EX-99.2

Published on February 14, 2023

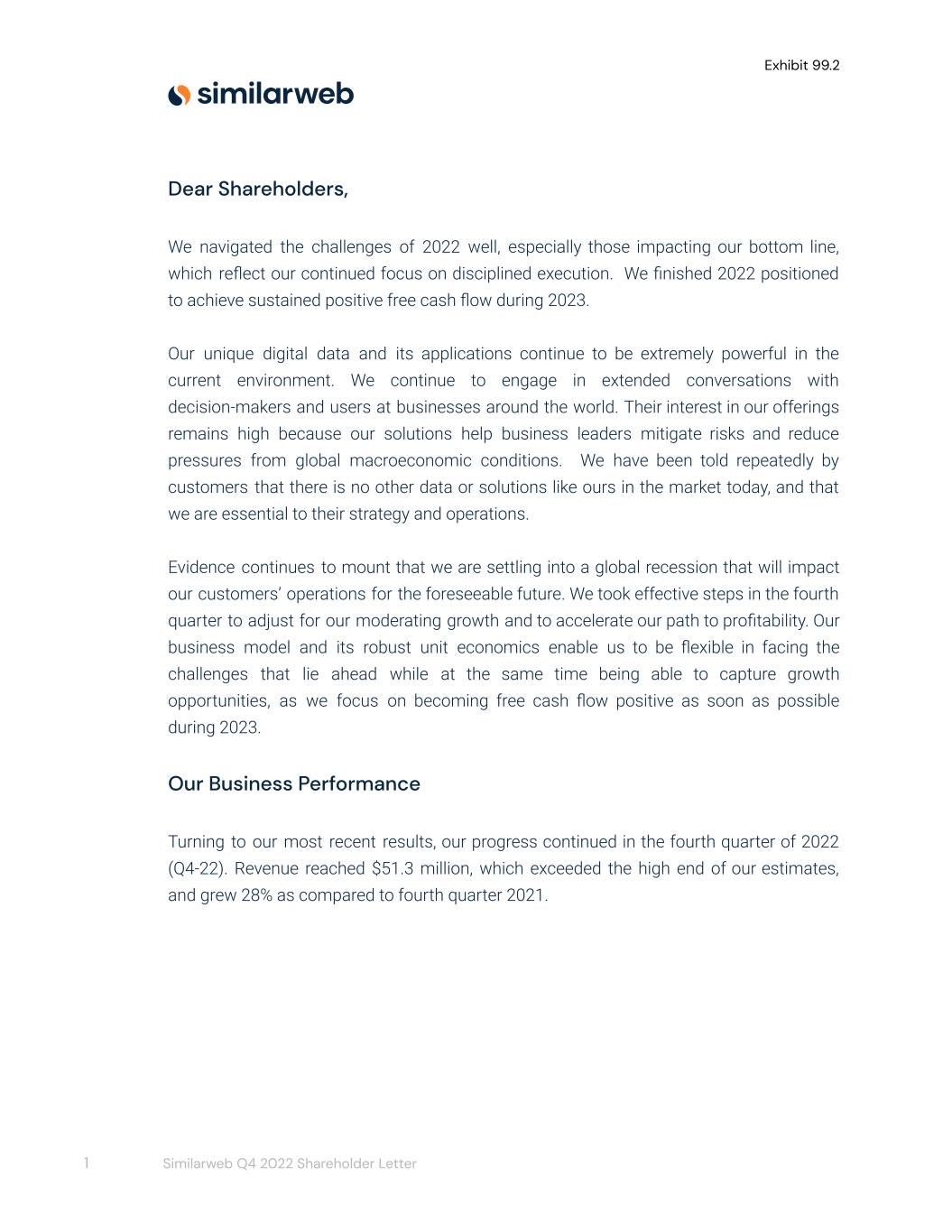

Exhibit 99.2 Dear Shareholders, We navigated the challenges of 2022 well, especially those impacting our bottom line, which reflect our continued focus on disciplined execution. We finished 2022 positioned to achieve sustained positive free cash flow during 2023. Our unique digital data and its applications continue to be extremely powerful in the current environment. We continue to engage in extended conversations with decision-makers and users at businesses around the world. Their interest in our offerings remains high because our solutions help business leaders mitigate risks and reduce pressures from global macroeconomic conditions. We have been told repeatedly by customers that there is no other data or solutions like ours in the market today, and that we are essential to their strategy and operations. Evidence continues to mount that we are settling into a global recession that will impact our customers’ operations for the foreseeable future. We took effective steps in the fourth quarter to adjust for our moderating growth and to accelerate our path to profitability. Our business model and its robust unit economics enable us to be flexible in facing the challenges that lie ahead while at the same time being able to capture growth opportunities, as we focus on becoming free cash flow positive as soon as possible during 2023. Our Business Performance Turning to our most recent results, our progress continued in the fourth quarter of 2022 (Q4-22). Revenue reached $51.3 million, which exceeded the high end of our estimates, and grew 28% as compared to fourth quarter 2021. 1 Similarweb Q4 2022 Shareholder Letter

