EX-99.2

Published on November 12, 2024

Exhibit 99.2 Dear Shareholders, In the third quarter of 2024 (Q3-24), revenue growth continued to accelerate and we delivered a fourth consecutive quarter of positive free cash flow. Our customer base increased by 21% YoY and our remaining performance obligations (RPO) increased by 27% YoY, faster than revenue growth. Our overall dollar-based net retention rate (NRR) increased to 101% and NRR for customers that generate over $100,000 in ARR increased to 111% reflecting our efforts in retaining and growing our business for all customers. Our conviction that we are still only starting to realize the significant potential of our data and the markets that we serve, is stronger than ever. Our Business Performance Total revenue for Q3-24 was $64.7 million, an increase of 18% compared to $54.8 million for the third quarter of 2023 (Q3-23), exceeding the top end of our estimate range. The 18% revenue growth in the quarter follows 13% and 12% YoY growth in Q2-24 and Q1-24 respectively - a fourth consecutive quarter of accelerating revenue growth. We continue to see strong demand at the top-of-funnel from companies of all sizes who appreciate the criticality of our Digital Data for their business. The graph above illustrates the revenue growth acceleration that reflects both the solid demand for our data and solutions and the successful implementation of our GTM strategy. 1 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Our ARR customer base increased to 5,308 accounts, as of September 30, 2024, representing a 21% increase year-over-year and continues to grow faster than revenues, a good indication of the demand and the potential of our data and solutions. The graph below shows the growth of our customer base over each of the last 4 quarters: The average annual revenue per customer was approximately $50 thousand, slightly lower than Q3-23 and an increase relative to Q2-24. As our global customer base continued to expand overall in Q3-24, the number of customers who generate more than $100K in ARR grew from 355, as of September 30, 2023, to 395, as of September 30, 2024, representing an increase of 11% YoY. The ARR 2 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 from this important customer segment has grown by 25% versus Q3-2023 and represents 60% of our total ARR, as of September 30, 2024. In Q3-24, we achieved an overall NRR of 101% and an NRR of 111% for our $100K+ annual recurring revenue customer segment, an increase from the results in Q2-24 and Q1-24. We are encouraged by the second consecutive quarter of improving NRR performance, and expect to see further improvement in the quarters ahead. The improved NRR performance is a result of our initiatives to improve and upskill our Account Management and Customer Success teams and the growth in multi-year customers. 3 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Similarweb data has become more important to our customers’ decision processes at all levels of the organization and this has been an important driver of the growth in multi-year contracts that today account for approximately 45% of our ARR up from 31% three years ago. The increase in longer term subscription commitments is beneficial for both our customers and Similarweb. Our customers benefit by securing access to our digital data. We benefit from increased predictability and durability of our ARR. Our Account