customers succeed. We constantly gather and process vast amounts of data generated by activity in the digital world, from which we distill the most important growth signals for our customers to leverage. In this era of digital transformation for businesses, we stand out because we illuminate opportunities and facilitate speed. We offer an advanced competitive intelligence and analytics software service, which provides compelling solutions in digital marketing, sales, market research, and ecommerce strategy, as well as reliable and timely alternative data for the investment community. Our data, technology and insights are dynamic. We seek to constantly innovate and improve upon our breadth of data acquisition, our depth of measurement, our speed of accurate insight creation, and our development of use cases. This quarter we made major investments and improvements to our mobile web data sets - across referrals, keywords and traffic. For over 10 years, we’ve been working relentlessly on solving the incredibly challenging problem of measuring and predicting digital behavior and determining its most valuable implications for companies and organizations around the world. To succeed in their respective industries, businesses must address perpetual strategic growth questions, namely: How do we grow our demand? How do we grow our product portfolio? How do we grow our market share? How do we grow our audience and customers? How do we grow our sales? Similarweb provides companies with contextual answers to these questions and more. We give companies visibility into the digital world that they do not have on their own, along with insights that guide them on what to do next in order to grow. Strong customer demand for our growth-enabling intelligence drove positive results across our product portfolio in the first quarter. When looking at our customer segments by industry, revenue grew fastest in B2B services, such as adtech and software companies. Our largest revenue contributions continued to come from transactional services, such as retail, travel, financial services and consumer-product companies. The effectiveness of our sales efforts continued in the first quarter, both direct and indirect. As of March 31, 2022, nearly 80% of our customer base currently purchased more than one 4 Similarweb Q1 2022 Shareholder Letter

solution. Our go-to-market execution continues to be highly efficient globally, with 54% of our revenue generated from outside of the United States in Q1 2022. The expansion of our global customer base – consisting of SMBs, enterprise, and strategic accounts – continues to show increasing velocity. A notable indicator of this velocity comes from companies who generate more than $100K in ARR, a number which continued to expand in the first quarter. We increased our number of $100K+ ARR customers as of March 31, 2022 by 96 from the same time last year, representing growth of 48% year-over-year. This important customer segment represents over 53% of our total ARR as of March 31, 2021, a new record. Further, we improved NRR from 125% as of December 31, 2021 to 127% as of March 31, 2022 in this customer segment, again a new record high. Financial Results With our solutions and customers driving our SaaS business model to new heights, our financial results in the first quarter exceeded our expectations. When examining our financial results, note that all references to our expenses and operating results (other than revenue) are presented on a non-GAAP basis and are reconciled to the GAAP results in the financial statements presented below. Revisiting our top line results, in the first quarter of 2022, we delivered record revenue of $44.3 million, reflecting 51% year-over-year growth driven by increases in customers and revenue per customer. 5 Similarweb Q1 2022 Shareholder Letter

