EX-99.2

Published on February 17, 2026

Exhibit 99.2 Dear Shareholders, The AI revolution presents tremendous opportunities for Similarweb as an essential data foundation to make AI models and agents smarter and more accurate and provide actionable insights into a rapidly changing and complex digital world. The early traction and strong commercial interest in our new AI offerings reinforces our confidence that our comprehensive and proprietary data is becoming a critical requirement for companies to win their markets in the generative AI era. Revenue from generative AI data and solutions is scaling fast and accounted for 11% of revenue in Q4-25, up from 8% at the beginning of the year. Our GenAI intelligence product, just launched at the beginning of Q3-25, is already responsible for one of our fastest growing revenue streams, approaching 200 customers with an ARR of approximately $3 million. We intend to continue to ramp and roll out new products in 2026, and we started the year by announcing a milestone partnership with Manus, validating our data’s foundational role in powering the next generation of agentic AI tools. The current transition period of AI adoption has introduced some short-term variability, and revenue growth in the fourth quarter was slower than expected mostly due to the timing of two large LLM data training contracts that did not close yet but remain active in our pipeline. However, we believe Similarweb’s long-term prospects are brighter than ever. Overall revenue performance in Q4-25 also continued to be impacted by broader market weakness as companies reallocate current budgets toward the AI transition and the modernization of their tech stacks. This shift is disruptive in the short term but ultimately supports our AI-led strategy to reaccelerate growth in 2026 and beyond. In addition to the external environment, we have identified specific commercial execution shortfalls this year and initiated corrective actions to better enable us to capture the emerging opportunities ahead of us. This includes upskilling our go-to-market organization to sell in the new AI world and creating a dedicated team for selling to LLMs. As we innovate and invest to capture AI opportunities and accelerate the top line, we remain committed to profitable growth and strong free cash flow, which is reflected in our results. Even though revenue growth did not step up as expected in Q4-25, non-GAAP operating profit for the quarter slightly surpassed our target with disciplined cost 1 Similarweb Q4 2025 Shareholder Letter

