EX-99.2

Published on August 9, 2022

Exhibit 99.2 1 Similarweb Q2 2022 Shareholder Letter Dear Shareholders, We performed well in the second quarter of 2022, crossing the midpoint of the year ahead of where we expected to be. We achieved excellent results during a challenging time for businesses globally. Over this period, we have seen an increased interest for our products from decision-makers at many companies, which is key to driving revenue growth to new levels in the rapidly shifting global macroeconomic environment. As we navigate in this dynamic environment, we are adapting. Prior to becoming a publicly traded company, we developed a culture of disciplined growth, focused on optimizing our unit economics that enabled us to achieve positive free cash flow in the first quarter of 2021. We used the proceeds of our IPO to accelerate our growth with the same disciplined culture on a path that saw us achieve over 50% revenue growth year-over-year on a quarterly basis. Today, we are expanding our strategic focus to balance growth and profitability. As we progress through the remainder of 2022, we will be working diligently to build on our growth success and drive operational efficiencies on our path to sustained free cash flow. Returning to our results, our momentum continued in the second quarter of 2022 (Q2-22). Revenue reached $47.6 million, which exceeded our estimates, and grew 46% year-over- year.

Exhibit 99.2 2 Similarweb Q2 2022 Shareholder Letter Our customer base increased to 3,849 accounts, as of June 30, 2022, representing 25% growth year-over-year (YoY). The average annual revenue per account was approximately $50,700 and increased approximately 16% compared to the second quarter of 2021 (Q2- 21). Notably, we achieved an overall net revenue retention (NRR) rate of 115% in Q2-22. We achieved an NRR rate of 127% for our $100K+ annual recurring revenue (ARR) customer segment alone. Again, we completed our second quarter with strong growth and sustained momentum from our results of the prior quarter. As our results indicate, we believe that companies continue to invest in digital transformation and our customers have increasingly relied on our technological solutions to operate and grow, especially during challenging times. Our

Exhibit 99.2 3 Similarweb Q2 2022 Shareholder Letter digital intelligence solutions are critical enablement tools for our customers to understand their markets better than their competitors, to act faster, and to win in today’s online world. Favorable Global Trends We continue to see three digital trends worldwide that are beneficial to the growth of our company. The first trend: we are living in the age of digital transformation. The collision of business and consumer dependencies on digital means of commerce and interaction create tremendous opportunities. The effect of “online first” activity necessitates that businesses constantly evaluate and understand current consumer and competitor behavior in the digital world. We believe that the actionable insights we deliver to our customers enable them to optimize their digital performance and position themselves for growth. The second trend: Data-driven decision-making by business leaders requires adding context and visibility beyond internal data. Businesses need reliable external data and insights on the current market environment. We believe that the increasingly urgent need for better visibility during rising global macroeconomic uncertainty appears to have become a catalyst for this trend. We believe Similarweb solutions ease anxiety at a time of volatility by enhancing visibility into the digital world, and are now more important than in the past. The third trend: The full ramifications of data privacy initiatives are yet to be felt by the global business community. From our close interactions with customers and partners, it is increasingly apparent that of the three trends, privacy and security will likely be the next definitive digital frontier over the long term. When support for third party cookies in Chrome is phased out in 2024, and as control of identifiers for advertisers (IDFAs) move into the hands of consumers, we foresee what will resemble a giant light switch being flipped from on to off. Companies will become enshrouded in digital darkness with limited means to discern meaningful audience behavior. As a result, we anticipate that Similarweb audience intelligence capabilities may become more essential to the operations of these companies. In particular, we believe our web and application intelligence solutions illuminate opportunities and facilitate action in the digital world. We believe we remain positioned to benefit from these trends because our customers' growth challenges represent our growth opportunities.

Exhibit 99.2 4 Similarweb Q2 2022 Shareholder Letter Strategy Execution For over 10 years, we have been working relentlessly on solving the challenging problem of measuring and predicting online behavior and determining its applications for companies and organizations around the world. Our passion led to us innovating in the research and business intelligence industries in the global market. Today, we believe our software-as-a- service (SaaS) solutions revolutionize the category of market research and intelligence within the digital world. Without our software, it can take weeks or months to research, benchmark, and analyze companies, industries and markets at a substantial cost. Using our software, companies can take hours, minutes, or seconds to access actionable insights with our relevant solutions. Our solutions apply to a wide variety of industries, ranging from financial services to retail, travel, CPGs, media, and others, and we believe they open up a tremendous market opportunity for us and our customers. We estimate the current total addressable market is approximately $34 billion annually that companies allocate to market research and analysis. To successfully grow our market share, we are laser-focused on execution. Our overall strategy is supported by three pillars we strive to implement: 1. Establishing, maintaining, and enhancing substantial advantages in data and technology 2. Delivering considerable return on investment for our customers through our digital intelligence solutions 3. Executing our go-to-market strategies, catalyzed by smart investments and operating discipline Ultimately, our success depends on the success of our customers. They come to us with data-driven requests such as: How do we increase our demand? How should we change our product portfolio? How do we grow our market share? How do we grow our audience? How do we grow our sales? We can predict how consumers and businesses interact on the internet, across the web and mobile continuum. From our vast data-enabled perspective, we can provide fresh, highly valuable, market- based digital signals to decision-makers who are responsible for driving their companies’ revenue growth. We offer compelling proprietary technology solutions in digital marketing,

Exhibit 99.2 5 Similarweb Q2 2022 Shareholder Letter sales, market research, and ecommerce strategy, which contain easy-to-understand insights that guide companies on what they can do in order to grow. Additionally, we provide reliable and timely alternative data for the investment community that help investors make informed decisions on companies and their strategies. We constantly innovate and improve upon the ability to create accurate insights and develop use cases. This quarter we launched a new, premium App Intelligence module, for which we have received favorable feedback from customers. The new module incorporates mobile app data through our partnership with data.ai (formerly App Annie), integrating leading mobile app coverage into our award-winning desktop and mobile web measurement solutions. We now give organizations a comprehensive view of available digital activity, and the ability to harness insights from mobile, desktop, and app users, from a single interface. We can provide a 360-degree view into virtually any company’s estimated digital footprint, which we believe gives our customers a competitive edge and aids their ability to make better informed business decisions in the digital world. Further advancing our capabilities, we acquired Rank Ranger in May 2022, and expanded our capabilities to create a solution that dominates the field of search engine optimization (SEO). By integrating our traffic analysis and competitive intelligence capabilities with Rank Ranger’s rank and backlink monitoring, we can connect many of the dots of cause-and- effect in SEO activities. Aligning ranking and backlinks monitoring with estimated real-time traffic and real competitors allows us to drive faster and smarter analysis and reporting over time. Combining tracking, advanced reporting, and varied API abilities with our existing solutions can potentially change the competitive landscape for our customers and we look forward to giving them new insights to drive their own operational results. Additionally, we are in the middle of an exciting platform build cycle for our Investor Intelligence solution. We are preparing to release our next major platform iteration, which includes new stock-specific analysis, and new estimated performance indicators on SaaS companies that have not been available previously on the platform. The early feedback that we are receiving from our customers that have participated in the beta testing and operations in the new interface has been positive. Our goal is to launch the new feature set in the second half of 2022, pending any final modifications. The performance of our current product solutions and the strong customer demand for our data insights drove positive results across our product portfolio in Q2-22. When looking at our customer segments by industry, revenue grew fastest in the B2B industry, and in