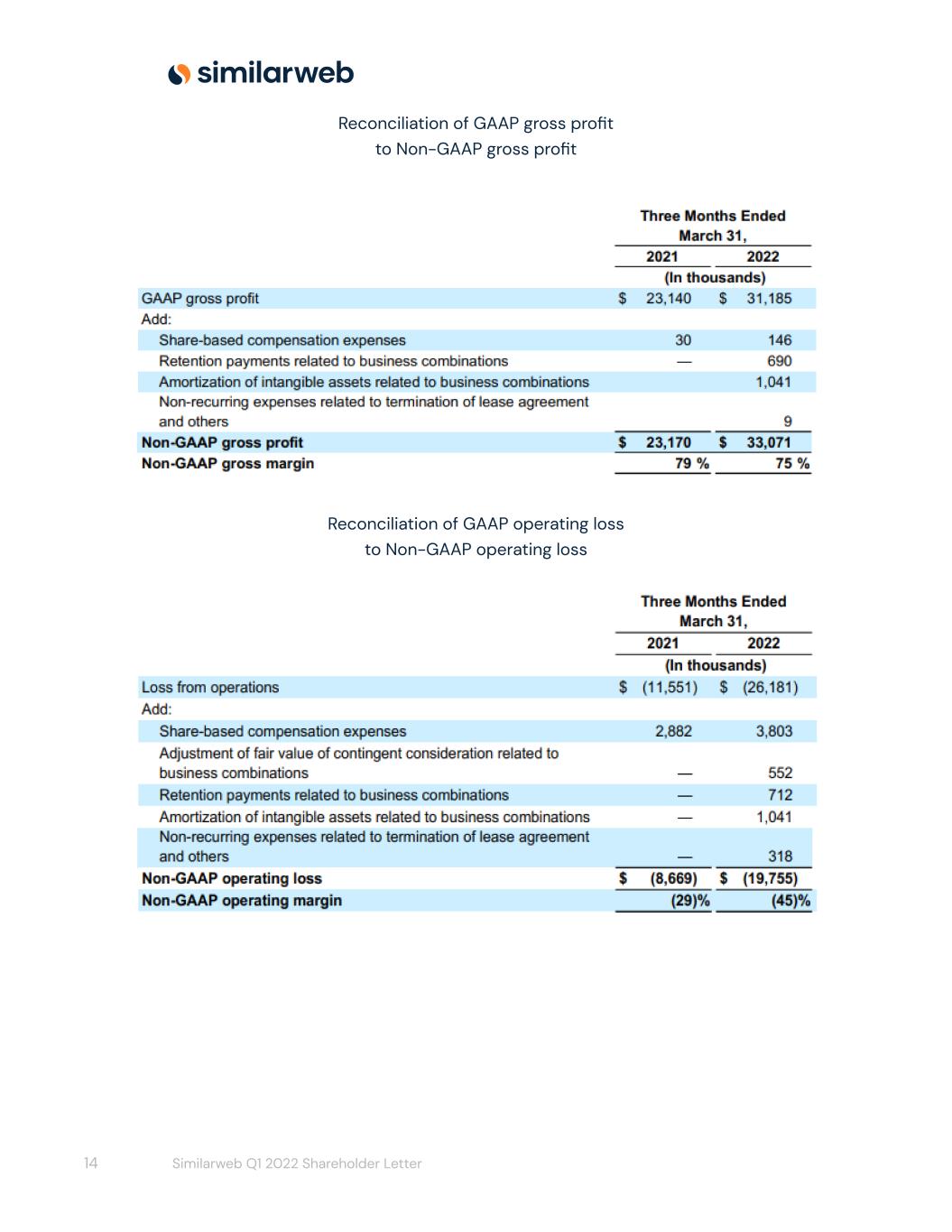

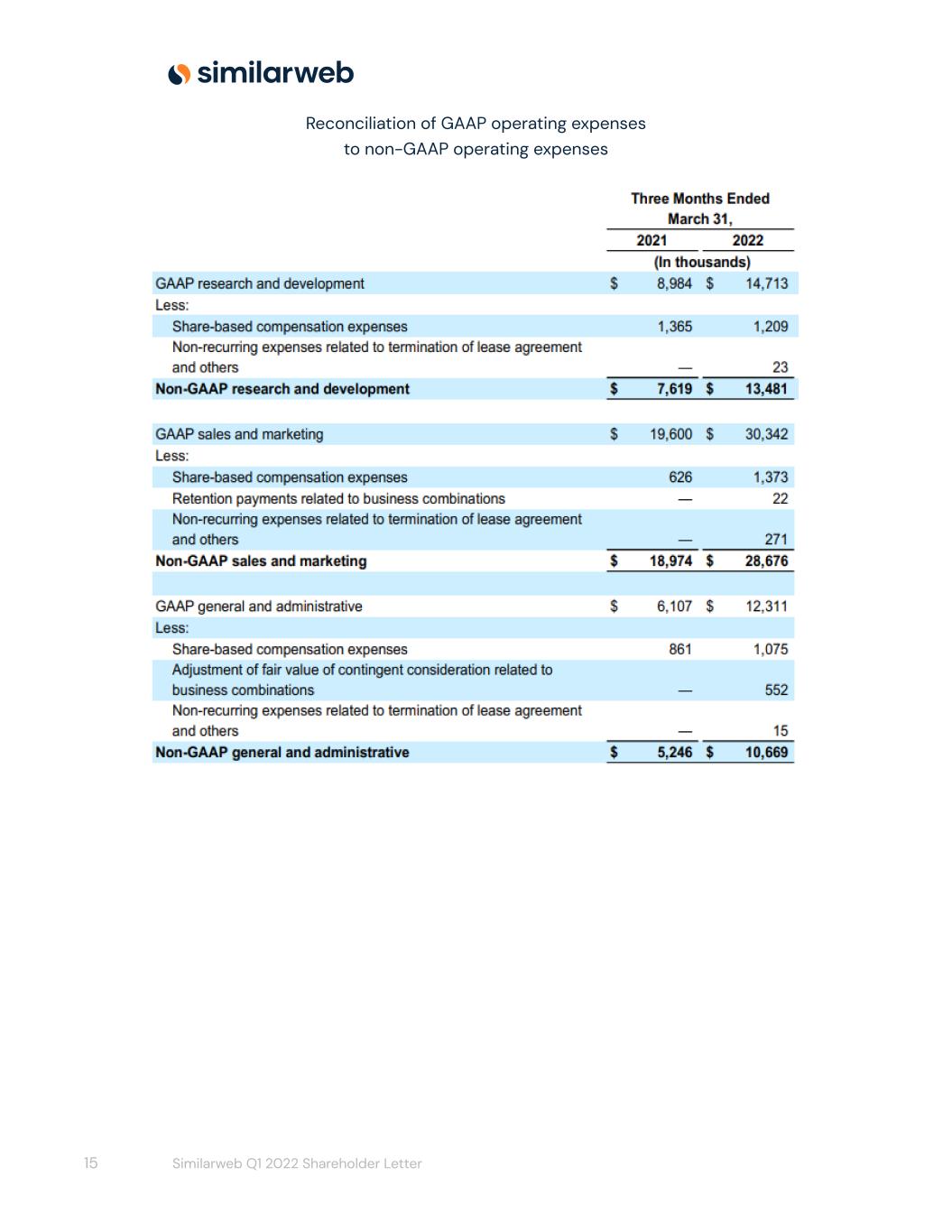

Our gross profit totaled $33.1 million in the first quarter of 2022, compared to $23.2 million at the same time last year. Gross margin was 74.7% in the first quarter of 2022, versus 78.8% in the first quarter of 2021. To analyze gross margin on a comparable basis, the impact from the Embee Mobile acquisition on gross margin in the first quarter of 2022 was approximately 320 basis points. Because these expenses are almost entirely fixed, we expect the negative impact on gross margin will decrease as revenue increases in future periods. Operating expenses grew to $52.8 million in the first quarter of 2022, representing 119.3% of revenue – up from $31.8 million in the first quarter of 2021, or 108.1% of revenue – largely reflecting the investment in personnel across the business to support our growth. Specific components of our operating expenses included: Our research and development investment nearly doubled to $13.5 million in the first quarter of 2022, up from $7.6 million in the first quarter of 2021. This increase was driven primarily by growth of employee headcount focused on our newer revenue-generating solutions, such as Shopper Intelligence, Sales Intelligence and Investor Intelligence. Sales and marketing grew to $28.7 million in the first quarter of 2022, up from $19.0 million in the first quarter of 2021, driven principally by increased headcount in sales and account management, as well as increased marketing activities. Our sales and marketing costs are divided approximately 55% to 60% to new customers acquisition (land), and 40% to 45% to retention, upsell and cross-sell (expand). When analyzing our investment in customer acquisition costs (CAC) for growth efficiency, we track an estimated payback period and its trend, which has averaged between 15 and 16 months, on a gross profit basis, over the trailing four quarters. We adjust for the impact of the Embee Mobile acquisition and data.ai partnership in computing the CAC payback period. Payback on expansion and customer retention costs (CRC), is faster than payback on new customer CAC and contributes meaningfully to our growth efficiency. We continue to invest into customer acquisition to support future growth as well as into CRC based on our accelerating NRR and increasing customer lifetime value. General and administrative costs grew to $10.7 million in the first quarter of 2022, up from $5.2 million in the first quarter of 2021, which was driven by headcount increases to support growth, as well as by expenses that we incur as a publicly traded company. Going 6 Similarweb Q1 2022 Shareholder Letter