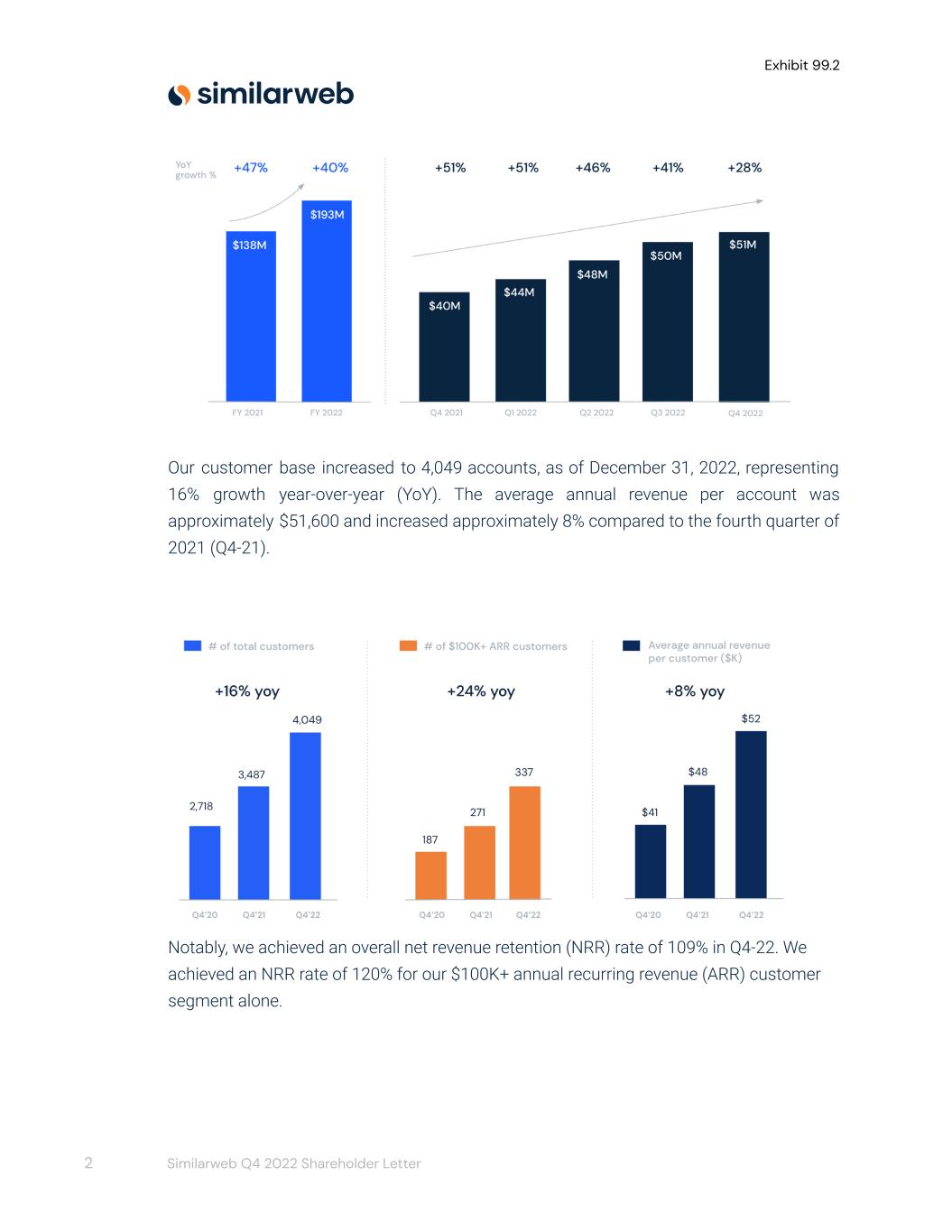

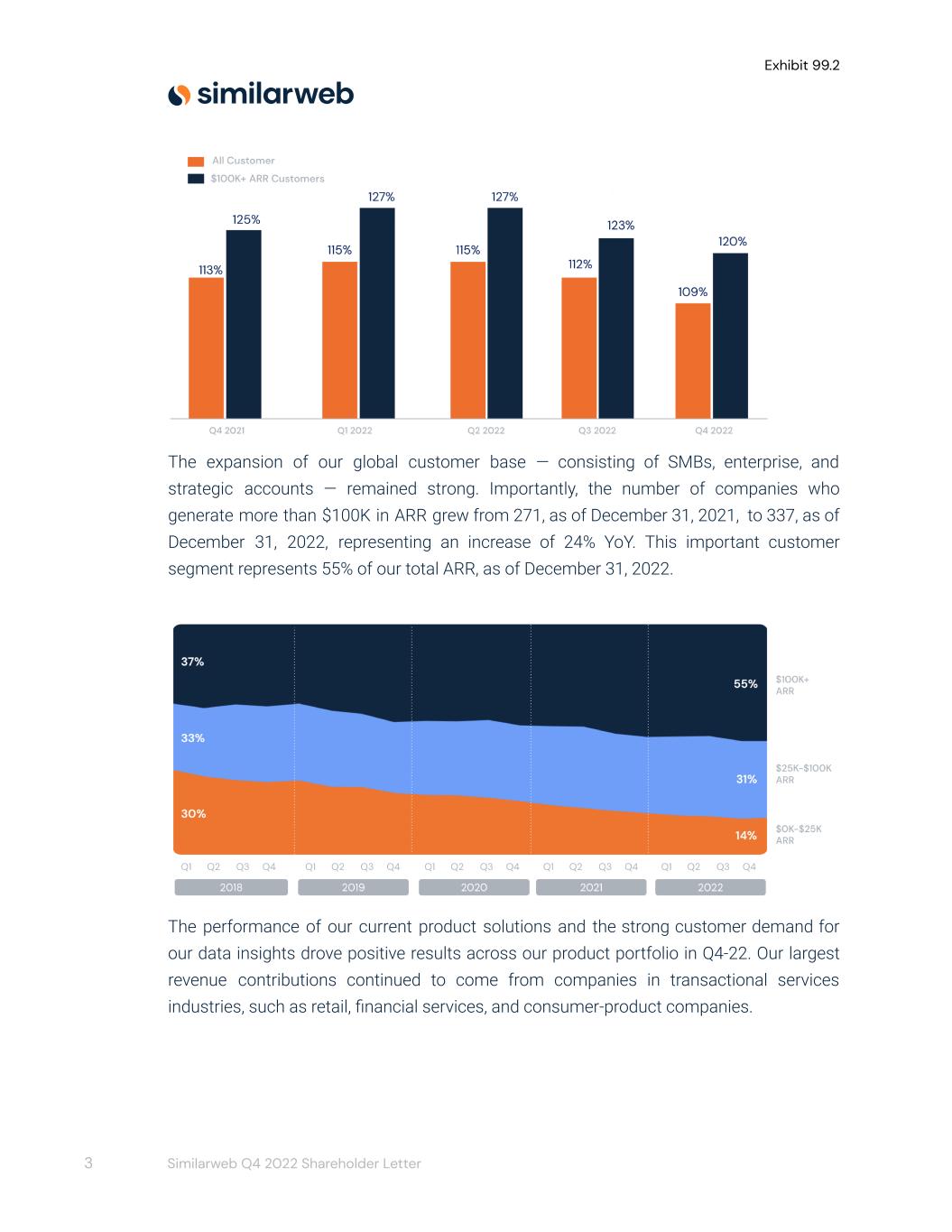

Exhibit 99.2 Our customer base increased to 4,049 accounts, as of December 31, 2022, representing 16% growth year-over-year (YoY). The average annual revenue per account was approximately $51,600 and increased approximately 8% compared to the fourth quarter of 2021 (Q4-21). Notably, we achieved an overall net revenue retention (NRR) rate of 109% in Q4-22. We achieved an NRR rate of 120% for our $100K+ annual recurring revenue (ARR) customer segment alone. 2 Similarweb Q4 2022 Shareholder Letter

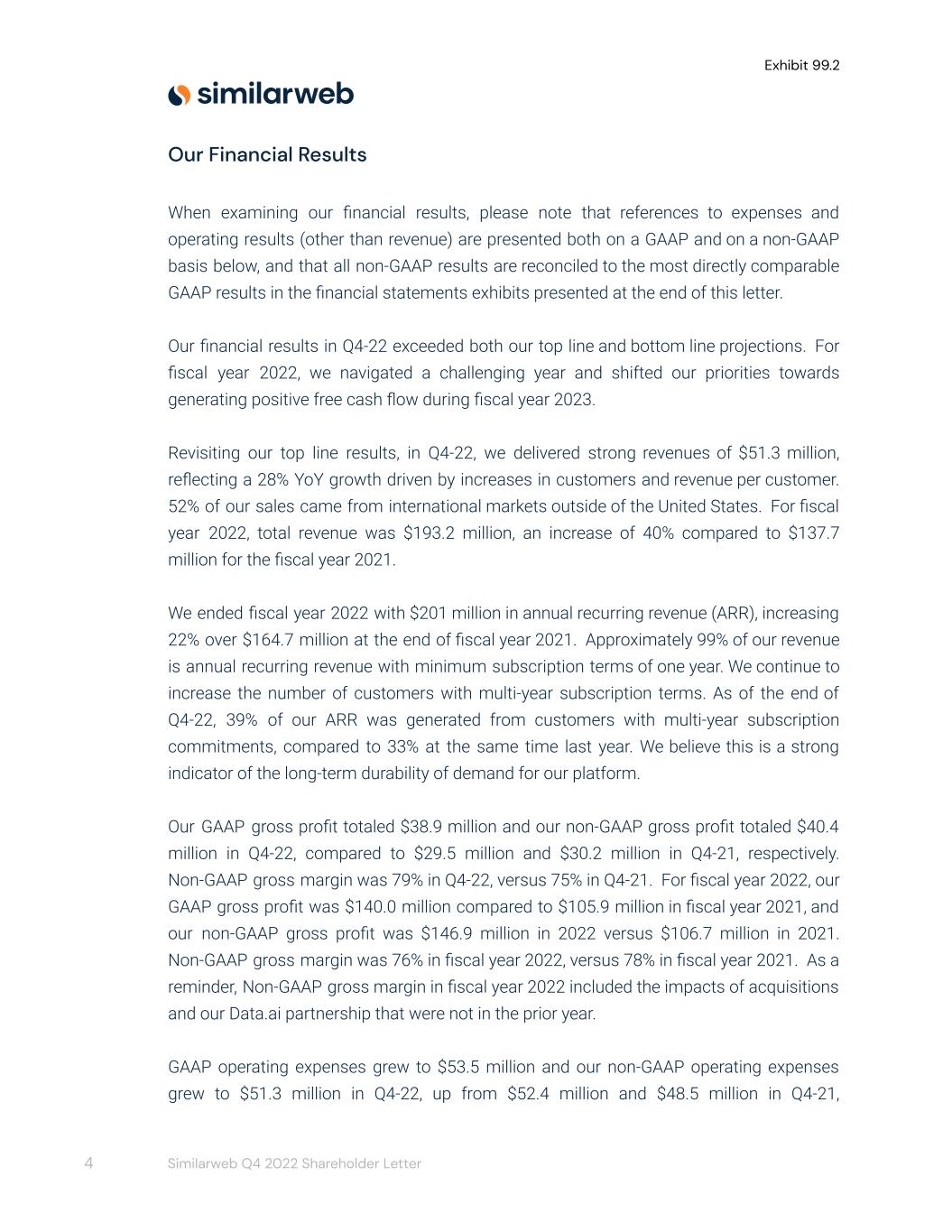

Exhibit 99.2 The expansion of our global customer base — consisting of SMBs, enterprise, and strategic accounts — remained strong. Importantly, the number of companies who generate more than $100K in ARR grew from 271, as of December 31, 2021, to 337, as of December 31, 2022, representing an increase of 24% YoY. This important customer segment represents 55% of our total ARR, as of December 31, 2022. The performance of our current product solutions and the strong customer demand for our data insights drove positive results across our product portfolio in Q4-22. Our largest revenue contributions continued to come from companies in transactional services industries, such as retail, financial services, and consumer-product companies. 3 Similarweb Q4 2022 Shareholder Letter