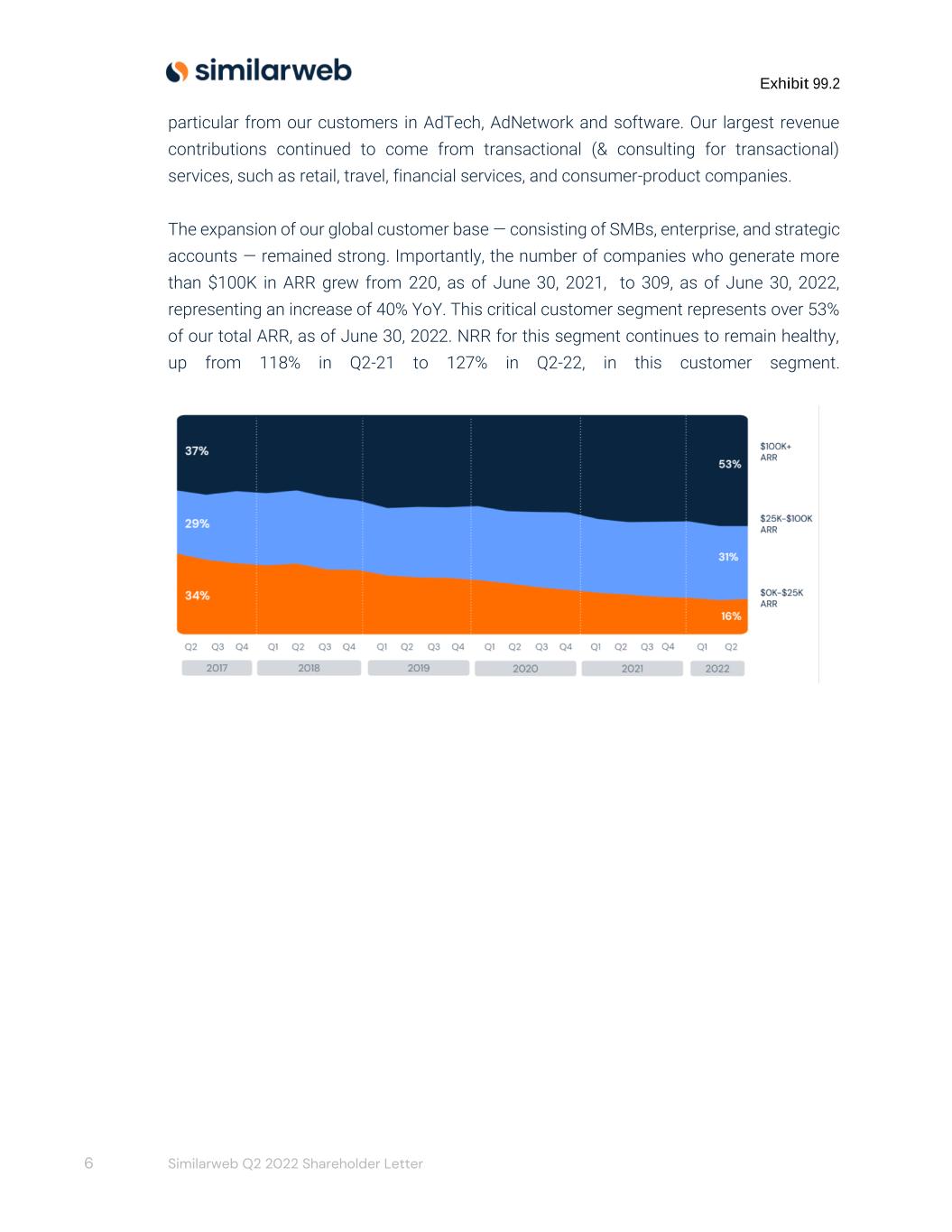

Exhibit 99.2 6 Similarweb Q2 2022 Shareholder Letter particular from our customers in AdTech, AdNetwork and software. Our largest revenue contributions continued to come from transactional (& consulting for transactional) services, such as retail, travel, financial services, and consumer-product companies. The expansion of our global customer base — consisting of SMBs, enterprise, and strategic accounts — remained strong. Importantly, the number of companies who generate more than $100K in ARR grew from 220, as of June 30, 2021, to 309, as of June 30, 2022, representing an increase of 40% YoY. This critical customer segment represents over 53% of our total ARR, as of June 30, 2022. NRR for this segment continues to remain healthy, up from 118% in Q2-21 to 127% in Q2-22, in this customer segment.