forward, these expenses will become more comparable as we have been publicly traded for over a year. Looking at our bottom line, our non-GAAP operating loss in the first quarter of 2022 totaled $19.8 million, better than our expectations. Importantly, as we exceeded our expectations for revenue, our operating losses were less than we anticipated. On an incremental basis from the midpoint of our guidance ranges, for every dollar in revenue we exceeded the midpoint (approximately $3 million total incremental revenue), 32% of the dollar flowed through as non-GAAP operating profit (approximately $1 million total incremental profit). Business Outlook As we look to the rest of the year ahead, we have much to be excited about. As a reminder, approximately 99% of our revenue is ARR - annual recurring revenue - with minimum subscription terms of one year. We continue to increase the number of customers with multi-year subscription terms. As of the end of first quarter of 2022, 35% of our ARR was generated from customers with multi-year subscription commitments, compared to 26% at the same time last year. This solid trend, along with our high NRR, confirms our belief that our customers receive substantial value from our digital intelligence offerings and gives us visibility into the durability of our ARR. We believe a further indication of our future performance is our deferred revenue, which was $91.3 million at the end of the first quarter of 2022, compared to $63.3 million at the end of the first quarter of 2021. Our Remaining Performance Obligations, or RPO, totaled $159.1 million at the end of the first quarter of 2022, up from $94.9 million at the end of the first quarter of 2021, and significantly more than in our most recent quarters. This represents strong demand and increased upsell commitments. We expect to recognize approximately 88% of total RPO at the end of the first quarter of 2022 as revenue over the next 12 months. The continued momentum in our business fuels our confidence to raise revenue guidance for the year. For the second quarter of 2022, we expect total revenue in the range of $45.5 million to $45.9 million, representing 41% year-over-year growth at the midpoint. For the fiscal year ending December 31, 2022, we are raising guidance and expect total revenue in 7 Similarweb Q1 2022 Shareholder Letter

the range of $196.0 million to $197.0 million, representing 43% growth year-over-year at the midpoint of the range. Looking at our projected Non-GAAP operating loss for the second quarter of 2022, we expect it to be in the range of ($23.0 million) to ($23.5 million) and for the full year of 2022 between ($82.0 million) and ($83.0 million). This outlook includes impacts to COGS and in turn, to gross profit and gross margin, from our Embee