Managers and Customer Success teams can allocate more time to understanding the requirements of our customers and improving the utility they derive from our data instead of dealing with renewal processes. The growth in multi-year contracts demonstrates the critical nature of our data. Our Unique Digital Data At our core, we are a data company. Our unique data asset, Similarweb Digital Data, provides the foundation for our solutions and consists of our proprietary estimations of the performance of companies, markets, products, consumer behavior, and trends in the digital world. Our world-class team of more than 300 data scientists, engineers, developers, and analysts gathers billions of unrefined data points amounting to close to one percent of online transactions and interactions and then transforms them into a comprehensive view of the internet across the web, mobile web, and apps. We deliver Similarweb Digital Data to our customers via Software-as-a-Service (SaaS) solutions, Data-as-a-Service (DaaS), and recurring Advisory Services. Our customers rely on our 4 Similarweb Q3 2024 Shareholder Letter

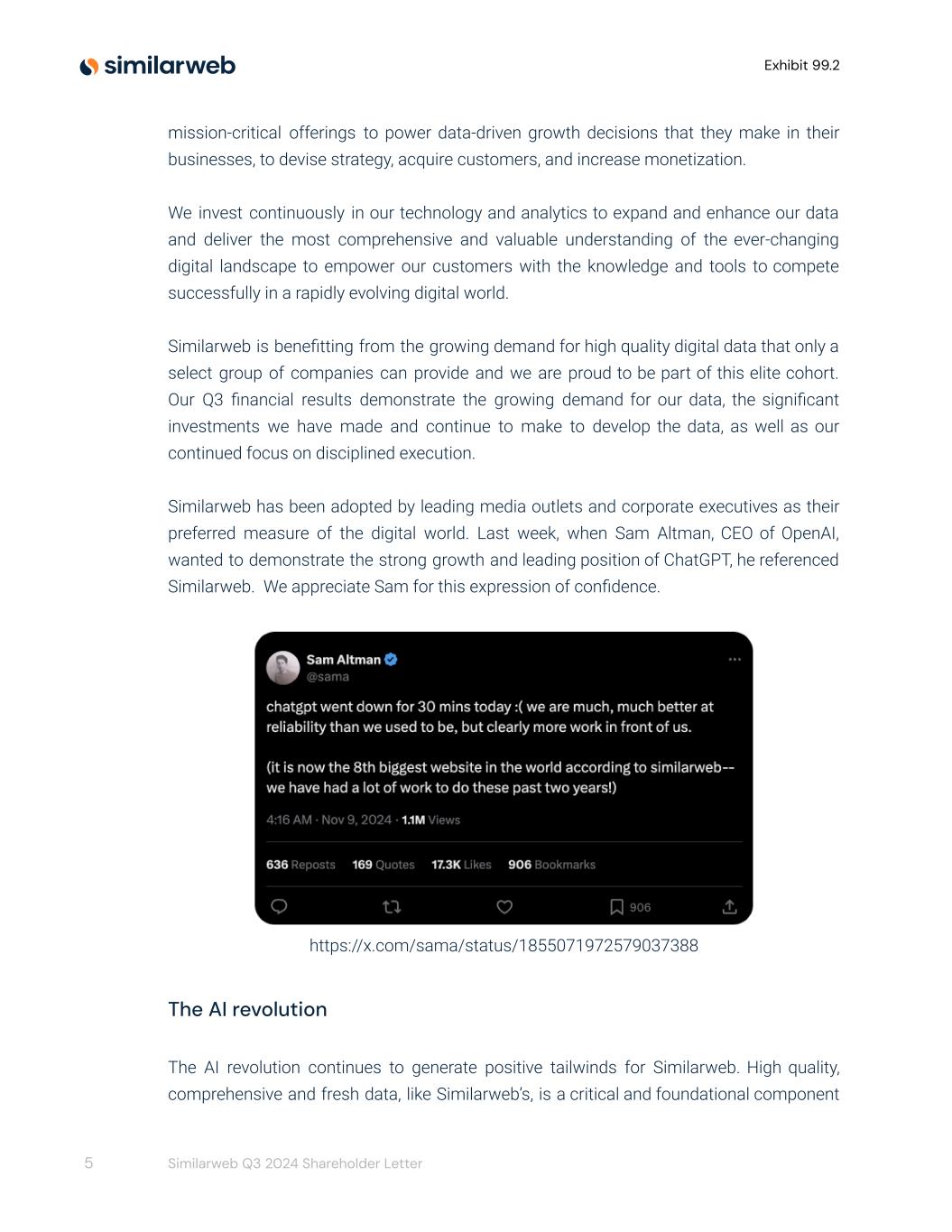

Exhibit 99.2 mission-critical offerings to power data-driven growth decisions that they make in their businesses, to devise strategy, acquire customers, and increase monetization. We invest continuously in our technology and analytics to expand and enhance our data and deliver the most comprehensive and valuable understanding of the ever-changing digital landscape to empower our customers with the knowledge and tools to compete successfully in a rapidly evolving digital world. Similarweb is benefitting from the growing demand for high quality digital data that only a select group of companies can provide and we are proud to be part of this elite cohort. Our Q3 financial results demonstrate the growing demand for our data, the significant investments we have made and continue to make to develop the data, as well as our continued focus on disciplined execution. Similarweb has been adopted by leading media outlets and corporate executives as their preferred measure of the digital world. Last week, when Sam Altman, CEO of OpenAI, wanted to demonstrate the strong growth and leading position of ChatGPT, he referenced Similarweb. We appreciate Sam for this expression of confidence. https://x.com/sama/status/1855071972579037388 The AI revolution The AI revolution continues to generate positive tailwinds for Similarweb. High quality, comprehensive and fresh data, like Similarweb’s, is a critical and foundational component 5 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 for every AI and LLM tech stack. The extensive investments by multiple companies in the infrastructure to support AI and LLMs require data to drive the output of their AI models that will run on their infrastructure. In our view, an LLM without data is like a racing car without gasoline. The AI revolution is creating powerful new opportunities for Similarweb both for our top-line and our bottom-line. We see four distinct opportunities for us to capitalize and monetize the Generative AI opportunity: 1. Embedding AI in Our Solutions: As reported earlier this year, we’ve launched SAM, our Sales AI module, which helps our Sales Intelligence customers generate tailored insights for targeted outreach. SAM significantly boosts response rates and improves sales performance. Following the same strategy, we recently enhanced our Web & Marketing Intelligence solution with AI-based automation enabling our customers to easily set up and customize an accurate and precise view of their market and the topics they want to capture through SEO and PPC. This approach enhances usability and engagement, driving growth by enabling users to access more actionable insights more efficiently. 