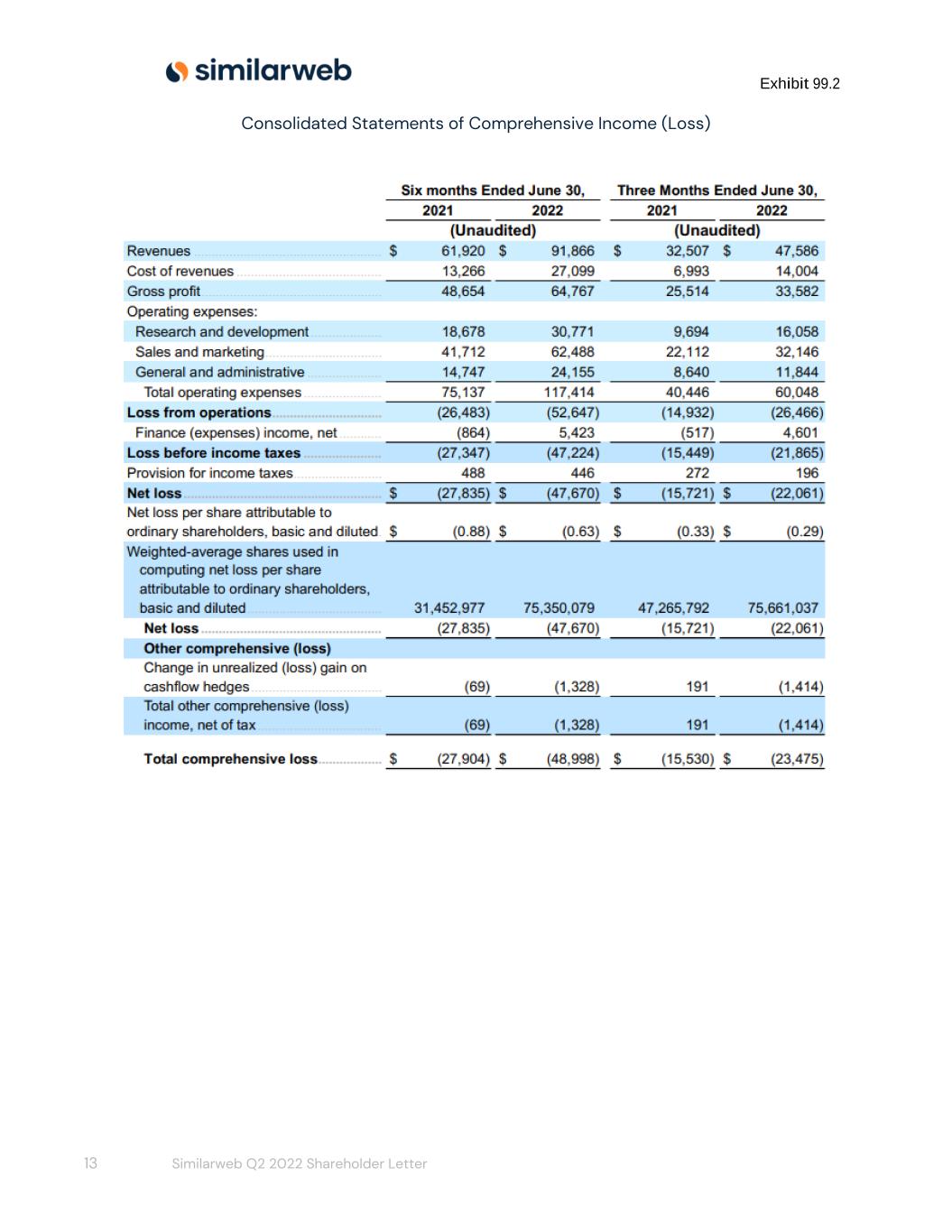

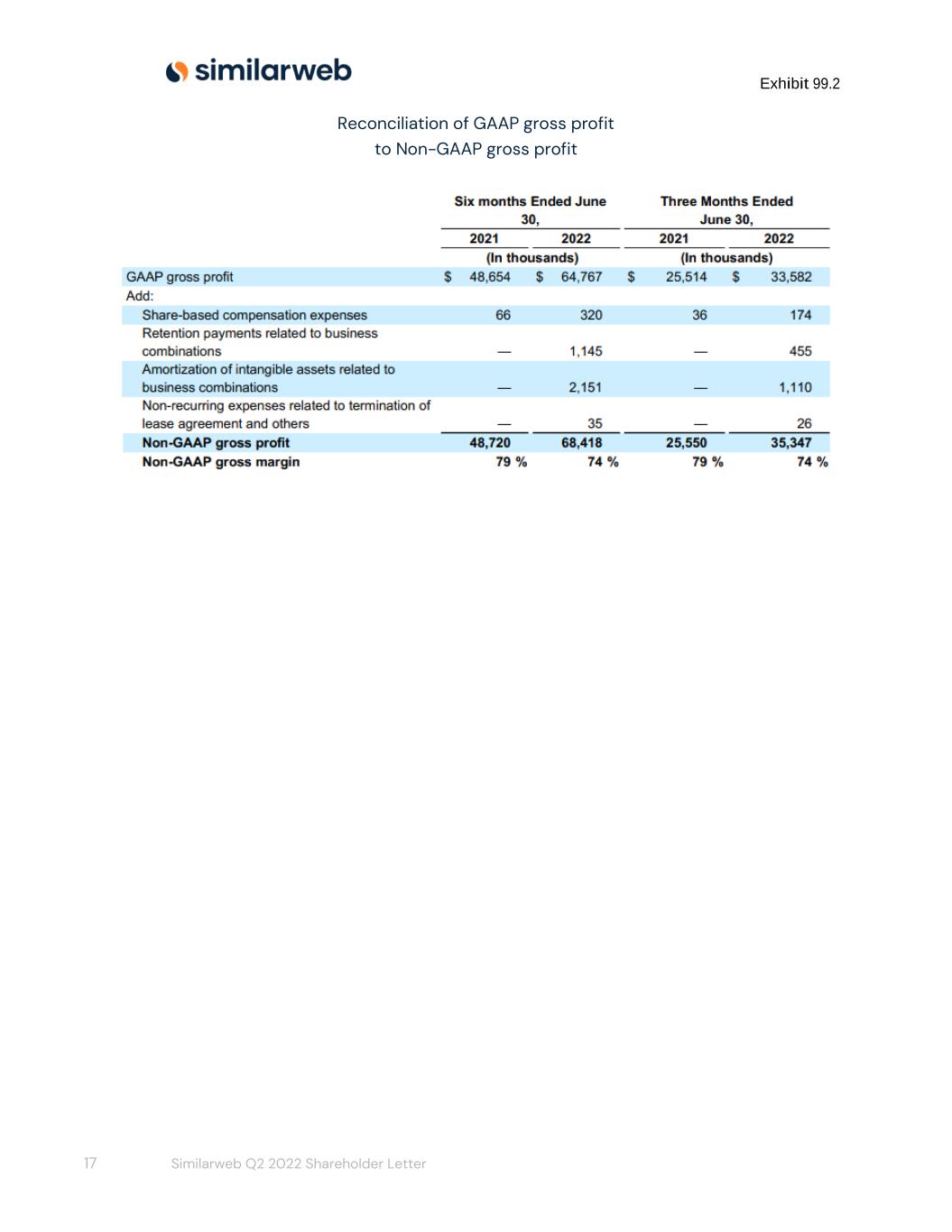

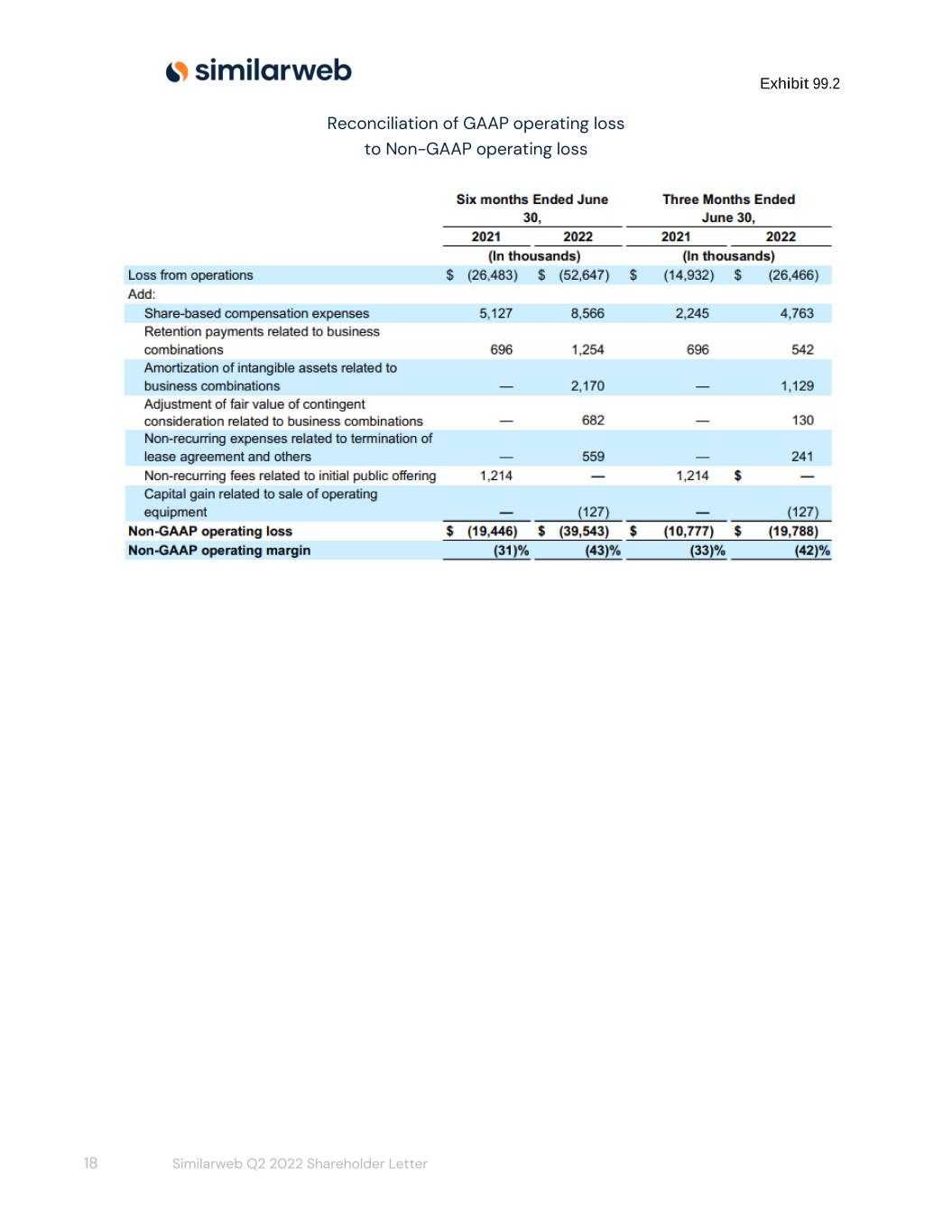

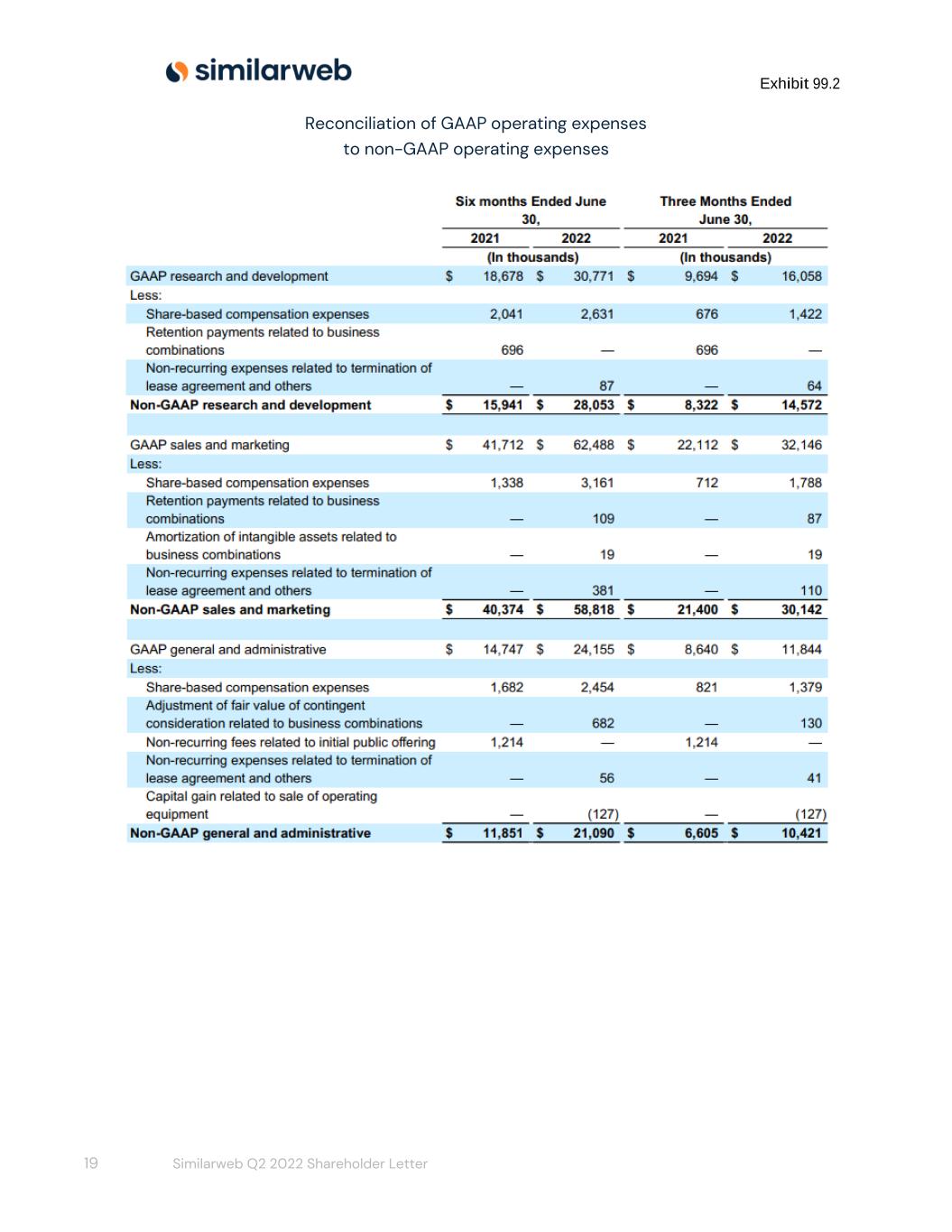

Exhibit 99.2 7 Similarweb Q2 2022 Shareholder Letter Financial Results When examining our financial results, please note that references to expenses and operating results (other than revenue) are presented both per GAAP and on a non-GAAP basis below, and that all non-GAAP results are reconciled to the GAAP results in the financial statements exhibits presented at the end of this letter. Our financial results in Q2-22 exceeded our estimates. Revisiting our top line results, in Q2-22, we delivered strong revenues of $47.6 million, reflecting a 46% YoY growth driven by increases in customers and revenue per customer. 53% of our sales came from international markets outside of the United States. Our gross profit totaled $33.6 million and our non-GAAP gross profit totaled $35.3 million non-GAAP in Q2-22, compared to $25.5 million and $25.6 million in Q2-21, respectively. Non-GAAP gross margin was 74.3% in Q2-22, versus 78.6% in Q2-21. To analyze gross margin on a comparable basis, the impact from the Embee Mobile acquisition and data.ai partnership on gross margin in Q2-22 was approximately 360 basis points. Because these expenses are almost entirely fixed, we expect the negative impact on gross margin will decrease as revenue increases in future periods. Operating expenses grew to $60.0 million and our non-GAAP operating expenses grew to $55.1 million in Q2-22, representing 115.9% of non-GAAP revenue in Q2-22 – up from $40.4 million and $36.3 million non-GAAP in Q2-21, respectively, or 111.7% of non-GAAP revenue in Q2-21 – largely reflecting the investment in human capital across the business to support our growth. Specific components of our operating expenses: Our research and development investment increased to $16.1 million and our non-GAAP research & development investment increased to $14.6 million in Q2-22, up from $9.7 million and $8.3 million in Q2-21, respectively. This increase was driven primarily by growth of employee headcount focused on our newer revenue-generating solutions: Shopper Intelligence, Sales Intelligence, and Investor Intelligence. Sales and marketing grew to $32.1 million and non-GAAP sales and marketing grew to $30.1 million in Q2-22, up from $22.1 million and $21.4 million in Q2-21, respectively, driven