Mobile acquisition and the data.ai (formerly App Annie) partnership that were not in prior year periods. As a reminder, we plan to deploy data.ai data into our intelligence solutions as a new, revenue-generating module in the second quarter of 2022. Both Embee Mobile and data.ai expenses are fixed and increase COGS when compared to prior year periods. For modeling our business, we anticipate Non-GAAP gross margin to be approximately 73% to 74% in the second quarter of 2022, and 75% to 76% for the year ending December 31, 2022 as a result of these impacts. Growth Opportunity We aspire to be one of the best SaaS companies in the world. To that end, we believe our revenue growth and gross margin continue to set us apart on a fundamental basis. Our company culture of innovation and inclusivity helps us better understand and serve our customers in a world that is becoming more global, more diverse, and more digital every day. Our investments in our pursuit of efficient momentum-fueled growth show early returns and incremental gains through disciplined execution. Our results to date show that our customers’ growth challenges represent our greatest opportunities around the world. We believe we are rapidly becoming the must-have solution that companies utilize to see and capture their growth opportunities in the digital world at global scale. Businesses are shifting their investments to technologies that get them to the right outcomes fast. Our solutions target the most essential, revenue-driving operations of our customers – sales, marketing, analytics, ecommerce – and directly benefit the C-suite with efficient time-to-value. We recently commissioned an independent study from Forrester Consulting which showed our solutions drove a return on customer investment of 642% between 2018 and 2021 for one of our customers who used our Research Intelligence and Marketing Intelligence solutions, a significant result. 8 Similarweb Q1 2022 Shareholder Letter

Our relevance across a wide variety of industries, ranging from financial services, to retail, travel, CPG’s, to media, and others, opens up a tremendous market opportunity. We estimate our total addressable market approaches is $34 billion annually on competitive market research and analysis. The more success our customers find with us, the more they spend with us, and the more they contribute to us achieving our objectives of positive free cash flow and $450 to $500 million in ARR exiting 2024. We are just getting started. Thank you very much for your attention. We look forward to keeping everyone updated on our progress. Sincerely, Or Offer Founder and Chief Executive Officer Jason Schwartz Chief Financial Officer 9 Similarweb Q1 2022 Shareholder Letter