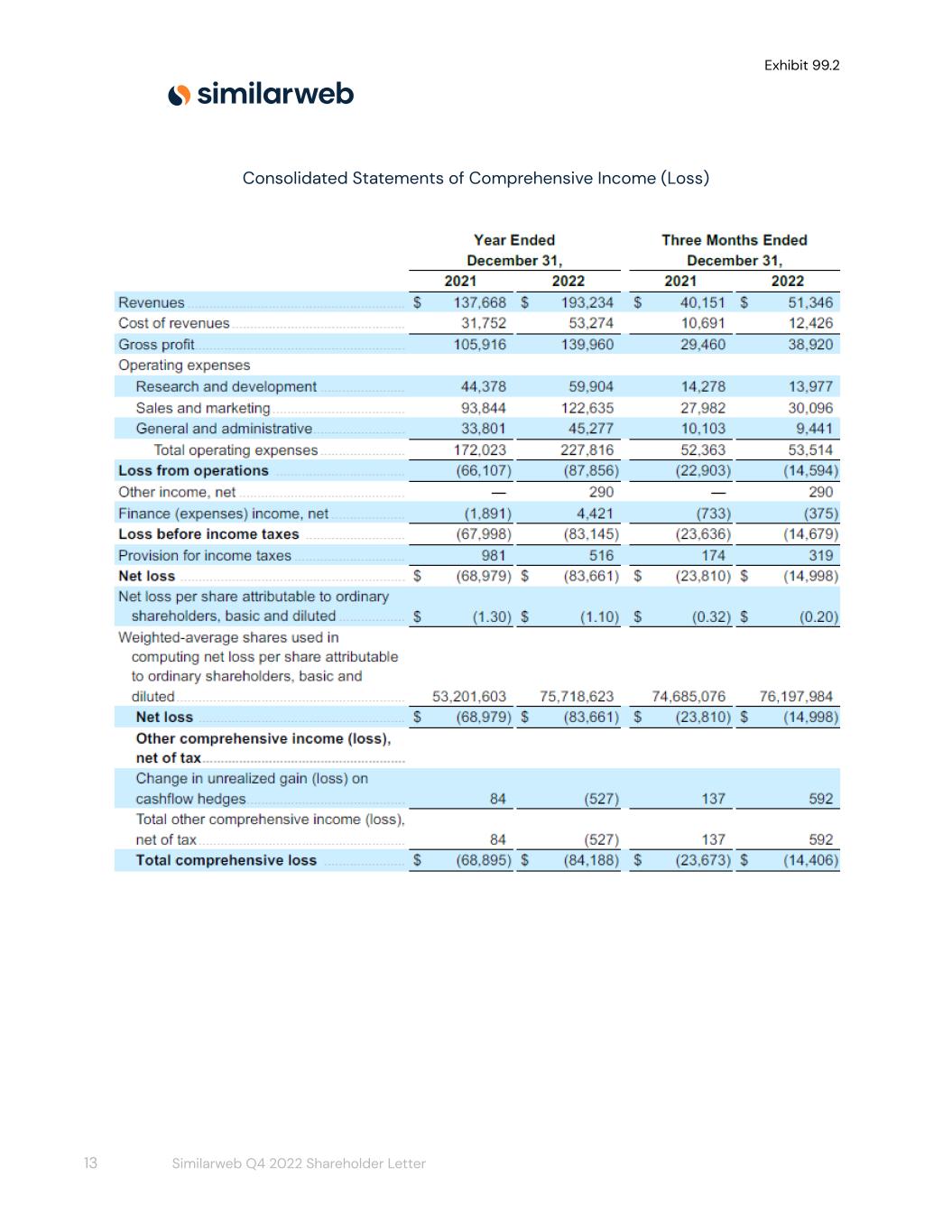

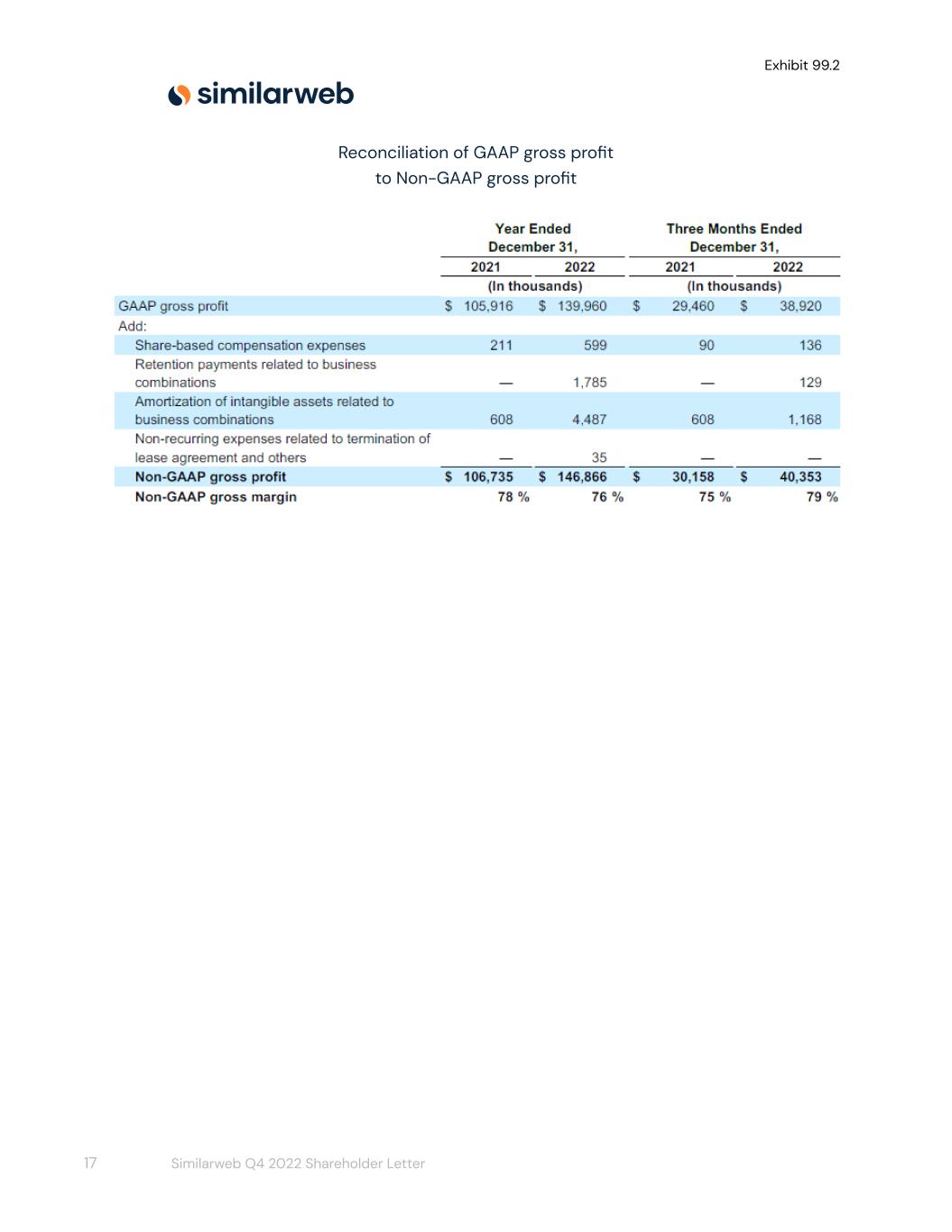

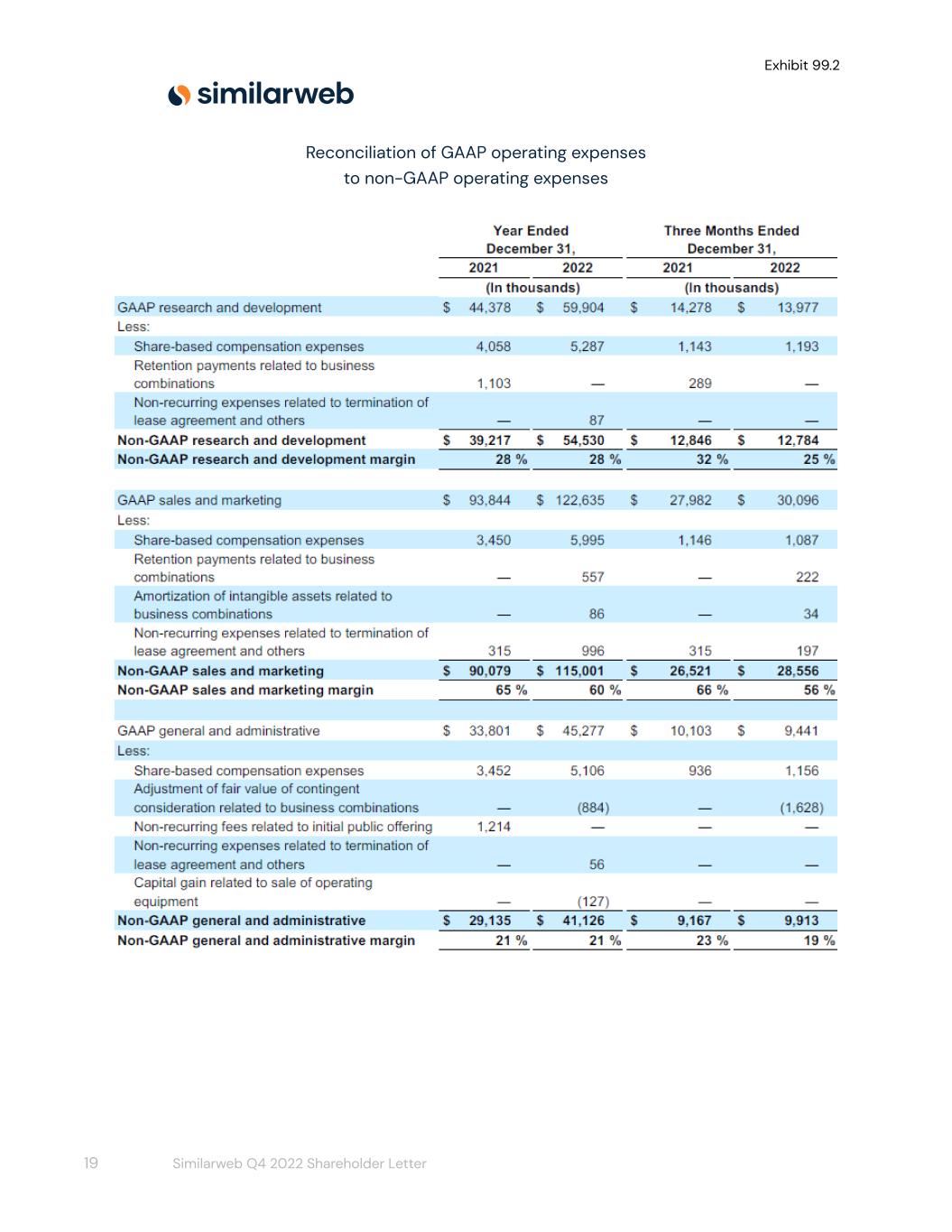

Exhibit 99.2 Our Financial Results When examining our financial results, please note that references to expenses and operating results (other than revenue) are presented both on a GAAP and on a non-GAAP basis below, and that all non-GAAP results are reconciled to the most directly comparable GAAP results in the financial statements exhibits presented at the end of this letter. Our financial results in Q4-22 exceeded both our top line and bottom line projections. For fiscal year 2022, we navigated a challenging year and shifted our priorities towards generating positive free cash flow during fiscal year 2023. Revisiting our top line results, in Q4-22, we delivered strong revenues of $51.3 million, reflecting a 28% YoY growth driven by increases in customers and revenue per customer. 52% of our sales came from international markets outside of the United States. For fiscal year 2022, total revenue was $193.2 million, an increase of 40% compared to $137.7 million for the fiscal year 2021. We ended fiscal year 2022 with $201 million in annual recurring revenue (ARR), increasing 22% over $164.7 million at the end of fiscal year 2021. Approximately 99% of our revenue is annual recurring revenue with minimum subscription terms of one year. We continue to increase the number of customers with multi-year subscription terms. As of the end of Q4-22, 39% of our ARR was generated from customers with multi-year subscription commitments, compared to 33% at the same time last year. We believe this is a strong indicator of the long-term durability of demand for our platform. Our GAAP gross profit totaled $38.9 million and our non-GAAP gross profit totaled $40.4 million in Q4-22, compared to $29.5 million and $30.2 million in Q4-21, respectively. Non-GAAP gross margin was 79% in Q4-22, versus 75% in Q4-21. For fiscal year 2022, our GAAP gross profit was $140.0 million compared to $105.9 million in fiscal year 2021, and our non-GAAP gross profit was $146.9 million in 2022 versus $106.7 million in 2021. Non-GAAP gross margin was 76% in fiscal year 2022, versus 78% in fiscal year 2021. As a reminder, Non-GAAP gross margin in fiscal year 2022 included the impacts of acquisitions and our Data.ai partnership that were not in the prior year. GAAP operating expenses grew to $53.5 million and our non-GAAP operating expenses grew to $51.3 million in Q4-22, up from $52.4 million and $48.5 million in Q4-21, 4 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 