2. Helping Brands Navigate Shifts in Consumer Behavior: As consumers move from traditional search to AI chatbots, brands face fresh challenges in reaching audiences and capturing their attention. The evolution of the customer journey and the risk of omission from the output of LLMs is a growing concern for many of the largest brands around the world. Using Similarweb’s data and our visibility into consumer behavior on these new AI platforms, we empower our customers to understand their presence and adapt to these changes, keeping them competitive in a rapidly evolving landscape. We believe that we are uniquely qualified to capitalize as the AI revolution evolves. 3. Providing Fresh Data for LLM Training: Leading tech companies building the next generation of content discovery and search engines rely on Similarweb’s high-quality, real-time data to keep their AI models accurate and relevant. This demand underscores our role as a critical partner in powering today’s and tomorrow’s AI. Last quarter, we announced our first 8-digit customer. Today, we are pleased to share that during October (after the close of Q3-24), we secured our second 8-digit customer. This is also a BigTech customer who has been with us for nearly 10 years and also uses our Web Intelligence, Sales Intelligence, Shopper Intelligence through the platform and API integrations across many divisions and geographies. It is now also using Similarweb digital data to train its LLMs. We continue to engage with several other companies on similar opportunities 6 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 4. Streamlining Internal Processes with AI: We also leverage AI in our internal processes and tools to improve efficiency and reduce costs. We have already realized improvements in our development cycles and reduced customer support response times with these tools. By automating workflows, we’re achieving cost savings and boosting reliability in our operations. With these developments, we believe Similarweb is well-positioned to expand its role in the digital intelligence landscape, creating growth opportunities as AI continues to evolve. Our Financial Results When examining our financial results, please note that references to expenses and operating results (other than revenue) are presented both on a GAAP and on a non-GAAP basis below, and that all non-GAAP results are reconciled to the most directly comparable GAAP results in the financial statements exhibits presented at the end of this letter. Revisiting our top line results, in Q3-24 we delivered revenue of $64.7 million, reflecting 18% growth as compared to Q3-23, driven primarily by an increase in the number of customers. The vast majority of our revenue is annual recurring revenue with minimum subscription terms of one year. We continue to increase the number of customers with multi-year subscription terms. As of the end of Q3-24, 45% of our ARR was generated from customers with multi-year subscription commitments, compared to 43% at the same time last