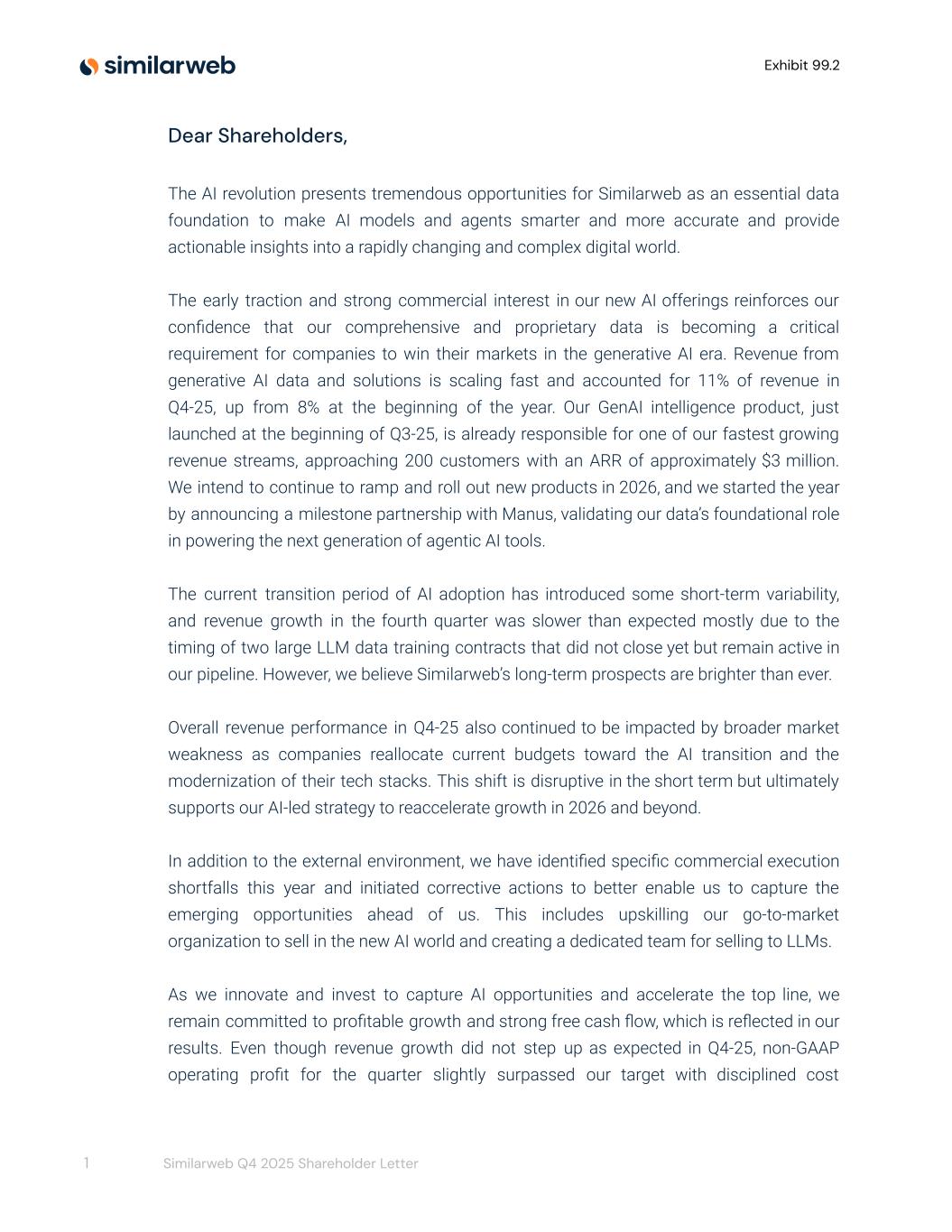

Exhibit 99.2 management. For the full year, 2025 was our second consecutive year of positive non-GAAP operating profit and Free Cash Flow. While we are not satisfied with our overall performance in 2025, we are entering 2026 with conviction in the unrivaled value of our data and with a clear strategy to leverage it into accelerated and profitable revenue growth in the AI-driven future. Business performance Total revenue for Q4-25 was $72.8 million, an increase of 11% compared to $65.6 million in the fourth quarter of 2024. Our Q4-25 results benefited from growth in overall customers as well as increased revenues from some of the new products we launched over the last year including App Intelligence and Gen AI Intelligence. YoY growth was slower than expected primarily due to the timing of two large LLM data training contracts that did not close yet but remain active in our pipeline. Given the size and complexity of these AI contracts, sales cycles can take longer to complete. The pipeline for these contracts continues to expand but the timing and form mean closing can vary reflecting their scale. Our $100K+ ARR customer segment continues to expand and deepen as we focus our sales team on expanding our presence with larger enterprise customers that recognize the importance of our digital data. As of December 31, 2025, this group represented 63% of total ARR. The sustained growth demonstrates the demand from larger organizations seeking mission-critical intelligence, and we believe this focus further strengthens our resilience and supports our long-term growth. 2 Similarweb Q4 2025 Shareholder Letter