respectively, largely reflecting the investment in human capital across the business to support our growth. Non-GAAP operating expenses represented 100% of revenue in Q4-22 as compared to 121% of revenue in Q4-21, demonstrating the efficiency of our unit economics and our disciplined execution. For fiscal year 2022, GAAP operating expenses grew to $227.8 million and our non-GAAP operating expenses grew to $210.7 million , up from $172.0 million and $158.4 million in fiscal year 2021, respectively, Specific components of our fourth quarter 2022 operating expenses: Our GAAP research and development investment decreased to $14.0 million and our non-GAAP research and development investment decreased to $12.8 million in Q4-22, down from $14.3 million and $12.8 million in Q4-21, respectively. As a percentage of revenue, non-GAAP research & development expense was 25% in Q4-22, as compared to 32% in Q4-21, an improvement of 7 percentage points. GAAP sales and marketing expenses grew to $30.1 million and non-GAAP sales and marketing expenses grew to $28.6 million in Q4-22, up from $28.0 million and $26.5 million in Q4-21, respectively, driven principally by compensation related to increased headcount in sales and account management, as well as commission expense partially offset by reduction in marketing activities. As a percentage of revenue, non-GAAP sales & marketing expense was 56% in Q4-22, as compared to 66% in Q4-21, an improvement of nearly 10 percentage points. An operating tenet in our model is that our sales and marketing costs are divided approximately 55% to 60% to new customer acquisition (land), and 40% to 45% to retention, upselling and cross-selling (expand) of our existing customer base. When analyzing our investment in customer acquisition costs (CAC) for growth efficiency, we track an estimated payback period. This metric has historically averaged between 15 and 16 months on a gross profit basis over the trailing four quarters. Currently, the average payback is ranging between 17 and 18 months, primarily due to the longer sales cycles in the current environment. For comparability, we adjust for the impact of the Embee Mobile acquisition and data.ai partnership in computing the CAC payback period. Payback from expansion and customer retention costs (CRC) is faster than payback on new customer CAC and contributes meaningfully to our growth efficiency. We continue to invest in customer acquisition to support future growth, as well as in CRC based on our strong NRR and increasing customer lifetime value. 5 Similarweb Q4 2022 Shareholder Letter