year. We continue to believe this is a strong indicator of the long-term durability of our customer relationships and demand for our solutions. We expect the growth in revenue from multi-year customers to contribute to improving NRR rates in the future. Our GAAP gross profit totaled $50.5 million and our non-GAAP gross profit totaled $51.8 million in Q3-24, compared to $44.3 million and $45.6 million in Q3-23, respectively. Non-GAAP gross margin decreased to 80% in Q3-24, versus 83% in Q3-23, primarily attributable to increased data processing costs relating to the launch of our new data version. Our GAAP operating expenses increased to $52.9 million and our non-GAAP operating expenses increased to $47.5 million in Q3-24 from $49.1 million and $44.5 million in 7 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Q3-23, respectively. On a marginal basis, non-GAAP operating expenses decreased and represented 73% of revenue in Q3-24 as compared to 81% of revenue in Q3-23. Specific components of our third quarter 2024 operating expenses: Our GAAP research and development investment increased to $14.5 million and our non-GAAP research and development investment increased to $13.1 million in Q3-24, from $14.2 million and $12.7 million in Q3-23, respectively. As a percentage of revenue, non-GAAP research & development expenses decreased to 20% in Q3-24, as compared to 23% in Q3-23. We expect non-GAAP research & development expenses to increase in absolute dollars as we continue to invest in our data moat and innovation, while maintaining a similar marginal expense. GAAP sales and marketing expenses increased to $26.8 million and non-GAAP sales and marketing expenses increased to $24.9 million in Q3-24, from $24.3 million and $22.8 million in Q3-23, respectively, driven primarily by our ongoing efforts to align our resources with our growth trajectory. As a percentage of revenue, non-GAAP sales & marketing expense decreased to 38% in Q3-24, as compared to 41% in Q3-23. An operating tenet in our model is that our sales and marketing costs are divided with approximately 45% to 50% attributable to new customer acquisition (land), and the remaining 50% to 55% attributable to retention, upselling and cross-selling (expand) of our existing customer base. When analyzing our investment in customer acquisition costs (CAC) for growth efficiency, we track an estimated payback period. This metric has historically averaged between 15 and 16 months on a gross profit basis over the trailing four quarters. As of Q3-24, the average payback is ranging between 21 and 22 months, primarily due to longer sales cycles over the last year. Payback from expansion and customer retention costs (CRC) is faster than payback on new customer CAC such that we are generating a 58%-62% contribution margin on our recurring customer base which contributes meaningfully to our growth efficiency. We intend to continue to invest in customer acquisition to support future growth, as well as in customer retention to drive NRR and to increase the lifetime value of our customers. GAAP general and administrative costs increased to $11.7 million from $10.7 million in Q3-23, and our non-GAAP general and administrative costs slightly increased to $9.5 million in Q3-24 from $9.0 million in Q3-23. As a percentage of revenue, non-GAAP general 8 Similarweb Q3 2024 Shareholder Letter

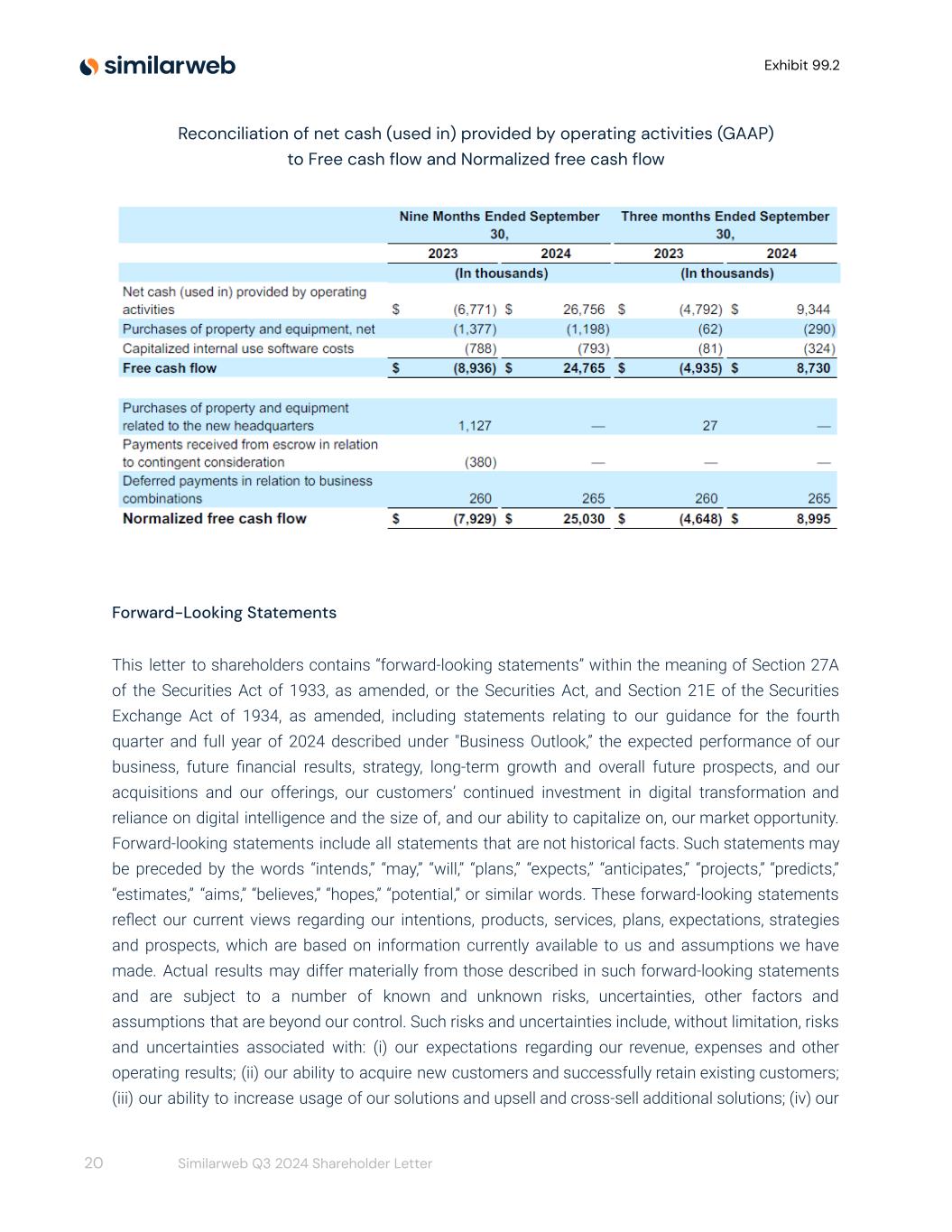