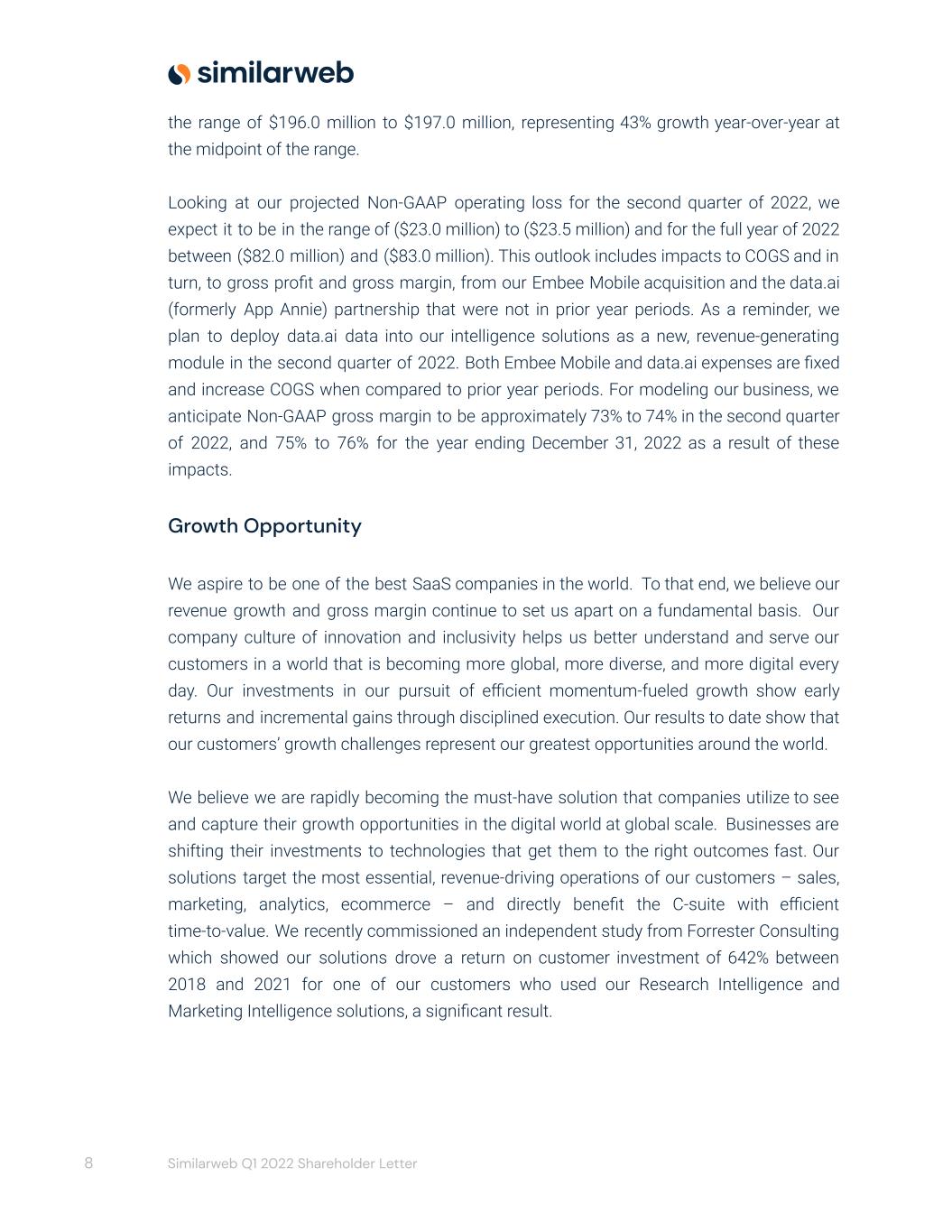

Consolidated Balance Sheet ֿ 10 Similarweb Q1 2022 Shareholder Letter

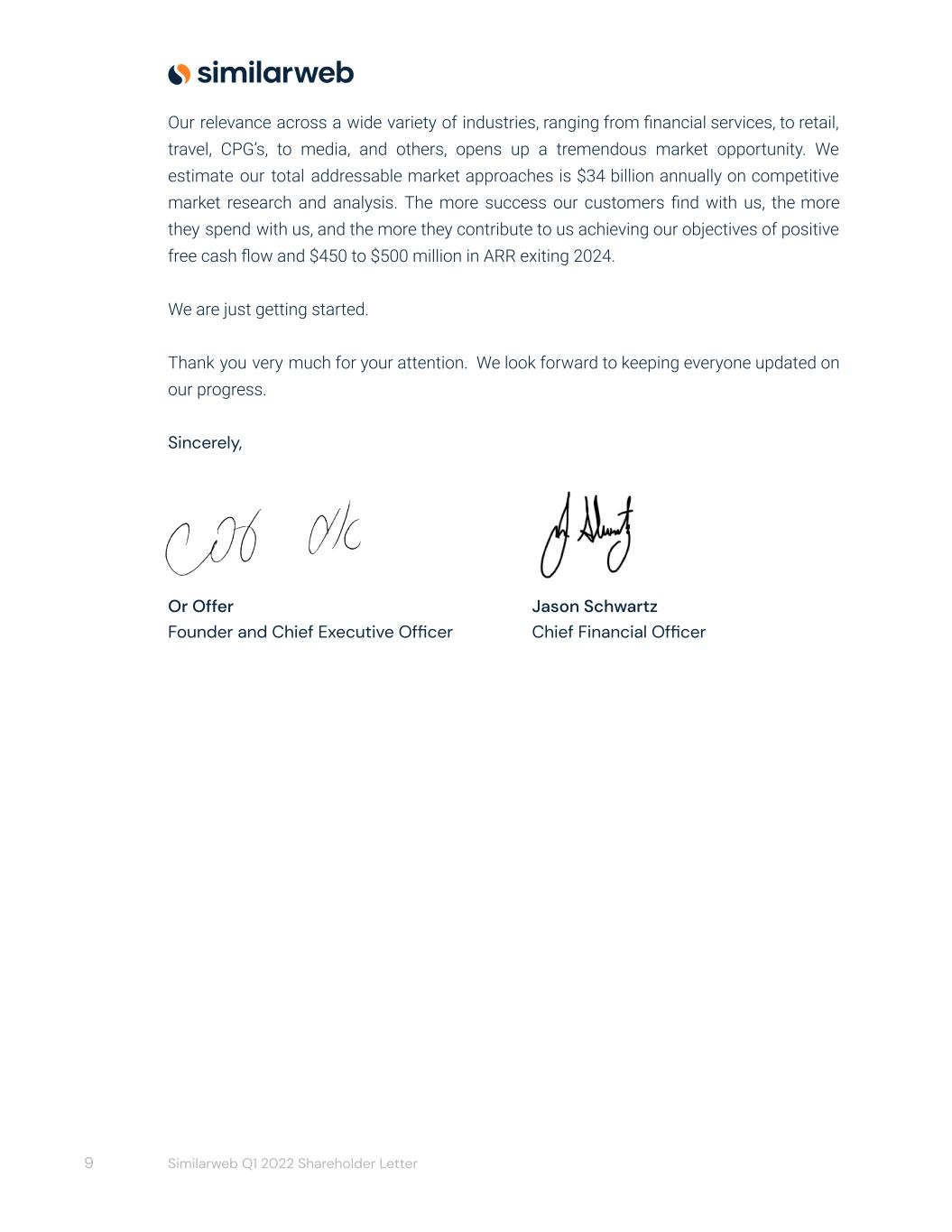

Consolidated Statements of Comprehensive Income (Loss) Share-based compensation costs included above: 11 Similarweb Q1 2022 Shareholder Letter