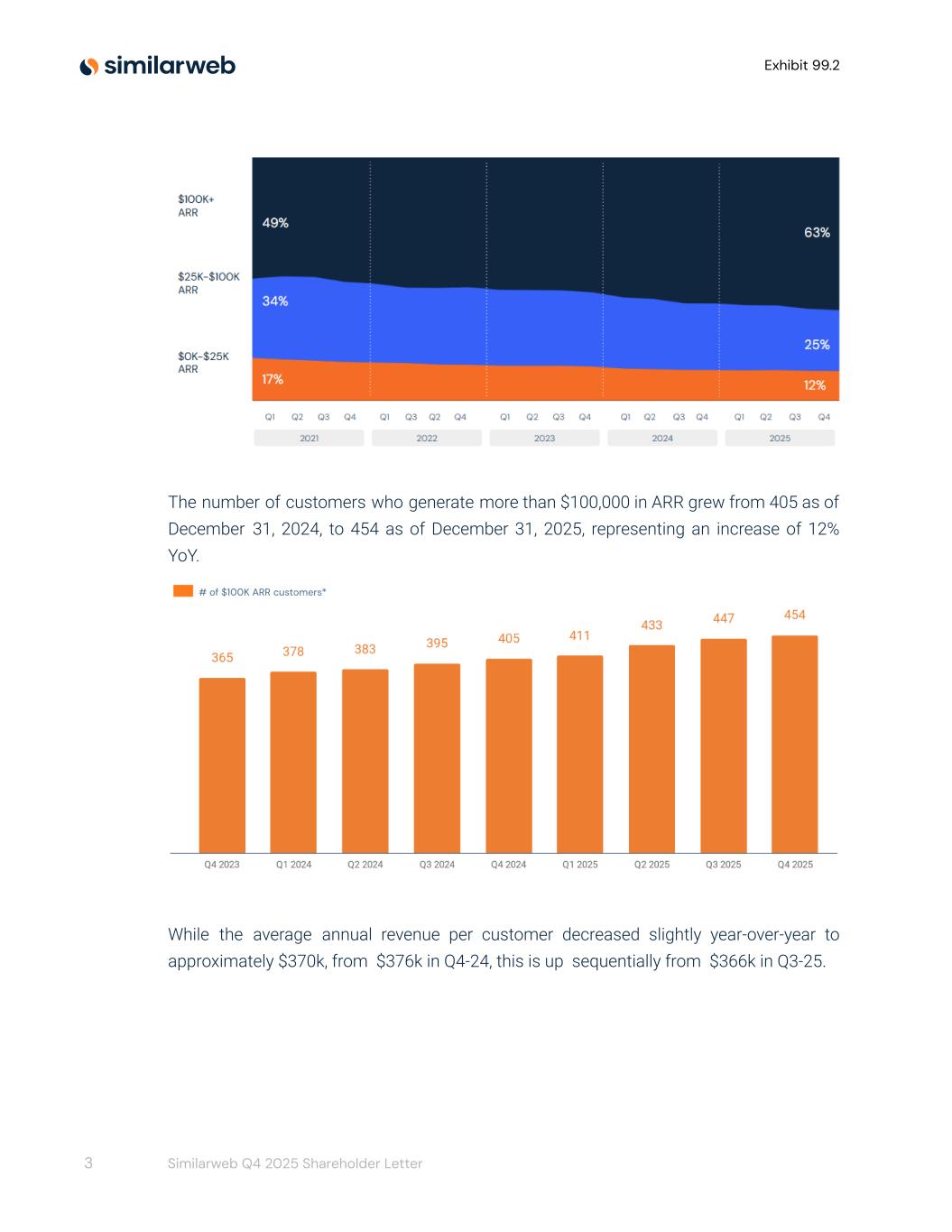

Exhibit 99.2 The number of customers who generate more than $100,000 in ARR grew from 405 as of December 31, 2024, to 454 as of December 31, 2025, representing an increase of 12% YoY. While the average annual revenue per customer decreased slightly year-over-year to approximately $370k, from $376k in Q4-24, this is up sequentially from $366k in Q3-25. 3 Similarweb Q4 2025 Shareholder Letter