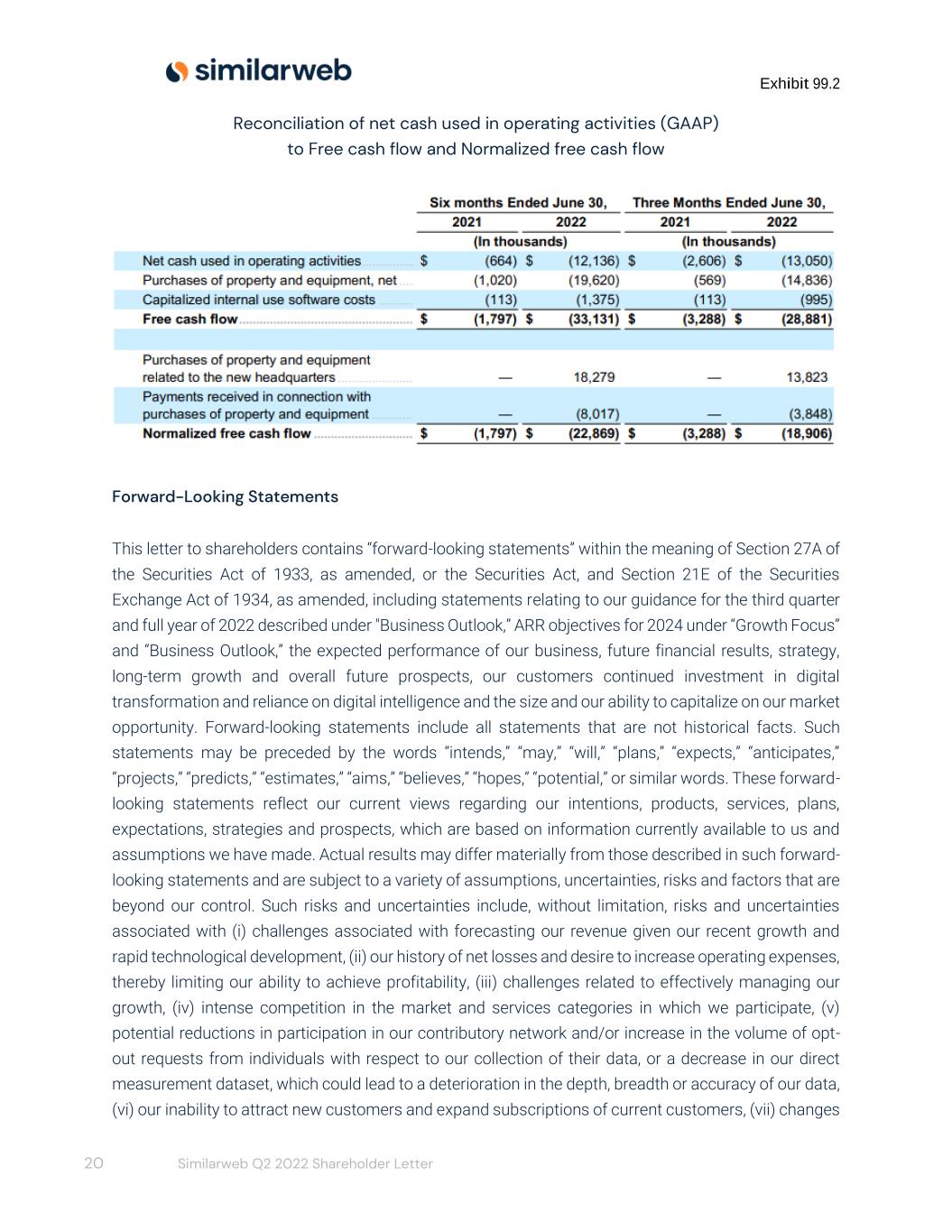

Exhibit 99.2 8 Similarweb Q2 2022 Shareholder Letter principally by increased headcount in sales and account management, as well as increased marketing activities. An operating tenet in our model is that our sales and marketing costs are divided approximately 55% to 60% to customer acquisition (land), and 40% to 45% to retention, upselling and cross-selling (expand). When analyzing our investment in customer acquisition costs (CAC) for growth efficiency, we track an estimated payback period. Its trend has averaged between 15 and 16 months on a gross profit basis over the trailing four quarters. For comparability, we adjust for the impact of the Embee Mobile acquisition and data.ai partnership in computing the CAC payback period. Payback from expansion and customer retention costs (CRC) is faster than payback on new customer CAC and contributes meaningfully to our growth efficiency. We continue to invest in customer acquisition to support future growth, as well as in CRC based on our strong NRR and increasing customer lifetime value. General and administrative costs grew to $11.8 million and our non-GAAP general and administrative costs grew to $10.4 million in Q2-22, up from $8.6 million and $6.6 million in Q2-21, respectively, which was driven by headcount increases to support growth, as well as by expenses incurred as a publicly traded company. Going forward, we expect these expenses will become more comparable as we have been publicly traded for over a year. Looking at our bottom line, our GAAP operating loss in Q2-22 totaled $26.5 million, and our non-GAAP operating loss totaled $19.8 million, which was less than our estimated loss for the quarter. As our revenue growth exceeded our estimates for the quarter, we experienced strong flow-through of the incremental sales as operating profit, while we also achieved operating efficiencies across the business. We ended the quarter with $93.9 million in cash and cash equivalents. Net cash used in operating activities was negative $13.1 million in Q2-22, compared to negative $2.6 million in Q2-21. Normalized free cash flow was negative $18.9 million in Q2-22, compared to negative $3.3 million in Q2-21, reflecting our investments in our growth across the business.

Exhibit 99.2 9 Similarweb Q2 2022 Shareholder Letter Business Outlook As we look to the rest of the year, we remain focused on disciplined execution through decisions within our control that relate to managing our balance sheet prudently and supporting both our growth and profitability potential. We believe our business is resilient. We are prepared to withstand potential macroeconomic impacts from a position of strength and agility. We are seeing and experiencing how our customers are reacting to local and global conditions differently. On a geographic basis, businesses in the EU appear to be on softening ground. On a customer segment basis, the smallest businesses seem to be the most anxious, while the largest are fortifying their positions and securing high-ROI relationships that help them succeed. Our customers repeatedly tell us that we are an important contributing factor to their success in this environment. In this challenging environment, we are taking an opportunistic approach towards acquisitions. Our recent acquisition of Rank Ranger is an excellent example of what we want to accomplish. We believe the Rank Ranger team, product, technology, and data complement us in every way. We believe that we can achieve smart growth through effective acquisitions like Rank Ranger, and that we will have more M&A opportunities to advance our strategy going forward. As a reminder, approximately 99% of our revenue is ARR — annual recurring revenue — with minimum subscription terms of one year. We continue to increase the number of customers with multi-year subscription terms. As of the end of Q2-22, 36% of our ARR was generated from customers with multi-year subscription commitments, compared to 28% at the same time last year. We believe this is a strong indicator of the long term durability of demand for our growth platform. We also believe that another strong indication of future performance is our deferred revenue, which was $91.4 million at the end of Q2-22, compared to $65.9 million in the same period last year. Importantly, our Remaining Performance Obligations (RPO) totaled $160 million at the end of Q2-22, up from $105 million at the end of Q2-21. We expect to recognize approximately 87% of total Q2-22 RPO as revenue over the next 12 months. This represents strong demand, increased upsell commitments, and substantiates the value our customers find in our solutions during these challenging times.

Exhibit 99.2 10 Similarweb Q2 2022 Shareholder Letter After assessing the momentum in our business and its continued likelihood in the current global macroeconomic environment, we are maintaining our revenue guidance for the year. In the third quarter of 2022 (Q3-22), we expect total revenue in the range of $48.8 million to $49.2 million, representing 38% YoY growth at the midpoint. For the fiscal year ending December 31, 2022, we continue to expect total revenue in the range of $196.0 million to $197.0 million, representing 43% growth YoY at the midpoint of the range. In 2H 22, we are watching our sales pipeline for signs of cycle extensions or softness. At this time, there are signs in the EU that indicate an increasing likelihood of slowing economic growth, which we have included in our outlook sensitivity. Looking at our projected Non-GAAP operating loss for Q3-22, we expect it to be in the range of ($20.9 million) to ($21.5 million) and for the full year of 2022 between ($80 million) and ($81 million). This outlook includes impacts to COGS and, in turn, to gross profit and gross margin from our Embee Mobile acquisition and the data.ai (formerly App Annie) partnership that were not present in the prior periods. As a reminder, we deployed data.ai data into our intelligence solutions as a new, revenue-generating module in Q2-22. Both Embee Mobile and data.ai expenses are fixed and increase COGS when compared to prior year periods. For modeling our business, we anticipate Non-GAAP gross margin to be approximately 74% to 75% in Q3 22, and 75% to 76% for the year ending December 31, 2022 as a result of these impacts.