Exhibit 99.2 & administrative expenses decreased to 15% in Q3-24, an improvement of 1 percentage point compared to Q3-23. Looking at our bottom line, the Q3-24 GAAP operating loss was ($2.5) million or (4%) of revenue, compared to ($4.9) million or (9%) of revenue for the third quarter of 2023. Q3-24 non-GAAP operating profit was $4.4 million or 7% of revenue, compared to a non-GAAP operating profit of $1.1 million or 2% of revenue for the third quarter of 2023, and exceeded our forecast. This is our fifth consecutive profitable quarter on a non-GAAP basis. Our dedication to achieving profitable growth over the last year yielded significant operating efficiencies across the business, which drove an operating margin improvement of 5 percentage points year over year in Q3-24. * non-GAAP We believe that a strong indication of future performance is our deferred revenue, which was $99.2 million at the end of Q3-24, compared to $90.2 million at the same time last year. Our Remaining Performance Obligations (RPO) totaled $212.5 million at the end of Q3-24, up 27% YoY from $167.7 million at the end of Q3-23. We expect to recognize approximately 76% of total Q3-24 RPO as revenue over the next 12 months. We ended the third quarter with $60.1 million in cash and cash equivalents and no outstanding debt. Net cash generated from operating activities was $9.3 million in Q3-24, compared to negative $4.8 million in Q3-23. Normalized free cash flow was $9.0 million in Q3-24, compared to negative $4.6 million in Q3-23. Free cash flow in the quarter was impacted by the phasing of receipts that we expected to collect in the fourth quarter. 9 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Importantly, this is our fourth consecutive quarter in which we achieved positive free cash flow, which we aim to sustain on a quarterly basis going forward. Our Business Outlook Based on the momentum that we have experienced in the first nine months of 2024, we are increasing our guidance for 2024 revenues. In the fourth quarter of 2024 (Q4-24), we expect total revenue in the range of $64.7 million to $65.7 million, representing approximately 15% YoY growth at the midpoint of the range. For the full year of 2024, we expect total revenue in the range of $249.0 million to $250.0 million, an increase from our previous expectation. We expect non-GAAP operating profit for Q4-24 to be in the range of $1.5 million to $2.5 million. For the full year of 2024, we expect non-GAAP operating profit to be between $14.0 million and $15.0 million, in line with our previous expectation. Our guidance reflects an increase in operating expenses, primarily related to increased headcount, in which we intend to invest to further accelerate our revenue growth while maintaining non-GAAP operating profit and positive free cash flow. We are focused on working to become a “Rule of 40” company on an annual basis over time and after delivering a full year of non-GAAP operating profit and positive free cash flow, we have made significant progress towards this goal. We plan to maintain our focus on achieving that goal in the future. Our Focus on Profitable Growth We continue to focus on generating profitable growth. At the beginning of the year, we shared with you our four strategic objectives for the year and are pleased at the progress that we have made during 2024: (1) We seek to land more new strategic accounts and to retain and expand our current strategic accounts. We are pleased with the continued growth of our $100,000 customer cohort, which now comprises 60% of our ARR. The average ARR per customer of this customer cohort increased by 13% YoY. (2) We are focused on increasing net retention across our existing customers. We are encouraged with the increase in NRR rates during the quarter and continue to 10 Similarweb Q3 2024 Shareholder Letter