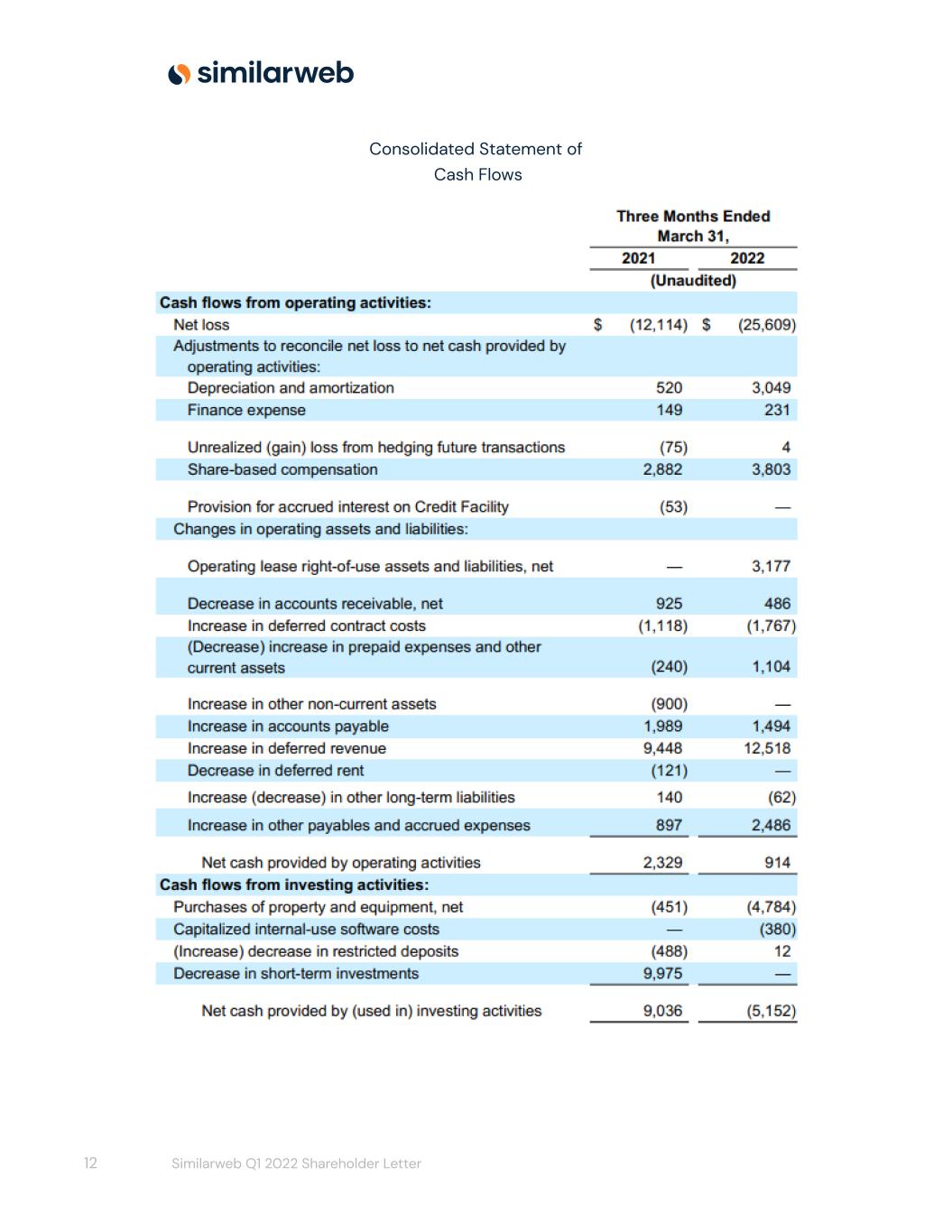

Consolidated Statement of Cash Flows 12 Similarweb Q1 2022 Shareholder Letter

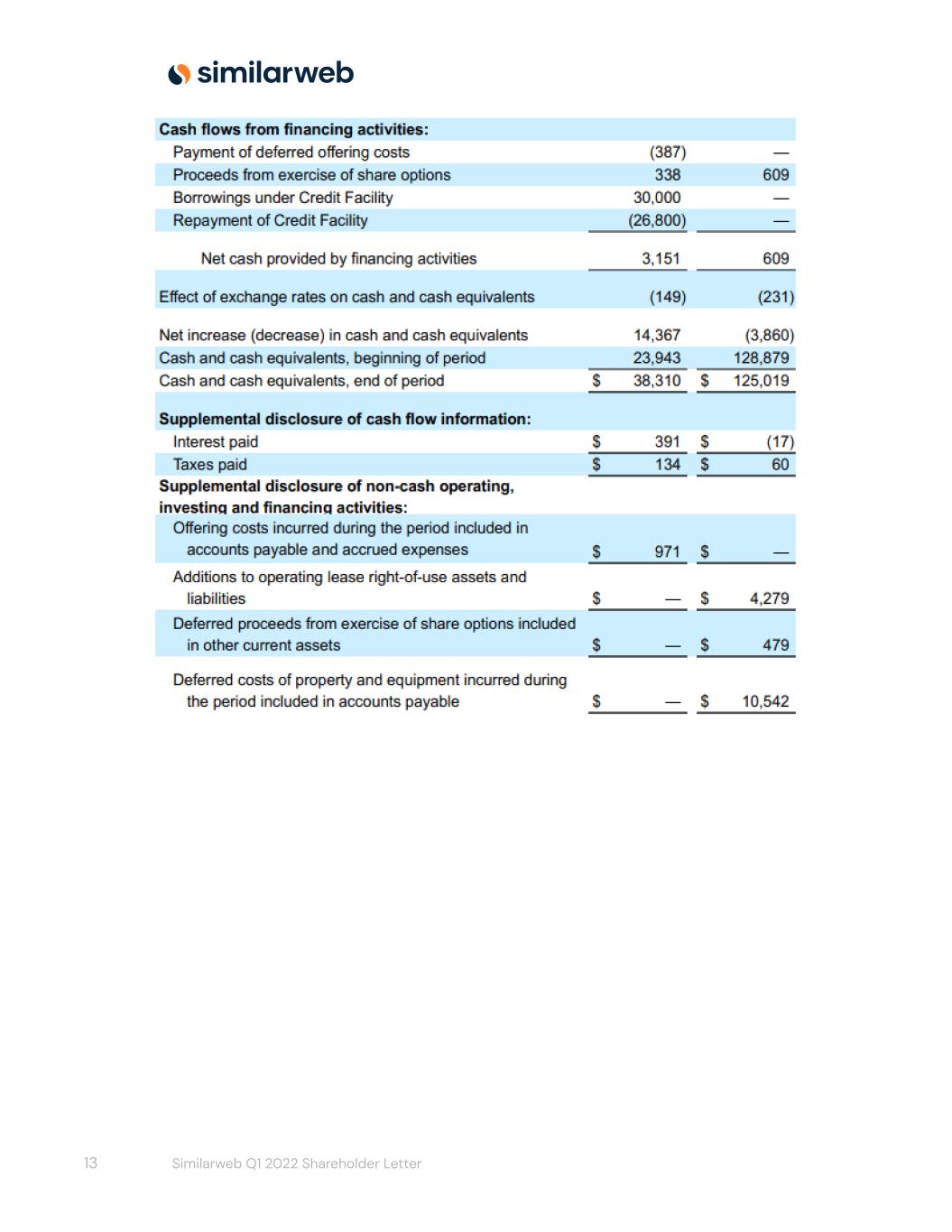

13 Similarweb Q1 2022 Shareholder Letter

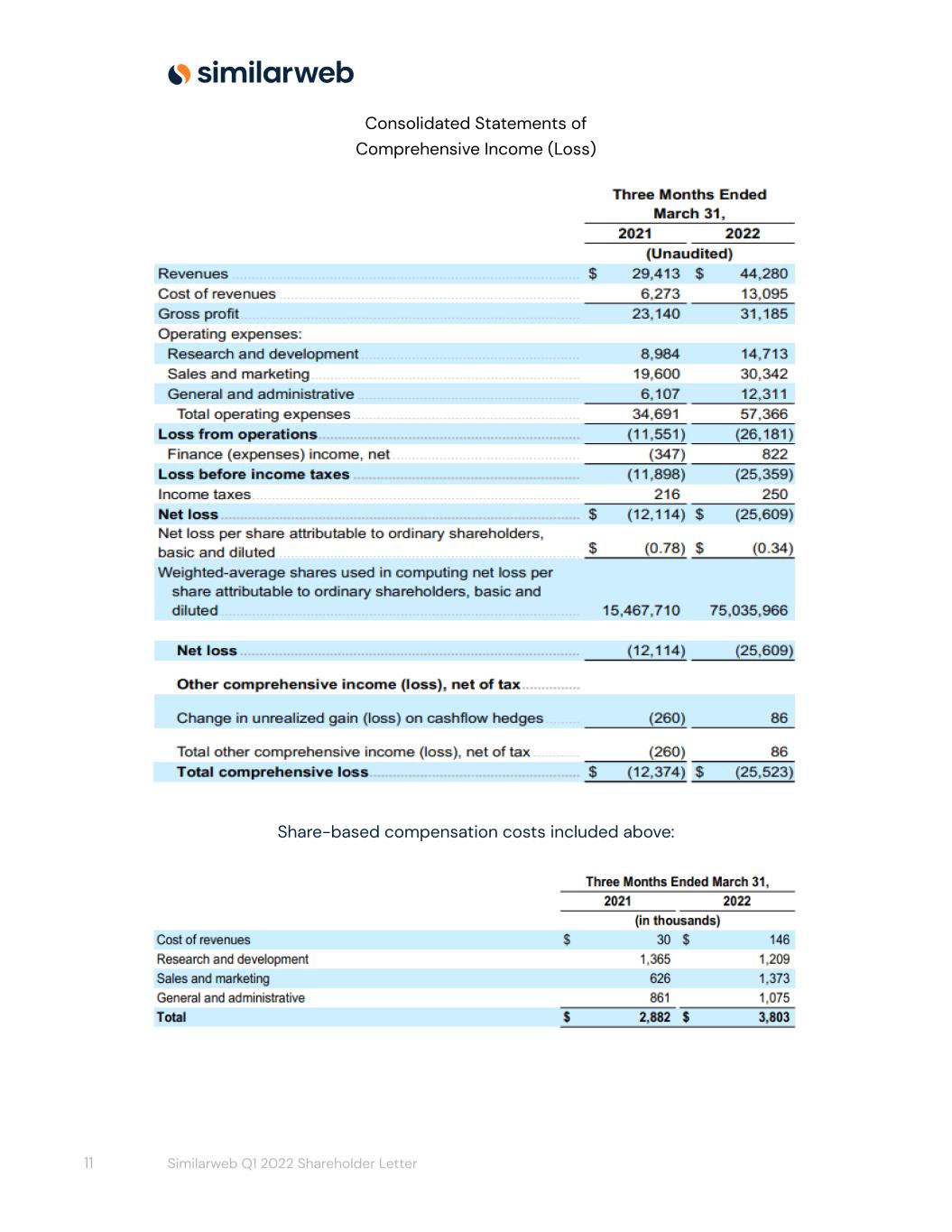

Reconciliation of GAAP gross profit to Non-GAAP gross profit Reconciliation of GAAP operating loss to Non-GAAP operating loss 14 Similarweb Q1 2022 Shareholder Letter

Reconciliation of GAAP operating expenses to non-GAAP operating expenses 15 Similarweb Q1 2022 Shareholder Letter