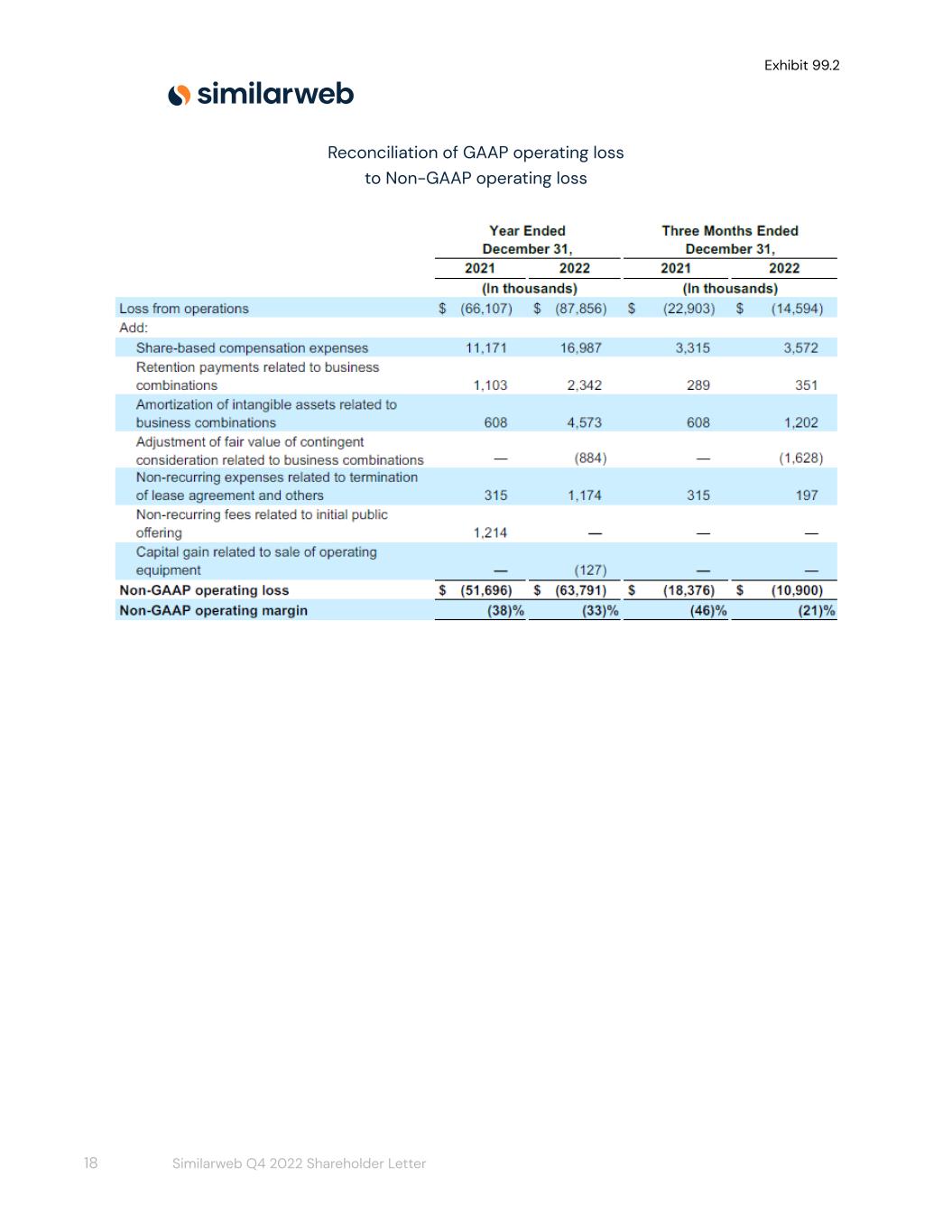

Exhibit 99.2 GAAP general and administrative costs decreased to $9.4 million and our non-GAAP general and administrative costs grew to $9.9 million in Q4-22, from $10.1 million and $9.2 million in Q4-21, respectively. As a percentage of revenue, non-GAAP general & administrative expense was 19% in Q4-22, as compared to 23% in Q4-21, an improvement of 4 percentage points. Looking at our bottom line, Q4-22 GAAP operating loss was $14.6 million or 28% of revenue, compared to $22.9 million or 57% of revenue for the fourth quarter of 2021. Q4-22 non-GAAP operating loss was $10.9 million or 21% of revenue, compared to $18.4 million or 46% of revenue for the fourth quarter of 2021, which was less than our estimated loss for the quarter. We experienced strong flow-through of incremental sales as operating profit, while we also achieved significant operating efficiencies across the business, which drove a 25 percentage point improvement year over year. For fiscal year 2022, GAAP operating loss was $87.9 million or 45% of revenue, compared to $66.1 million or 48% of revenue for the fiscal year 2021. Non-GAAP operating loss for fiscal year 2022 was $63.8 million or 33% of revenue, compared to $51.7 million or 38% of revenue for the full year 2021. We believe that a strong indication of future performance is our deferred revenue, which was $94.2 million at the end of Q4-22, compared to $78.8 million in the same period last 6 Similarweb Q4 2022 Shareholder Letter