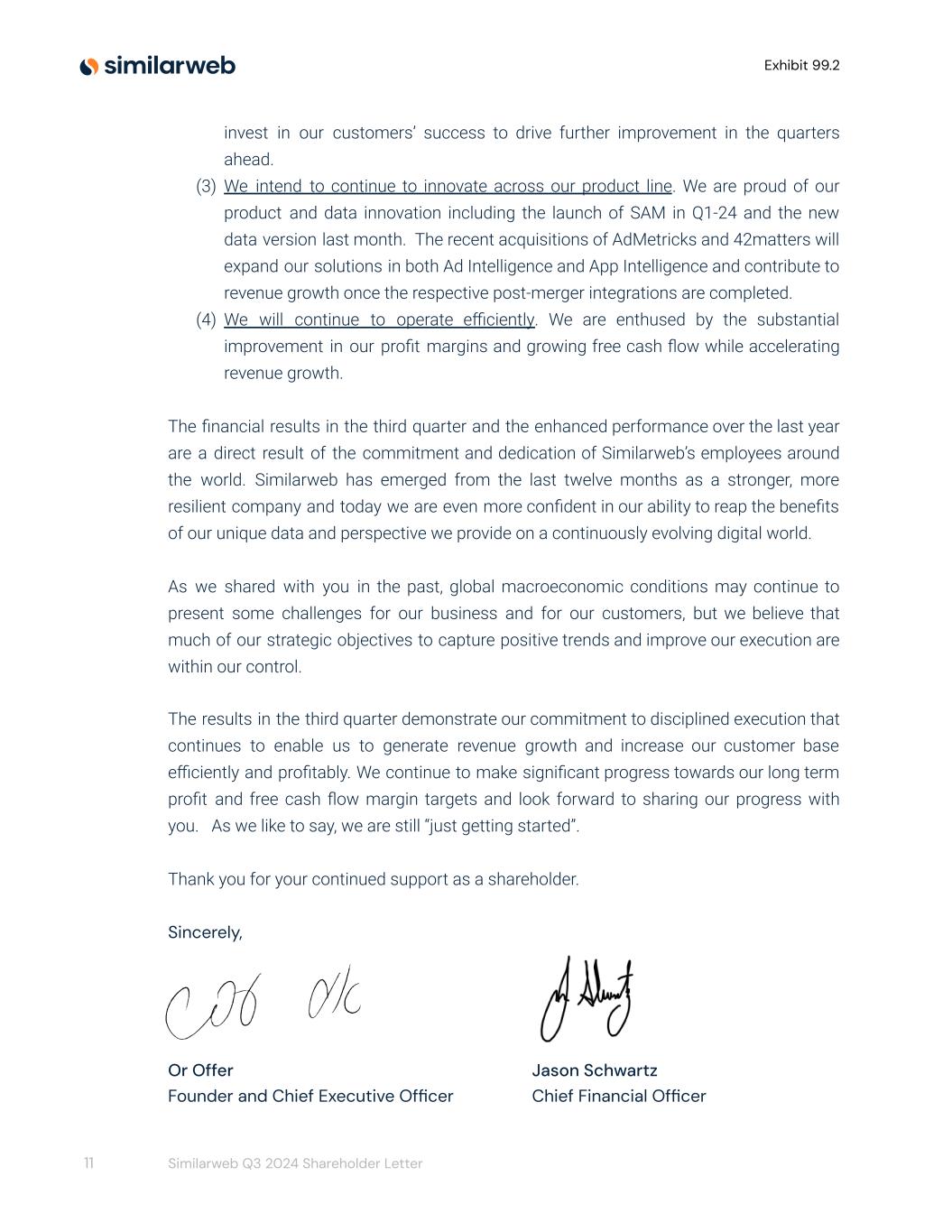

Exhibit 99.2 invest in our customers’ success to drive further improvement in the quarters ahead. (3) We intend to continue to innovate across our product line. We are proud of our product and data innovation including the launch of SAM in Q1-24 and the new data version last month. The recent acquisitions of AdMetricks and 42matters will expand our solutions in both Ad Intelligence and App Intelligence and contribute to revenue growth once the respective post-merger integrations are completed. (4) We will continue to operate efficiently. We are enthused by the substantial improvement in our profit margins and growing free cash flow while accelerating revenue growth. The financial results in the third quarter and the enhanced performance over the last year are a direct result of the commitment and dedication of Similarweb’s employees around the world. Similarweb has emerged from the last twelve months as a stronger, more resilient company and today we are even more confident in our ability to reap the benefits of our unique data and perspective we provide on a continuously evolving digital world. As we shared with you in the past, global macroeconomic conditions may continue to present some challenges for our business and for our customers, but we believe that much of our strategic objectives to capture positive trends and improve our execution are within our control. The results in the third quarter demonstrate our commitment to disciplined execution that continues to enable us to generate revenue growth and increase our customer base efficiently and profitably. We continue to make significant progress towards our long term profit and free cash flow margin targets and look forward to sharing our progress with you. As we like to say, we are still “just getting started”. Thank you for your continued support as a shareholder. Sincerely, Or Offer Founder and Chief Executive Officer Jason Schwartz Chief Financial Officer 11 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Consolidated Balance Sheets 12 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Consolidated Statements of Comprehensive Income (Loss) 13 Similarweb Q3 2024 Shareholder Letter

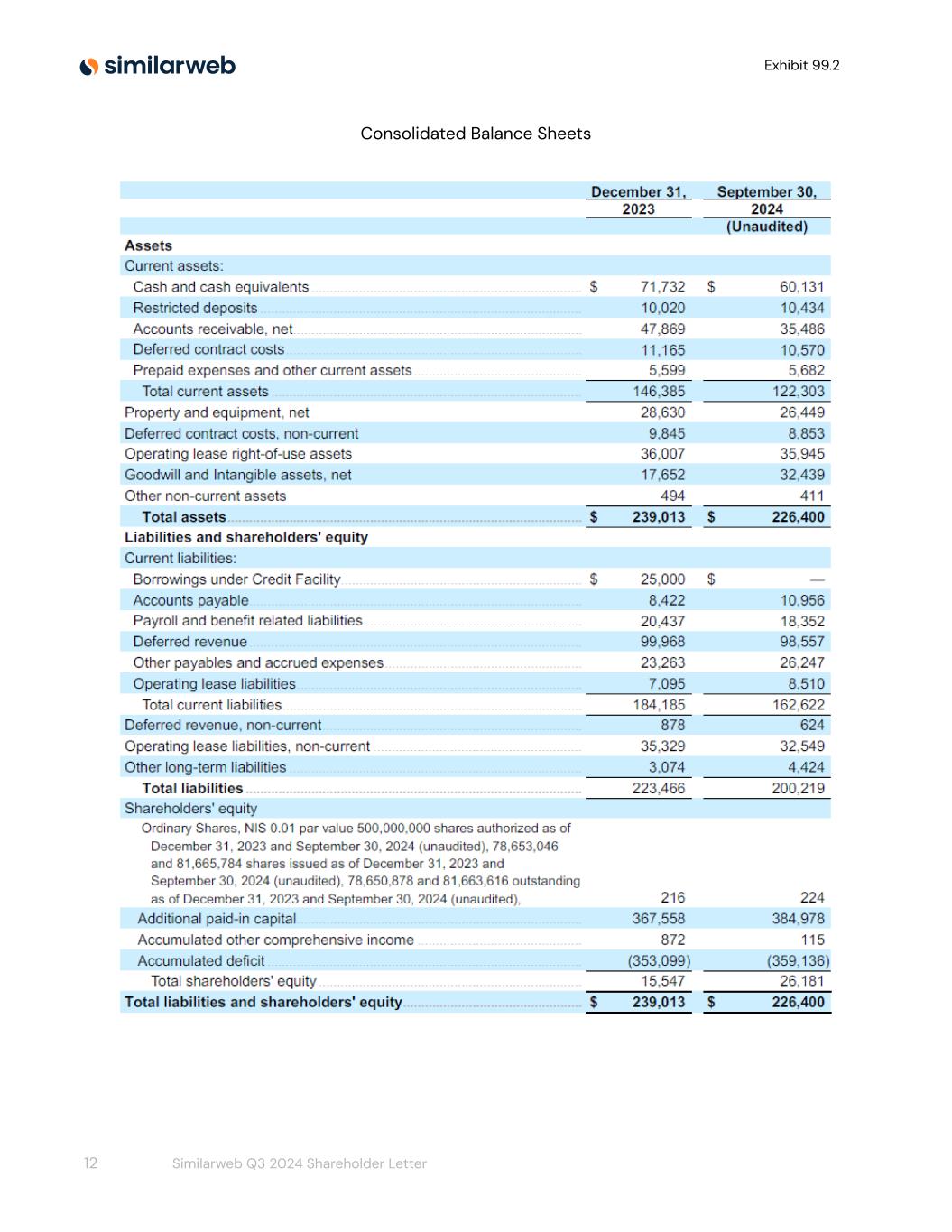

Exhibit 99.2 Share-based compensation costs included above: 14 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Consolidated Statements of Cash Flows 15 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 16 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Reconciliation of GAAP gross profit to Non-GAAP gross profit 17 Similarweb Q3 2024 Shareholder Letter

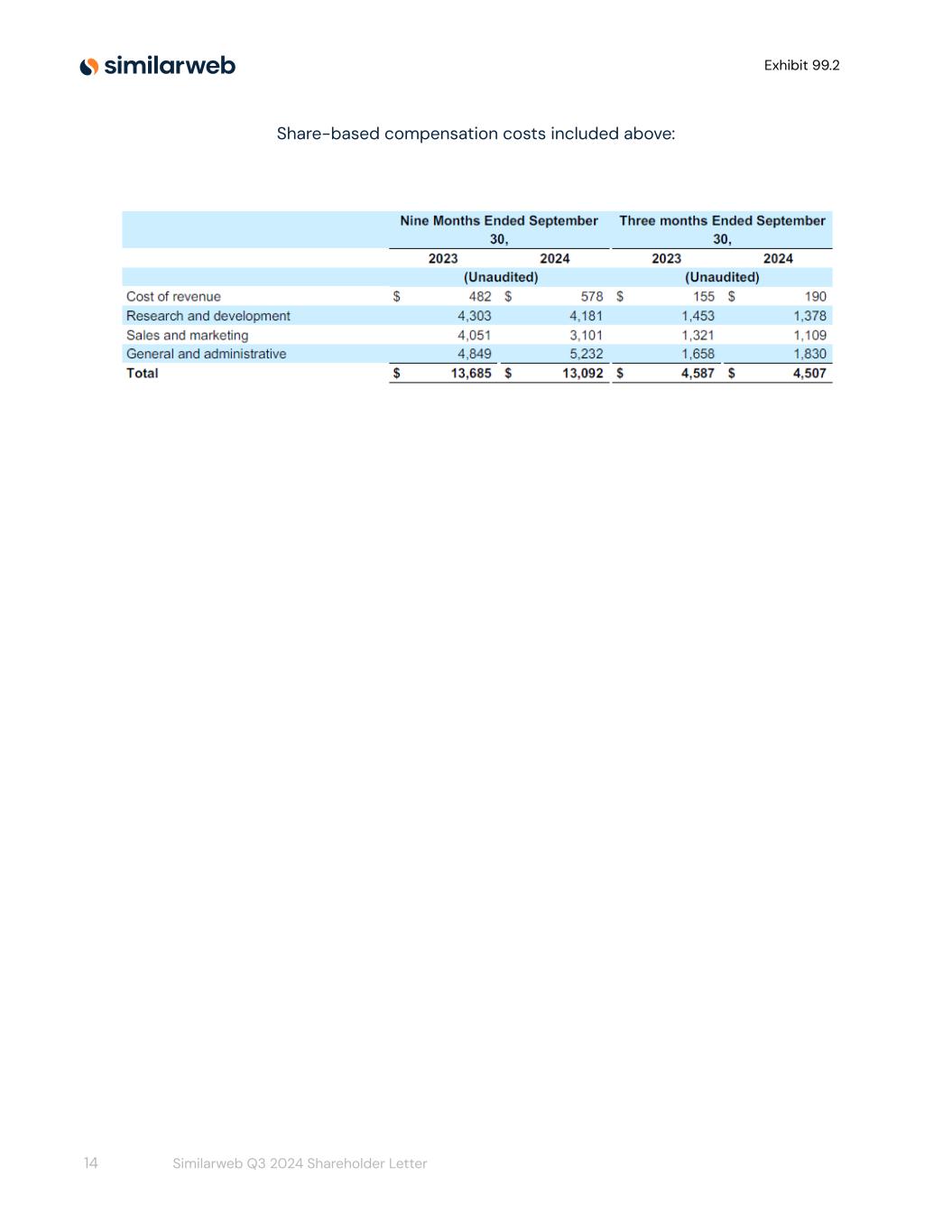