Exhibit 99.2 11 Similarweb Q2 2022 Shareholder Letter Growth Opportunity We enter the second half of 2022 with positive momentum. We are mindful of current macroeconomic conditions and are proactively making decisions to strengthen our financial position as we pursue profitable growth. Considering the current environment, we believe we have become a must-have technology solution that companies utilize to see and capture their growth opportunities across the web and mobile continuum at scale. Our SaaS solutions are designed to support the revenue-driving operations of our customers — sales, marketing, analytics, ecommerce — by providing tremendous visibility into risks and opportunities during times of uncertainty. We strive to empower the C-suite with additional agility to execute efficiently by enabling leaders to make real-time course corrections and optimize business performance based on our actionable insights. Importantly, companies can utilize our easy-to-understand solutions on their own to navigate the challenges ahead in a cost-effective way. The investments we have previously made in our pursuit of smart growth and free cash flow generation show early returns through our disciplined execution. We believe our results to date indicate that our customers’ growth challenges during these times of increasing uncertainty likely represent one of our most important opportunities yet to deliver value. We are just getting started. These are still early days for us. We look forward to keeping everyone updated on our progress. Sincerely, Or Offer Founder and Chief Executive Officer Jason Schwartz Chief Financial Officer

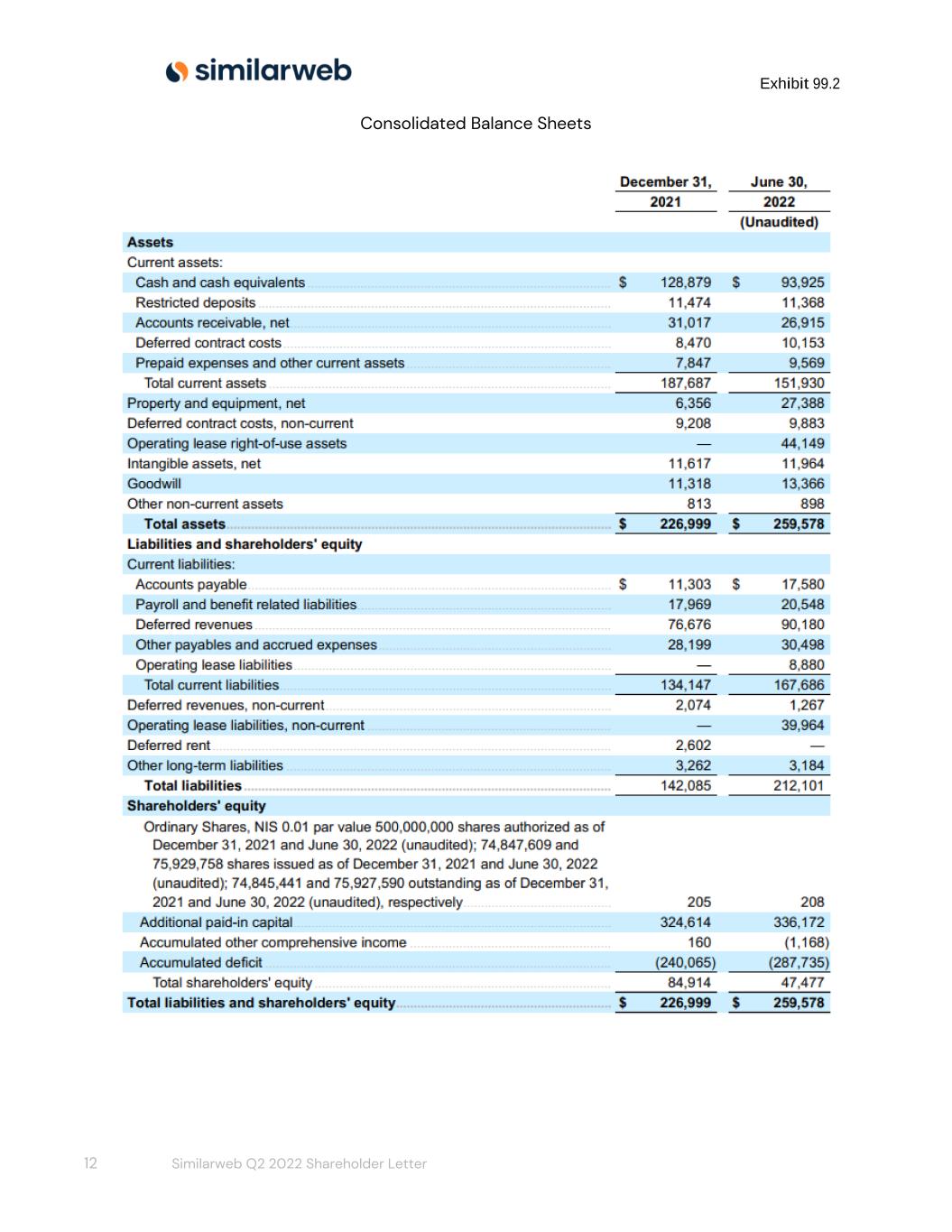

Exhibit 99.2 12 Similarweb Q2 2022 Shareholder Letter Consolidated Balance Sheets

Exhibit 99.2 13 Similarweb Q2 2022 Shareholder Letter Consolidated Statements of Comprehensive Income (Loss)