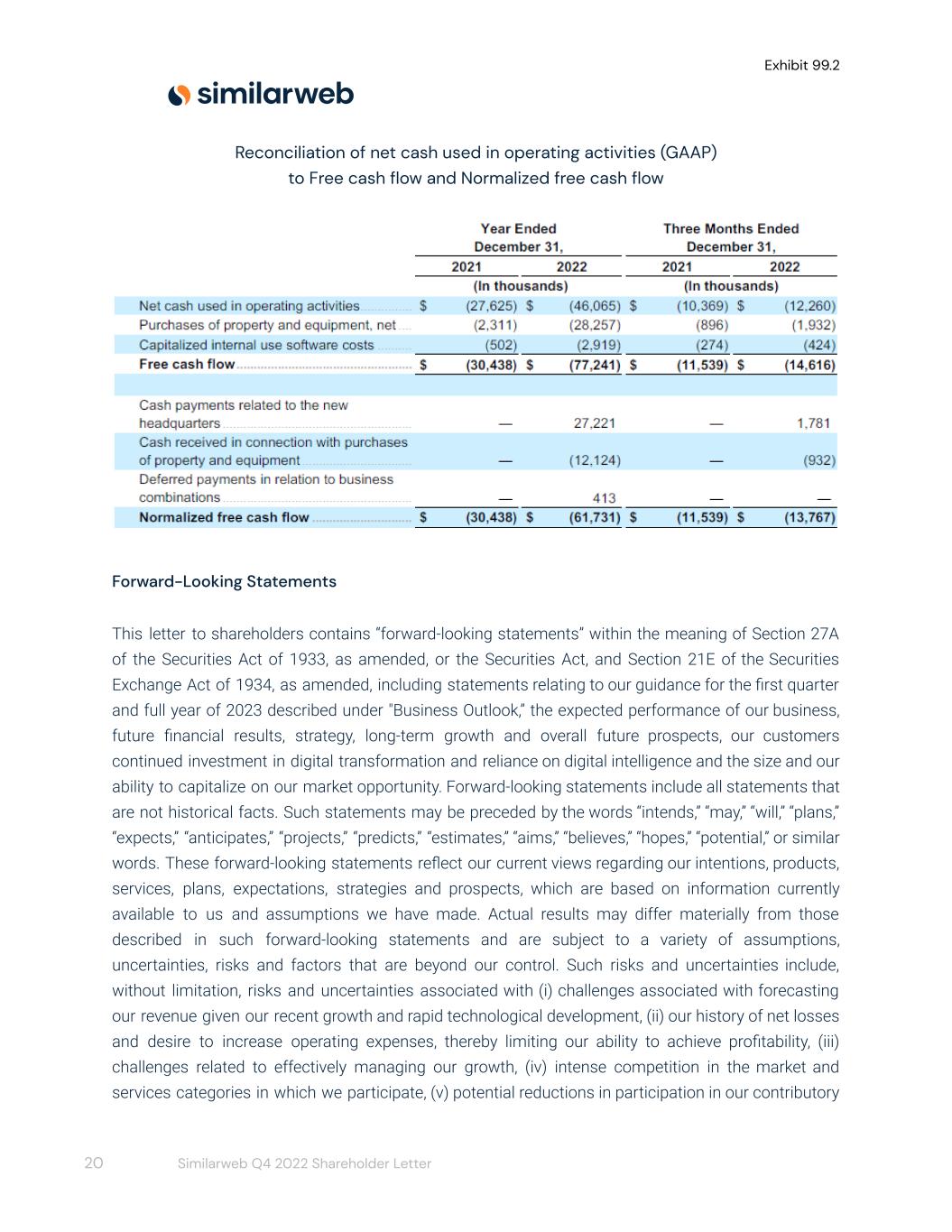

Exhibit 99.2 year. Importantly, our Remaining Performance Obligations (RPO) totaled $171.0 million at the end of Q4-22, up from $137.5 million at the end of Q4-21. We expect to recognize approximately 80% of total Q4-22 RPO as revenue over the next 12 months. This represents strong demand, increased upsell commitments, and substantiates the value our customers find in our solutions during these challenging times. We ended the year with $77.8 million in cash and cash equivalents. As part of our balance sheet management plan, we have drawn $25 million from our credit line. Net cash used in operating activities was $12.3 million in Q4-22, compared to $10.4 million in Q4-21. Normalized free cash flow was negative $13.8 million in Q4-22, compared to negative $11.5 million in Q4-21, reflecting our investments in our growth across the business. Comparing normalized free cash flow in Q4-22 to the negative $25.1 million in Q3-22 shows that we are making progress toward our goal of becoming free cash flow positive. Our Strategy At our core, we are a data and analytics company. We believe that our proprietary data, which we call Similarweb Digital Data, sets us apart from our competition. Similarweb Digital Data is our proprietary view into the online performance of companies, markets, products, consumer behavior and trends in the digital world. Our world-class team of more than 200 data scientists create Similarweb Digital Data using advanced machine learning processes and algorithms that have been refined and optimized over the last 15 years to ensure we provide an accurate and comprehensive view of the digital world. We then deliver it to our customers via Software-as-a-Service (SaaS) solutions, Data-as-a-Service (DaaS), or recurring Advisory Services. Our customers rely on our mission critical offerings to power data-driven decisions that they make in creating strategy, acquiring customers, or increasing monetization, by contracting for our productized Software-as-a-Service (SaaS) solutions or by integrating Similarweb Digital Data into their own systems and solutions through Data-as-a-Service (DaaS) offerings and recurring advisory services. We believe our SaaS solutions along with our DaaS and advisory offerings disrupt and redefine the category of online market research and intelligence. Without our services, it can take weeks or months to research, benchmark, and analyze companies, industries and markets at a substantial cost. By either using our software or accessing our data directly, our customers can reduce the time it takes to discover actionable insights to 7 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 hours, minutes, or even seconds utilizing our relevant solutions. Importantly, our digital intelligence solutions enable our customers to understand their markets better than their competitors, to act faster, and to win in today’s online world. Our overall strategy consists of three pillars we strive to implement: 1. Establishing, maintaining, and enhancing substantial advantages in data and technology 2. Delivering considerable return on investment for our customers through our digital intelligence solutions 3. Executing our go-to-market strategies, catalyzed by smart investments and operational discipline Using our proprietary technology, we offer compelling solutions that catalyze results for company executives and their leaders in sales, digital marketing, market research, and business strategy. We deliver easy-to-understand insights from Similarweb Digital Data that power the decisions company leaders will make to win their market. As we executed on our strategy in Q4-22, we had some wins in our own market as we released a number of important new product features. Notably in our Marketing Intelligence solution, we introduced Keyword Search Intent - a powerful metric that helps search marketers understand the reason for a search query. Perhaps the most exciting highlight of the quarter was Amazon setting up an AWS Data Exchange service to aid APIs in the transition from Alexa to Similarweb so that former Alexa users can easily access and benefit from our comprehensive data. Our new DigitalRank API has our proprietary website ranking data available, which means users can track their rank against their competitors easily. Looking back on 2022 overall, we improved the insights, capabilities, and data granularity within all of our solutions. We added 100+ new features across our solutions throughout the year, and we worked tirelessly on enhancing Similarweb Digital Data in our platform to make it more timely and granular than ever before. Recently we were recognized by G2 as one of the Best Global Software Companies, ahead of many competitors, and our products were highlighted in their rankings as well. Despite the challenges of 2022, we remain inspired by relieving the pains our customers experience, and we look forward to innovating further in the coming year and beyond. 8 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 As we turn now to 2023, our strategic objectives consist of the following: 1. Successfully serve strategic customers. Now more than ever, our strategic customers - our largest spending named accounts - are increasing their use of and expanding their access to Similarweb Digital Data through deeper integrations. Our DaaS offering is of particular interest to these customers and we will explore its potential extensively this year. We will also explore new service optimizations that our strategic customers request of us. 2. Grow our number of accounts through product led growth and effective go-to-market strategies. To date we have penetrated only a fraction of our multi-billion dollar total addressable market that consists of hundreds of thousands of businesses. We will experiment with different approaches to packaging and pricing as well as service levels this year that our prospective customers value. We have hundreds of thousands of inquiries per year by professionals seeking unassisted access to our data and solutions - we plan to test different variations of delivering our solutions with customer driven activation. 3. Accelerate adoption of new products and add-ons. Today we are a multi-solution company with many products and solutions we can offer to our customers. We see a big opportunity to continue cross selling these solutions to our existing customer base. 4. Operate with excellence and efficiency. We will constantly seek to optimize our execution this year with a focus towards finding additional efficiencies across our functional areas, especially in our marketing and sales funnel. We look forward to keeping everyone updated on our progress towards achieving these objectives throughout the year. 9 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 Our Business Outlook As we have shared previously, we, along with our customers, are not immune to the realities of inflation, rising interest rates, energy shocks, and geopolitical conflict that will likely weigh on the global economy throughout 2023. After assessing the prospects of our business in the current global macroeconomic environment, we are issuing our initial guidance for the year. In the first quarter of 2023 (Q1-23), we expect total revenue in the range of $52.5 million to $53.0 million, representing approximately 19% YoY growth at the midpoint. For the fiscal year ending December 31, 2023, we expect total revenue in the range of $221 million to $222 million, representing approximately 15% growth YoY at the midpoint of the range. Looking at our projected Non-GAAP operating loss for Q1-23, we expect it to be in the range of $11.5 million to $12 million and for the full year of 2023 between $30 million and $31 million. We anticipate Non-GAAP gross margin to be approximately 77.0% to 77.5% in Q1-23, and approximately 78.0% to 79.0% for the year ending December 31, 2023. Our Focus on Achieving Positive Free Cash Flow As a reminder, in the first quarter of 2021, our business was generating positive free cash flow on a quarterly basis. To achieve that, we developed a culture of disciplined execution, which we still nurture and benefit from today. In 2023, we are determined to work smarter, to optimize our unit economics, and to drive operational excellence in order to accelerate our path to profitability. Our strategic focus is to balance growth and profitability, and to achieve positive free cash flow on a sustained quarterly basis by the fourth quarter of this year. Please note that our free cash flow may fluctuate seasonally as we progress through this year. In particular, we anticipate substantial improvement in the first half of 2023, as compared to the first half of 2022. Ultimately, we expect our quarterly cadence will be positive when we finish the year. We believe we have aligned our infrastructure costs to achieve this goal within the parameters of our moderating revenue trajectory as efficiently as possible. We remain focused on disciplined execution through decisions within our control that relate to managing our balance sheet prudently and supporting both our growth and profitability potential. 10 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 In the near term, we believe our business will remain resilient. Our customers tell us and others that we have become a must-have data and technology solution that they utilize to execute their strategy in the digital world. Our data business and its solutions empower the revenue-driving operations of our customers — sales, marketing, analytics, ecommerce — by providing actionable insights to address external risks and opportunities, which are especially valuable during these times of volatility, uncertainty, complexity, and ambiguity. Over the long term, we aspire to achieve durable growth and sustained free cash flow. Helping our customers make decisions and take action to adjust their strategy, accelerate their customer acquisition, and increase their monetization during these challenging times represents our most important opportunity to prove our enduring value. We believe that we hold our destiny in our hands and that we are well prepared to do what is needed to thrive going forward. We look forward to sharing our progress in future updates. Sincerely, Or Offer Founder and Chief Executive Officer Jason Schwartz Chief Financial Officer 11 Similarweb Q4 2022 Shareholder Letter