Exhibit 99.2 Reconciliation of GAAP operating loss to Non-GAAP operating (loss) income 18 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Reconciliation of GAAP operating expenses to non-GAAP operating expenses 19 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Reconciliation of net cash (used in) provided by operating activities (GAAP) to Free cash flow and Normalized free cash flow Forward-Looking Statements This letter to shareholders contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to our guidance for the fourth quarter and full year of 2024 described under "Business Outlook,” the expected performance of our business, future financial results, strategy, long-term growth and overall future prospects, and our acquisitions and our offerings, our customers’ continued investment in digital transformation and reliance on digital intelligence and the size of, and our ability to capitalize on, our market opportunity. Forward-looking statements include all statements that are not historical facts. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. These forward-looking statements reflect our current views regarding our intentions, products, services, plans, expectations, strategies and prospects, which are based on information currently available to us and assumptions we have made. Actual results may differ materially from those described in such forward-looking statements and are subject to a number of known and unknown risks, uncertainties, other factors and assumptions that are beyond our control. Such risks and uncertainties include, without limitation, risks and uncertainties associated with: (i) our expectations regarding our revenue, expenses and other operating results; (ii) our ability to acquire new customers and successfully retain existing customers; (iii) our ability to increase usage of our solutions and upsell and cross-sell additional solutions; (iv) our 20 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 ability to achieve or sustain profitability; (v) anticipated trends, growth rates, rising interest rates, rising global inflation and current macroeconomic conditions, and challenges in our business and in the markets in which we operate, and the impact of Israel's war with Hamas and other terrorist organizations and potential hostilities with Iran or Lebanon on geopolitical and macroeconomic conditions or on our company and business; (vi) future investments in our business, our anticipated capital expenditures and our estimates regarding our capital requirements; (vii) the costs and success of our sales and marketing efforts and our ability to promote our brand; (viii) our reliance on key personnel and our ability to identify, recruit and retain skilled personnel; (ix) our ability to effectively manage our growth, including continued international expansion; (x) our reliance on certain third party platforms and sources for the collection of data necessary for our solutions; (xi) our ability to protect our intellectual property rights and any costs associated therewith; (xii) our ability to identify and complete acquisitions that complement and expand our reach and platform; (xiii) our ability to comply or remain in compliance with laws and regulations that currently apply or become applicable to our business, including in Israel, the United States, the European Union, the United Kingdom and other jurisdictions where we elect to do business; (xiv) our ability to compete effectively with existing competitors and new market entrants; and (xv) the growth rates of the markets in which we compete. These risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Form 20-F filed with the Securities and Exchange Commission on February 28, 2024, and subsequent reports that