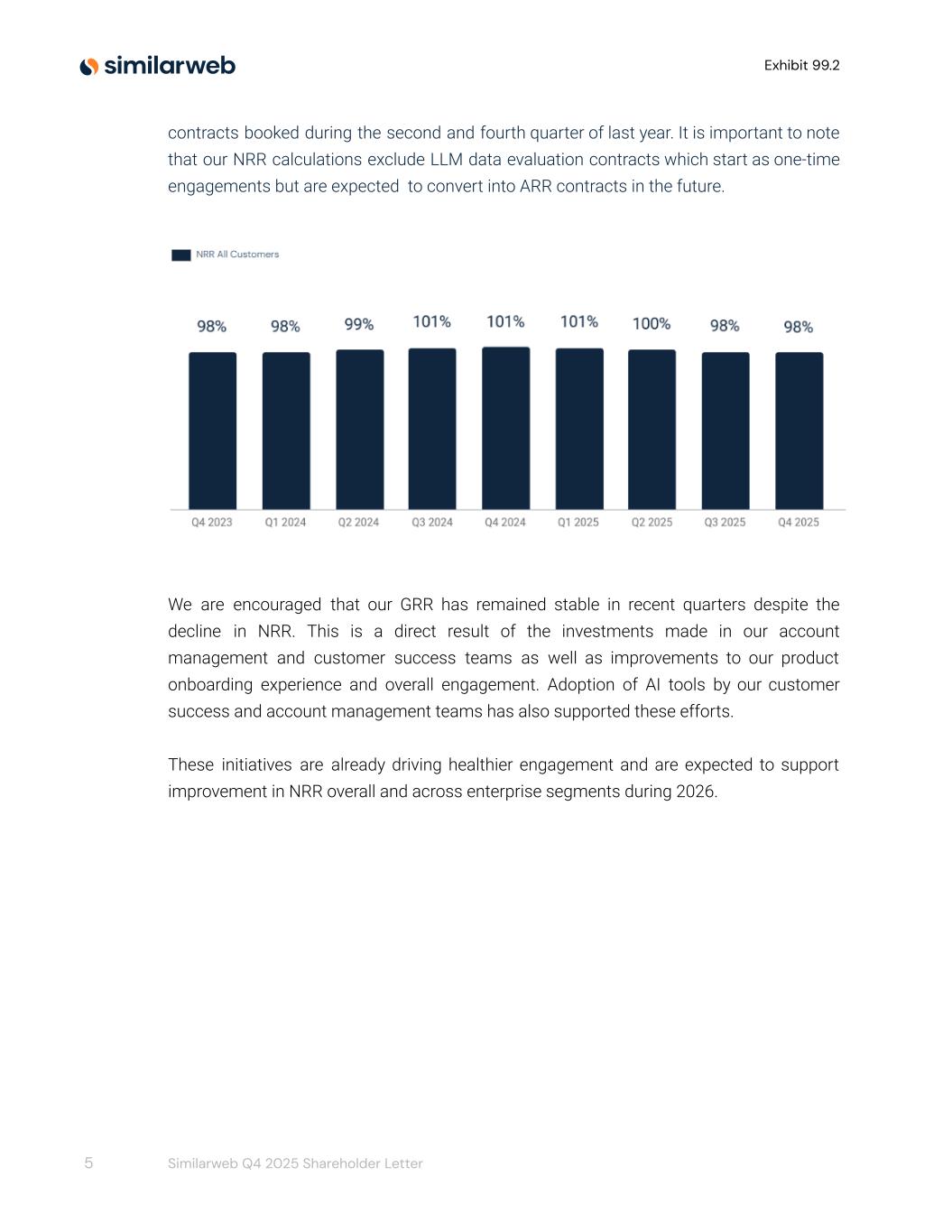

Exhibit 99.2 While our largest customers continue to grow, we are equally encouraged by the solid momentum in new customer acquisition. As of December 31, 2025 our total ARR customer base grew to 6,128 accounts, representing an 11% increase year-over-year. We view this growth as a healthy indicator of demand and a leading signal for future expansion. It reflects growing awareness of the value of Similarweb’s digital data across a wide range of customers, industries and use cases. In Q4-25, we achieved an overall NRR of 98% across all customers and an NRR of 103% among customers with over $100k ARR, a decrease from 101% and 112% respectively in Q4-24. This decline reflects the strong expansion activity in 2024, particularly from large 4 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 contracts booked during the second and fourth quarter of last year. It is important to note that our NRR calculations exclude LLM data evaluation contracts which start as one-time engagements but are expected to convert into ARR contracts in the future. We are encouraged that our GRR has remained stable in recent quarters despite the decline in NRR. This is a direct result of the investments made in our account management and customer success teams as well as improvements to our product onboarding experience and overall engagement. Adoption of AI tools by our customer success and account management teams has also supported these efforts. These initiatives are already driving healthier engagement and are expected to support improvement in NRR overall and across enterprise segments during 2026. 5 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 Our ability to scale from a single initial use case to an enterprise-wide, multi-solution relationship continues to be a powerful driver of long-term ARR growth. A leading global payments and financial services company illustrates this progression. The relationship began in 2017 with a ~$10k Web Intelligence engagement within the marketing team, initially deployed alongside a competitor to validate data accuracy and demonstrate value. Over time, adoption expanded across international marketing, merchant sales, and the small business division. As usage deepened, the customer broadened access through additional users, API integrations, expanded country coverage, and custom reporting, and later Sales Intelligence was added to support merchant prospecting and lead enrichment. Similarweb data is now embedded across the customer’s B2B marketing and sales workflows, informing audience strategy, competitive benchmarking, and regional sales prioritization, particularly across EMEA. In 2025, Similarweb insights enabled the U.S. B2B organization of the customer to optimize affiliate, paid, and organic search strategies, reducing spend while improving performance across all channels. Most recently, the customer expanded into Pro access and consulting services for additional B2B financial products. As a result, ARR increased to more than $400k representing a ~40x expansion over eight years. 6 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 We are super proud that Similarweb Digital Data has become deeply embedded in our customers’ decision processes at all levels of their organizations. As of the end of Q4-25, 60% of our ARR was generated from customers who contracted under multi-year subscription commitments, compared to 49% at the same time last year and 42% two years ago. We believe this is a strong indicator of the long-term durability of our customer relationships and demand for our solutions. Another strong example of our customer expansion is a global leader in high-performance athletic footwear and lifestyle apparel that began its journey as a Similarweb customer in 2015 with a small, self-service package for their e-commerce team. Over the following decade, the relationship scaled significantly, expanding in 2019 to a ~$60k contract for European e-commerce data and then to a global Digital Partner Commerce (DPC) rollout in 2022, that empowered the brand with the data to track market share across all key retailers and channels. In 2025, the partnership expanded over multiple regions including North America, LATAM, and Emerging Markets, with the customer also adding our Shopper Intelligence for its Amazon e-commerce team in Europe. Since 2015 this account has grown by ~100x to an ARR of $500k, demonstrating how a localized e-commerce tool can evolve into a multi-solution strategic asset for a complex 7 Similarweb Q4 2025 Shareholder Letter