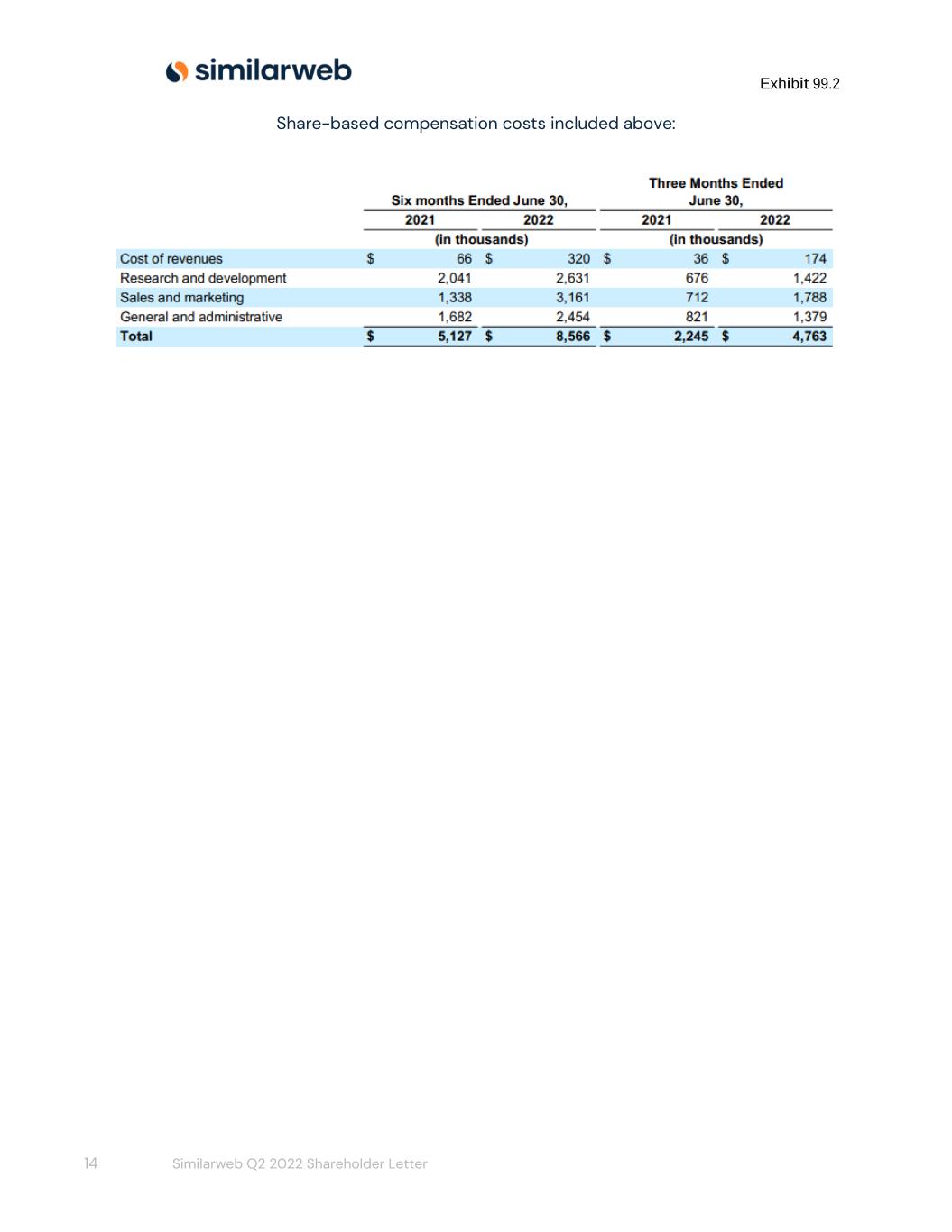

Exhibit 99.2 14 Similarweb Q2 2022 Shareholder Letter Share-based compensation costs included above:

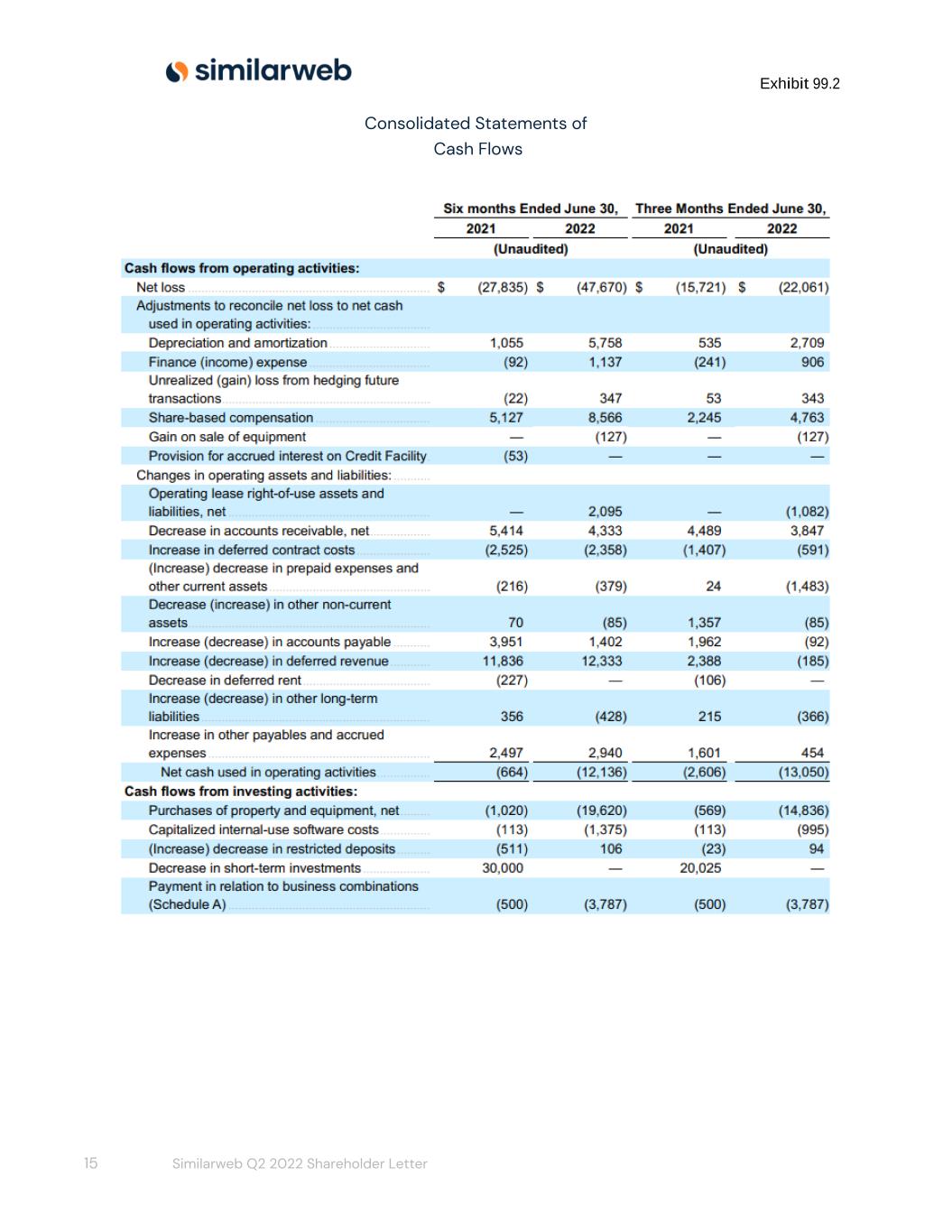

Exhibit 99.2 15 Similarweb Q2 2022 Shareholder Letter Consolidated Statements of Cash Flows