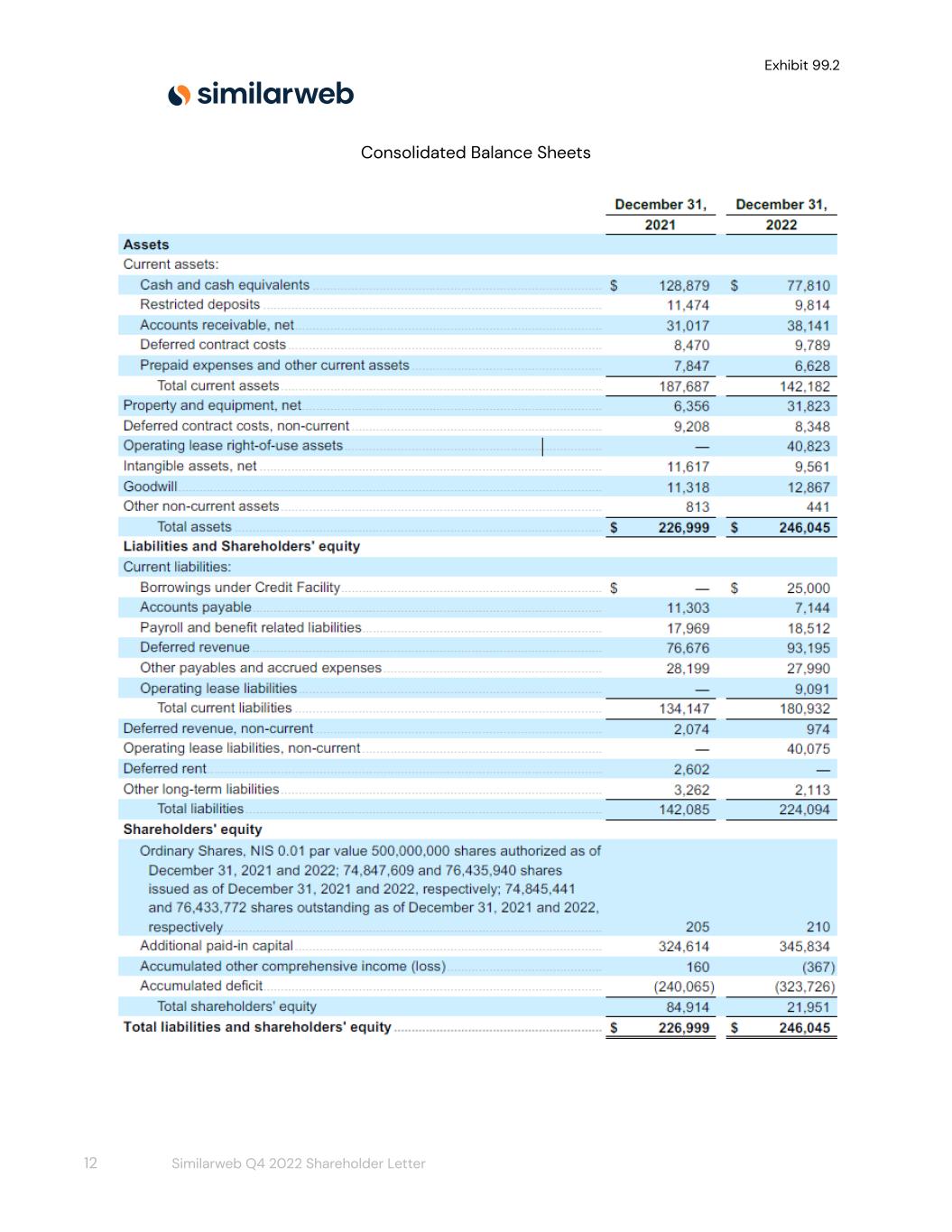

Exhibit 99.2 Consolidated Balance Sheets 12 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 Consolidated Statements of Comprehensive Income (Loss) 13 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 Share-based compensation costs included above: 14 Similarweb Q4 2022 Shareholder Letter

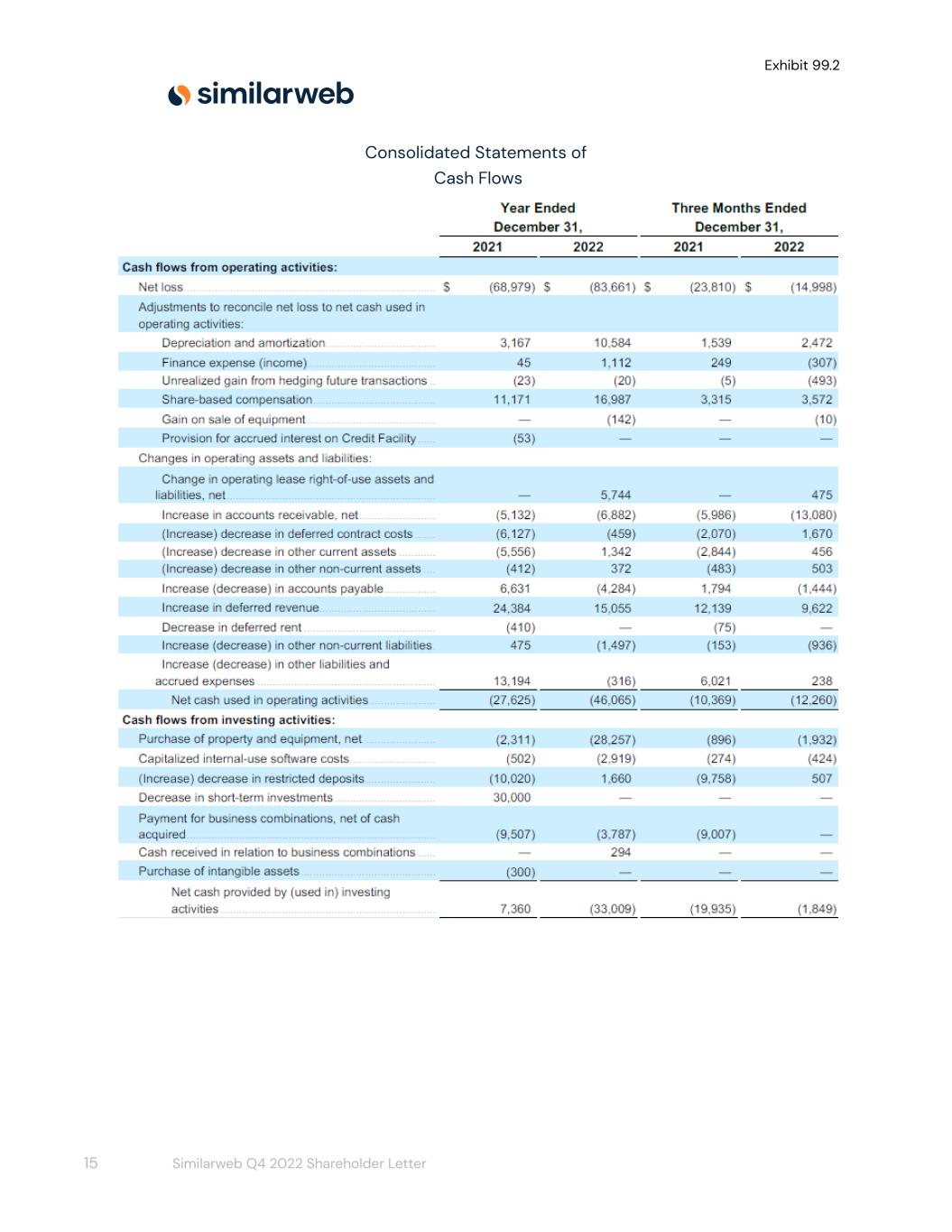

Exhibit 99.2 Consolidated Statements of Cash Flows 15 Similarweb Q4 2022 Shareholder Letter