we file with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Forward-looking statements represent our beliefs and assumptions only as of the date of this letter, November 12, 2024. Except as required by law, we undertake no duty to update any forward-looking statements contained in this letter as a result of new information, future events, changes in expectations, or otherwise. Certain information contained in this letter relates to or is based on studies, publications, surveys, and other data obtained from third-party sources and the Company's own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this letter, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy, or completeness of any information obtained from third-party sources. In addition, all of the market data included in this letter involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source. 21 Similarweb Q3 2024 Shareholder Letter

Exhibit 99.2 Non-GAAP Financial Measures This letter to shareholders contains certain financial measures that are expressed on a non-GAAP basis. We use these non-GAAP financial measures internally to facilitate analysis of our financial and business trends and for internal planning and forecasting purposes. We believe these non-GAAP financial measures, when taken collectively, may be helpful to investors because they provide consistency and comparability with past financial performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. However, non-GAAP financial measures have limitations as an analytical tool and are presented for supplemental informational purposes only. They should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Free cash flow represents net cash provided by (used in) operating activities less capital expenditures and capitalized internal-use software costs. Normalized free cash flow represents free cash flow less capital investments related to the Company's headquarters, payments received in connection with these capital investments and deferred payments related to business combinations. Non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP gross profit, non-GAAP gross margin, non-GAAP research and development expenses, non-GAAP sales and marketing expenses, and non-GAAP general and administrative expenses represents the comparable GAAP financial figures, less share-based compensation, adjustments, and payments related to business combinations, amortization of intangible assets, and certain other non-recurring items, as applicable and indicated in the above tables. Other Metrics Customer acquisition costs (CAC) represent the portion of sales and marketing expenses allocated to acquire new customers. Customer retention costs (CRC) represent the portion of sales and marketing expenses allocated to retain existing customers and to increase existing customers’ subscriptions. Annual recurring revenue (ARR) represents the annualized subscription revenue we would contractually expect to receive from customers assuming no increases or reductions in their subscriptions. CAC payback period is the estimated time in months to recover CAC in terms of incremental gross profit that newly acquired customers generate. Net retention rate (NRR) represents the comparison of our ARR from the same set of customers as of a certain point in time, relative to the same point in time in the previous year, expressed as a percentage. 22 Similarweb Q3 2024 Shareholder Letter