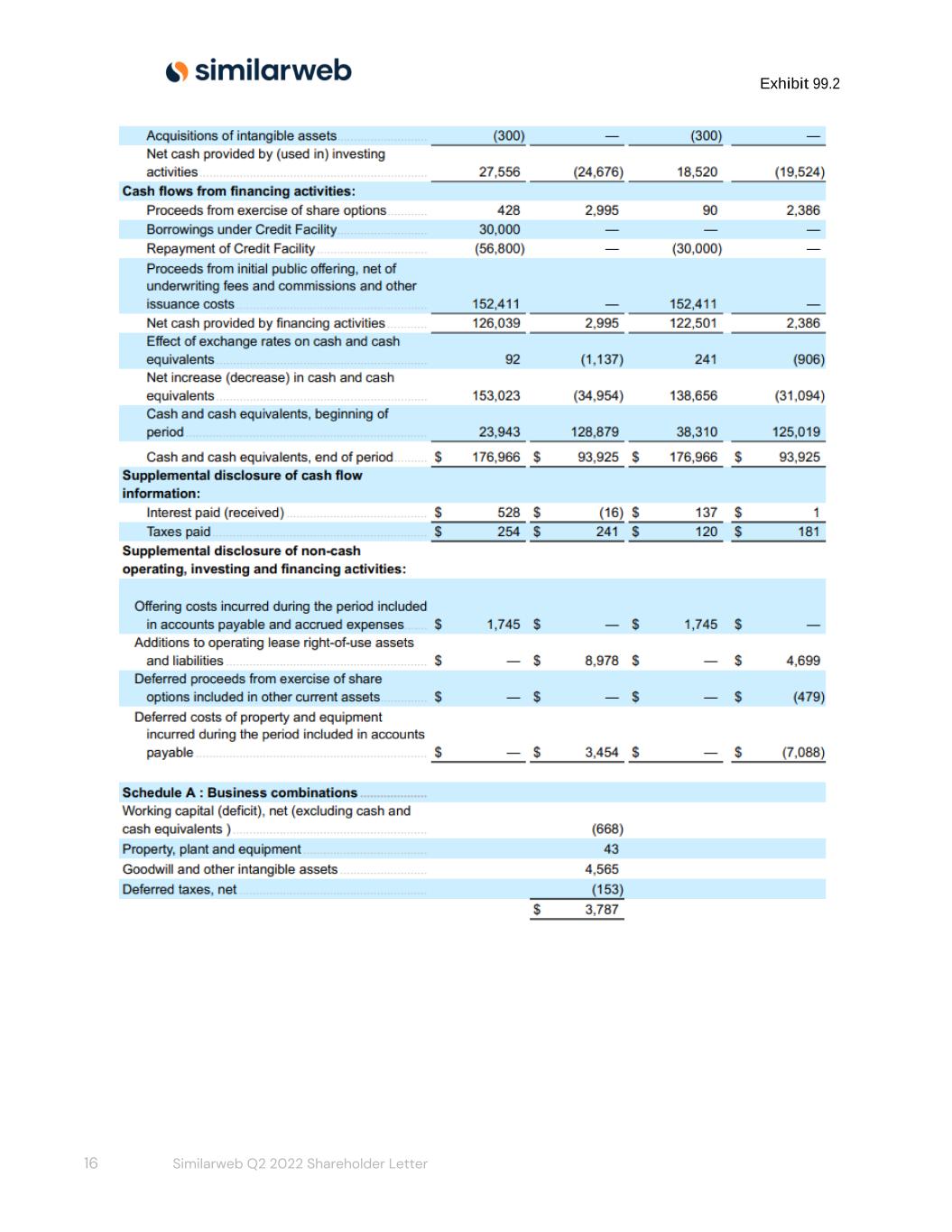

Exhibit 99.2 16 Similarweb Q2 2022 Shareholder Letter

Exhibit 99.2 17 Similarweb Q2 2022 Shareholder Letter Reconciliation of GAAP gross profit to Non-GAAP gross profit

Exhibit 99.2 18 Similarweb Q2 2022 Shareholder Letter Reconciliation of GAAP operating loss to Non-GAAP operating loss

Exhibit 99.2 19 Similarweb Q2 2022 Shareholder Letter Reconciliation of GAAP operating expenses to non-GAAP operating expenses

Exhibit 99.2 20 Similarweb Q2 2022 Shareholder Letter Reconciliation of net cash used in operating activities (GAAP) to Free cash flow and Normalized free cash flow Forward-Looking Statements This letter to shareholders contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to our guidance for the third quarter and full year of 2022 described under "Business Outlook,” ARR objectives for 2024 under “Growth Focus” and “Business Outlook,” the expected performance of our business, future financial results, strategy, long-term growth and overall future prospects, our customers continued investment in digital transformation and reliance on digital intelligence and the size and our ability to capitalize on our market opportunity. Forward-looking statements include all statements that are not historical facts. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. These forward- looking statements reflect our current views regarding our intentions, products, services, plans, expectations, strategies and prospects, which are based on information currently available to us and assumptions we have made. Actual results may differ materially from those described in such forward- looking statements and are subject to a variety of assumptions, uncertainties, risks and factors that are beyond our control. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) challenges associated with forecasting our revenue given our recent growth and rapid technological development, (ii) our history of net losses and desire to increase operating expenses, thereby limiting our ability to achieve profitability, (iii) challenges related to effectively managing our growth, (iv) intense competition in the market and services categories in which we participate, (v) potential reductions in participation in our contributory network and/or increase in the volume of opt- out requests from individuals with respect to our collection of their data, or a decrease in our direct measurement dataset, which could lead to a deterioration in the depth, breadth or accuracy of our data, (vi) our inability to attract new customers and expand subscriptions of current customers, (vii) changes

Exhibit 99.2 21 Similarweb Q2 2022 Shareholder Letter in laws, regulations, and public perception concerning data privacy or change in the patterns of enforcement of existing laws and regulations, (viii) our inability to introduce new features or solutions and make enhancements to our existing solutions, (ix) real or perceived errors, failures, vulnerabilities or bugs in our platform, (x) potential security breaches to our systems or to the systems of our third- party service providers, (xi) our inability to obtain and maintain comprehensive and reliable data to generate our insights, (xii) changes in laws and regulations related to the Internet or changes in the Internet infrastructure itself that may diminish the demand for our solutions, (xiii) failure to effectively develop and expand our direct sales capabilities, which could harm our ability to increase the number of organizations using our platform and achieve broader market acceptance for our solutions, and (ix) the impact of global events, such as the ongoing COVID-19 pandemic, including variants of COVID-19, or other public health crises and the Russian military operations in Ukraine, and any related economic downturn could have on or on our customers’ businesses, financial condition, and results of operations. These risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Form 20-F filed with the Securities and Exchange Commission on March 25, 2022, and subsequent reports that we file with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Forward-looking statements represent our beliefs and assumptions only as of the date of this letter. Except as required by law, we undertake no duty to update any forward-looking statements contained in this release as a result of new information, future events, changes in expectations, or otherwise. Certain information contained in this letter relates to or is based on studies, publications, surveys, and other data obtained from third-party sources and the Company's own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this letter, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy, or completeness of any information obtained from third-party sources. In addition, all of the market data included in this letter involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source.

Exhibit 99.2 22 Similarweb Q2 2022 Shareholder Letter Non-GAAP Financial Measures This letter to shareholders contains certain financial measures that are expressed on a non-GAAP basis. We use these non-GAAP financial measures internally to facilitate analysis of our financial and business trends and for internal planning and forecasting purposes. We believe these non-GAAP financial measures, when taken collectively, may be helpful to investors because they provide consistency and comparability with past financial performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. However, non-GAAP financial measures have limitations as an analytical tool and are presented for supplemental informational purposes only. They should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures and capitalized internal-use software costs. Normalized free cash flow represents free cash flow less capital investments related to the Company's new headquarters and payments received in connection with these capital investments. Non-GAAP operating income (loss), non-GAAP gross profit, Non-GAAP research and development expenses, non-GAAP sales and marketing expenses, and non-GAAP general and administrative expenses represents the comparable GAAP financial figure, less share-based compensation, adjustments, and payments related to business combinations, amortization of intangible assets, and certain other non-recurring items, as applicable and indicated in the above tables. Other Metrics Customer acquisition costs (CAC) represent the portion of sales and marketing expenses allocated to acquire new customers. Customer retention costs (CRC) represent the portion of sales and marketing expenses allocated to retain existing customers and to increase existing customers’ subscriptions. Annual recurring revenue (ARR) represents the annualized subscription revenue we would contractually expect to receive from customers assuming no increases or reductions in their subscriptions. CAC payback period is the estimated time in months to recover CAC in terms of incremental gross profit that newly acquired customers generate. Net retention rate (NRR) represents the comparison of our ARR from the same set of customers as of a certain point in time, relative to the same point in time in the previous year ago period, expressed as a percentage.