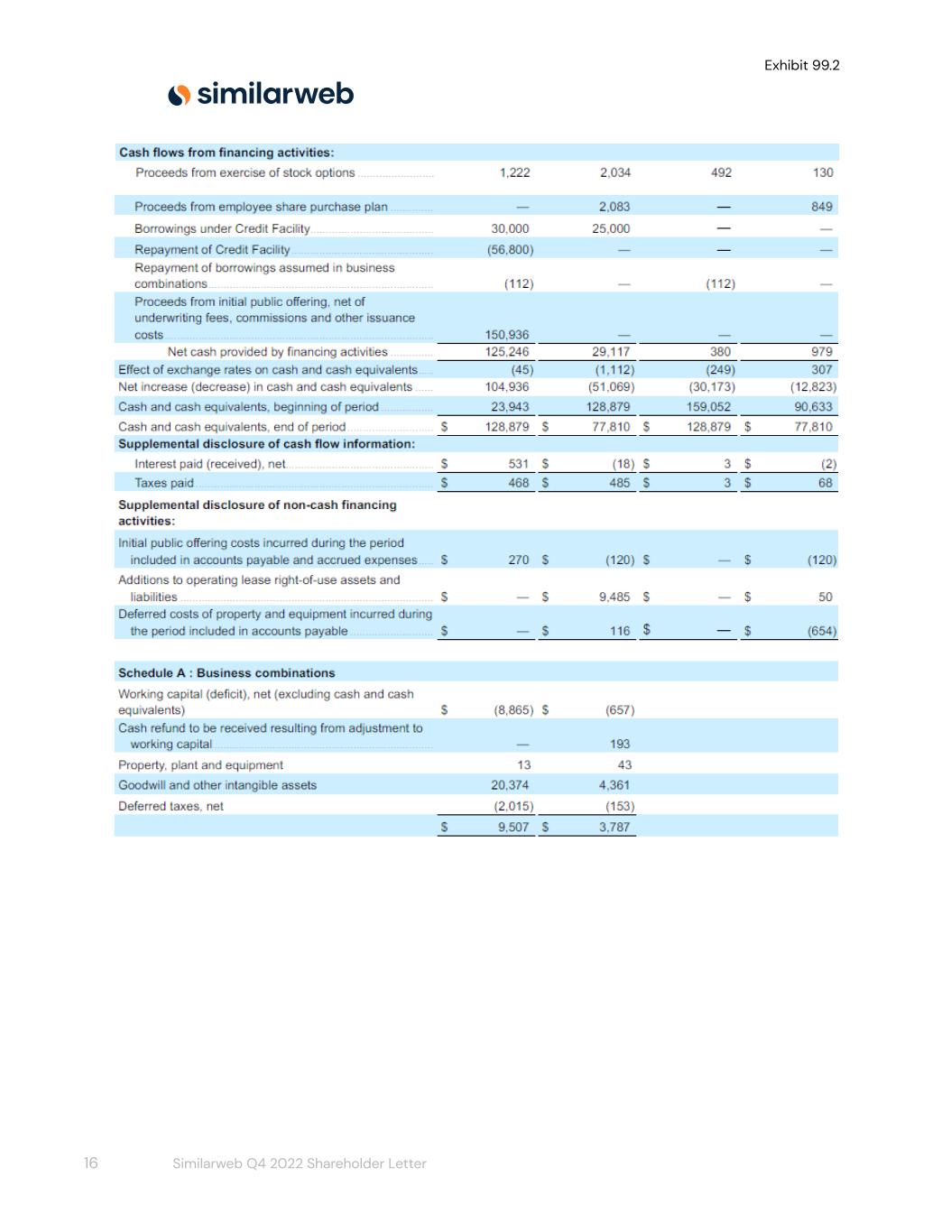

Exhibit 99.2 16 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 Reconciliation of GAAP gross profit to Non-GAAP gross profit 17 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 Reconciliation of GAAP operating loss to Non-GAAP operating loss 18 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 Reconciliation of GAAP operating expenses to non-GAAP operating expenses 19 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 Reconciliation of net cash used in operating activities (GAAP) to Free cash flow and Normalized free cash flow Forward-Looking Statements This letter to shareholders contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to our guidance for the first quarter and full year of 2023 described under "Business Outlook,” the expected performance of our business, future financial results, strategy, long-term growth and overall future prospects, our customers continued investment in digital transformation and reliance on digital intelligence and the size and our ability to capitalize on our market opportunity. Forward-looking statements include all statements that are not historical facts. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. These forward-looking statements reflect our current views regarding our intentions, products, services, plans, expectations, strategies and prospects, which are based on information currently available to us and assumptions we have made. Actual results may differ materially from those described in such forward-looking statements and are subject to a variety of assumptions, uncertainties, risks and factors that are beyond our control. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) challenges associated with forecasting our revenue given our recent growth and rapid technological development, (ii) our history of net losses and desire to increase operating expenses, thereby limiting our ability to achieve profitability, (iii) challenges related to effectively managing our growth, (iv) intense competition in the market and services categories in which we participate, (v) potential reductions in participation in our contributory 20 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 network and/or increase in the volume of opt-out requests from individuals with respect to our collection of their data, or a decrease in our direct measurement dataset, which could lead to a deterioration in the depth, breadth or accuracy of our data, (vi) our inability to attract new customers and expand subscriptions of current customers, (vii) changes in laws, regulations, and public perception concerning data privacy or change in the patterns of enforcement of existing laws and regulations, (viii) our inability to introduce new features or solutions and make enhancements to our existing solutions, (ix) real or perceived errors, failures, vulnerabilities or bugs in our platform, (x) potential security breaches to our systems or to the systems of our third-party service providers, (xi) our inability to obtain and maintain comprehensive and reliable data to generate our insights, (xii) changes in laws and regulations related to the Internet or changes in the Internet infrastructure itself that may diminish the demand for our solutions, (xiii) failure to effectively develop and expand our direct sales capabilities, which could harm our ability to increase the number of organizations using our platform and achieve broader market acceptance for our solutions, and (xiv) the impact that current worldwide geopolitical and macroeconomic uncertainty, including uncertainty resulting from the COVID-19 pandemic or other public health crises and the Russian military operations in Ukraine, and any related economic downturn could have on our or our customers' businesses, financial condition and results of operations. These risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Form 20-F filed with the Securities and Exchange Commission on March 25, 2022, and subsequent reports that we file with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Forward-looking statements represent our beliefs and assumptions only as of the date of this letter. Except as required by law, we undertake no duty to update any forward-looking statements contained in this release as a result of new information, future events, changes in expectations, or otherwise. Certain information contained in this letter relates to or is based on studies, publications, surveys, and other data obtained from third-party sources and the Company's own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this letter, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy, or completeness of any information obtained from third-party sources. In addition, all of the market data included in this letter involves a number of assumptions and limitations, and there can be no 21 Similarweb Q4 2022 Shareholder Letter

Exhibit 99.2 guarantee as to the accuracy or reliability of such assumptions. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source. Non-GAAP Financial Measures This letter to shareholders contains certain financial measures that are expressed on a non-GAAP basis. We use these non-GAAP financial measures internally to facilitate analysis of our financial and business trends and for internal planning and forecasting purposes. We believe these non-GAAP financial measures, when taken collectively, may be helpful to investors because they provide consistency and comparability with past financial performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. However, non-GAAP financial measures have limitations as an analytical tool and are presented for supplemental informational purposes only. They should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures and capitalized internal-use software costs. Normalized free cash flow represents free cash flow less capital investments related to the Company's new headquarters, payments received in connection with these capital investments and deferred payments related to business combinations. Non-GAAP operating income (loss), non-GAAP gross profit, Non-GAAP research and development expenses, non-GAAP sales and marketing expenses, and non-GAAP general and administrative expenses represents the comparable GAAP financial figure, less share-based compensation, adjustments, and payments related to business combinations, amortization of intangible assets, and certain other non-recurring items, as applicable and indicated in the above tables. Other Metrics Customer acquisition costs (CAC) represent the portion of sales and marketing expenses allocated to acquire new customers. Customer retention costs (CRC) represent the portion of sales and marketing expenses allocated to retain existing customers and to increase existing customers’ subscriptions. Annual recurring revenue (ARR) represents the annualized subscription revenue we would contractually expect to receive from customers assuming no increases or reductions in their subscriptions. CAC payback period is the estimated time in months to recover CAC in terms of incremental gross profit that newly acquired customers generate. Net retention rate (NRR) represents the comparison of our ARR from the same set of customers as of a certain point in time, relative to the same point in time in the previous year ago period, expressed as a percentage. 22 Similarweb Q4 2022 Shareholder Letter