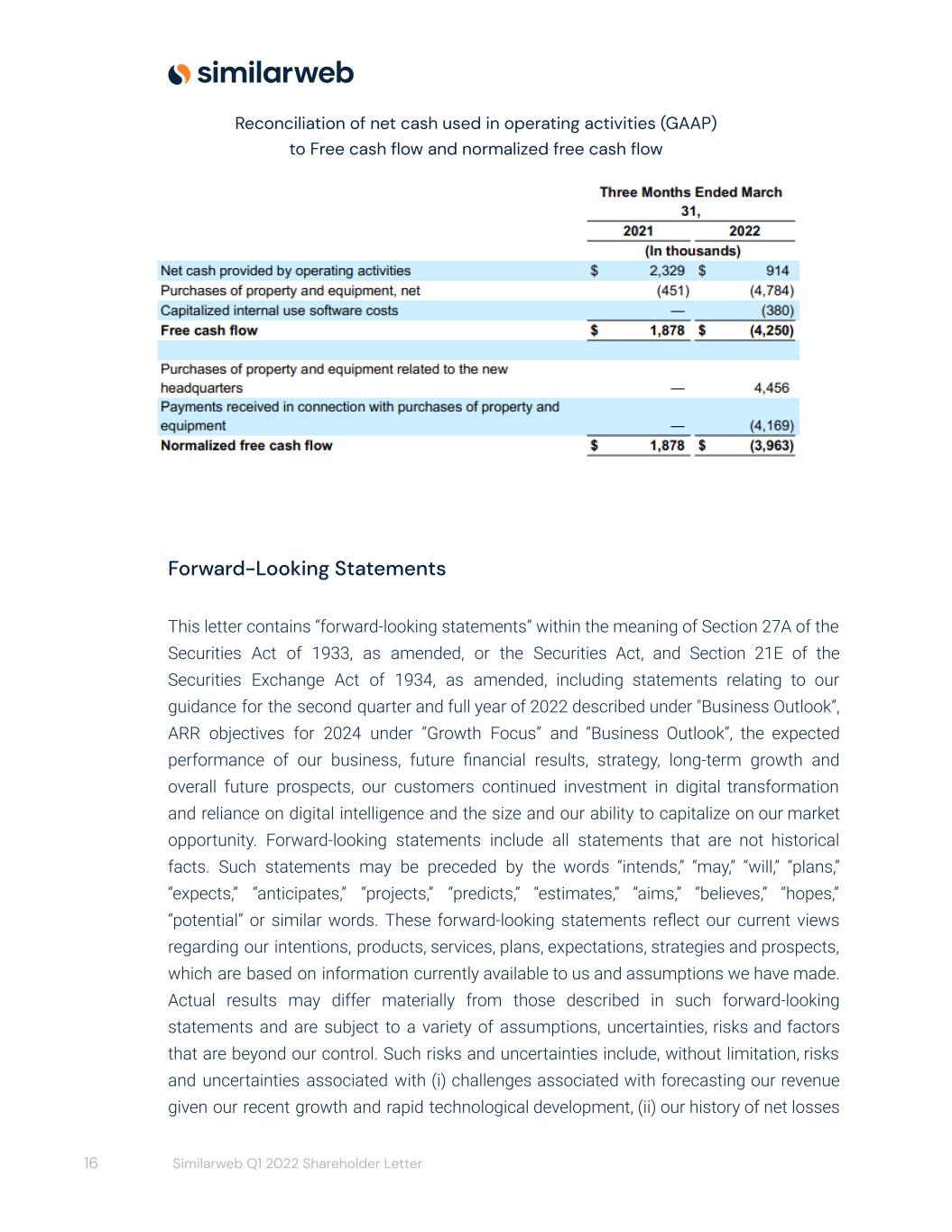

Reconciliation of net cash used in operating activities (GAAP) to Free cash flow and normalized free cash flow Forward-Looking Statements This letter contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to our guidance for the second quarter and full year of 2022 described under "Business Outlook”, ARR objectives for 2024 under “Growth Focus” and “Business Outlook”, the expected performance of our business, future financial results, strategy, long-term growth and overall future prospects, our customers continued investment in digital transformation and reliance on digital intelligence and the size and our ability to capitalize on our market opportunity. Forward-looking statements include all statements that are not historical facts. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. These forward-looking statements reflect our current views regarding our intentions, products, services, plans, expectations, strategies and prospects, which are based on information currently available to us and assumptions we have made. Actual results may differ materially from those described in such forward-looking statements and are subject to a variety of assumptions, uncertainties, risks and factors that are beyond our control. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) challenges associated with forecasting our revenue given our recent growth and rapid technological development, (ii) our history of net losses 16 Similarweb Q1 2022 Shareholder Letter

and desire to increase operating expenses, thereby limiting our ability to achieve profitability, (iii) challenges related to effectively managing our growth, (iv) intense competition in the market and services categories in which we participate, (v) potential reductions in participation in our contributory network and/or increase in the volume of opt-out requests from individuals with respect to our collection of their data, or a decrease in our direct measurement dataset, which could lead to a deterioration in the depth, breadth or accuracy of our data, (vi) our inability to attract new customers and expand subscriptions of current customers, (vii) changes in laws, regulations, and public perception concerning data privacy or change in the patterns of enforcement of existing laws and regulations, (viii) our inability to introduce new features or solutions and make enhancements to our existing solutions, (ix) real or perceived errors, failures, vulnerabilities or bugs in our platform, (x) potential security breaches to our systems or to the systems of our third-party service providers, (xi) our inability to obtain and maintain comprehensive and reliable data to generate our insights, (xii) changes in laws and regulations related to the Internet or changes in the Internet infrastructure itself that may diminish the demand for our solutions, (xiii) failure to effectively develop and expand our direct sales capabilities, which could harm our ability to increase the number of organizations using our platform and achieve broader market acceptance for our solutions and (ix) the impact of global events, such as the ongoing COVID-19 pandemic, including variants of COVID-19, or other public health crises and the Russian military operations in Ukraine, and any related economic downturn could have on or on our customers’ businesses, financial condition and results of operations. These risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Form 20-F filed with the Securities and Exchange Commission on March 25, 2022, and subsequent reports that we file with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Forward-looking statements represent our beliefs and assumptions only as of the date of this letter. Except as required by law, we undertake no duty to update any 17 Similarweb Q1 2022 Shareholder Letter

forward-looking statements contained in this release as a result of new information, future events, changes in expectations or otherwise. Certain information contained in this letter relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the Company's own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this letter, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of any information obtained from third-party sources. In addition, all of the market data included in this letter involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source. Non-GAAP Financial Measures This letter to shareholders contains certain financial measures that are expressed on a non-GAAP basis. We use these non-GAAP financial measures internally to facilitate analysis of our financial and business trends and for internal planning and forecasting purposes. We believe these non-GAAP financial measures, when taken collectively, may be helpful to investors because they provide consistency and comparability with past financial performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. However, non-GAAP financial measures have limitations as an analytical tool and are presented for supplemental informational purposes only. They should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures and capitalized internal-use software costs. Normalized free cash flow represents free cash flow less capital investments related to the Company's new headquarters and payments received in connection with these capital investments. Non-GAAP operating income (loss), non-GAAP gross profit, Non-GAAP research and development expenses, non-GAAP sales and marketing expenses and non-GAAP general and administrative expenses represents the comparable GAAP financial figure, less share-based compensation, adjustments and payments related to business combinations, amortization of intangible assets and certain other non-recurring items, as applicable and indicated in the above tables. 18 Similarweb Q1 2022 Shareholder Letter

Other Metrics Customer acquisition costs (CAC) represent the portion of sales and marketing expenses allocated to acquire new customers. Customer retention costs (CRC) represent the portion of sales and marketing expenses allocated to retain existing customers and to increase existing customers’ subscriptions. Annual recurring revenue (ARR) represents the annualized subscription revenue we would contractually expect to receive from customers assuming no increases or reductions in their subscriptions. CAC payback period is the estimated time in months to recover CAC in terms of incremental gross profit that newly acquired customers generate. Net retention rate (NRR) represents the comparison of our ARR from the same set of customers as of a certain point in time, relative to the same point in time in the previous year ago period, expressed as a percentage. 19 Similarweb Q1 2022 Shareholder Letter