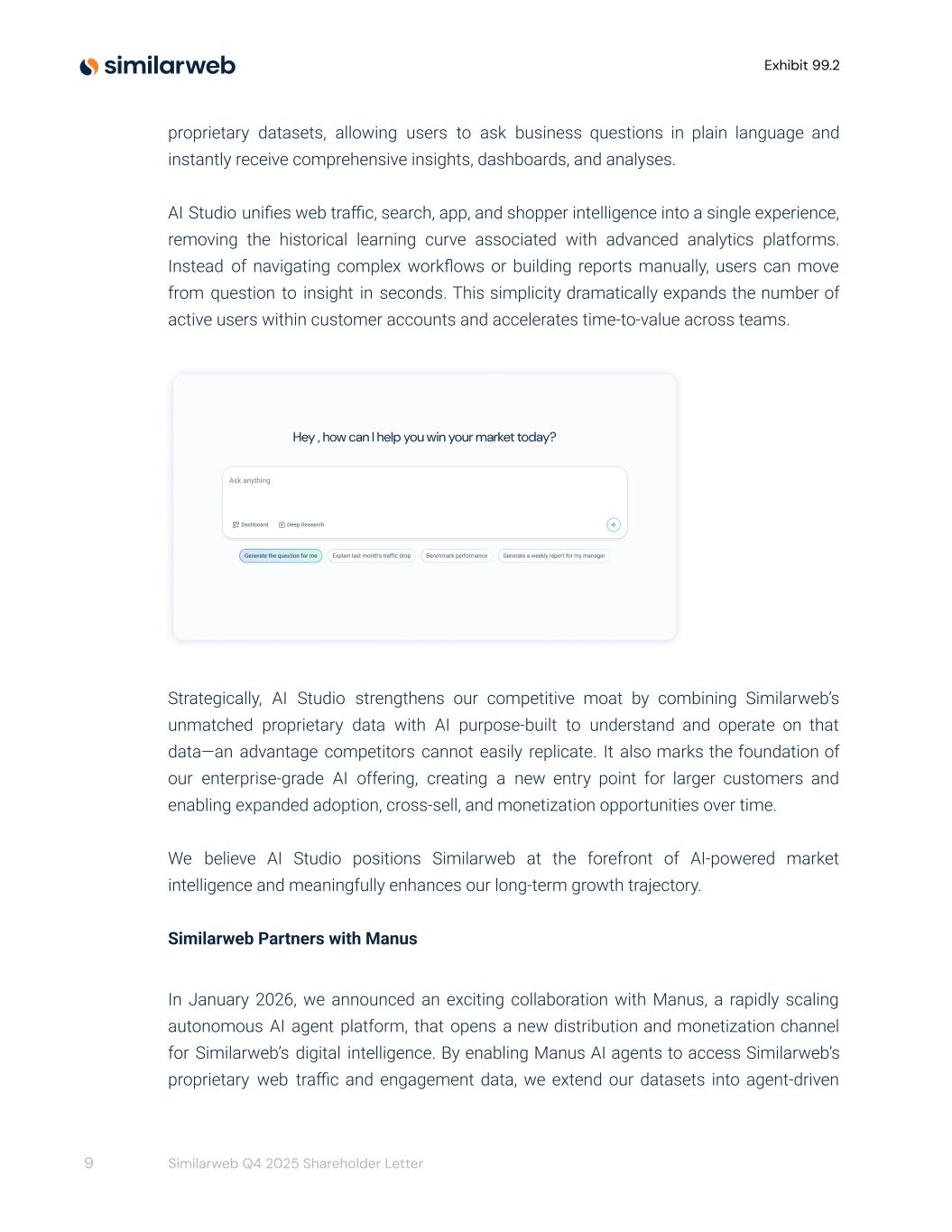

Exhibit 99.2 global organization. We are super proud that Similarweb Digital Data has become deeply embedded in our customers’ e-commerce teams. Business highlights At our core, we are a data company. Our unique data asset, Similarweb Digital Data, provides the foundation for our solutions and consists of our proprietary estimations of the performance of companies, markets, products, consumer behavior, and trends in the digital world. We invest continuously in our technology and analytics to expand and enhance our data in order to deliver the most comprehensive and valuable understanding of the ever-changing digital landscape. In 2025, we translated this data strength into new intelligence products — expanding across advertising, mobile apps, and AI — to provide our customers with faster, deeper insights into how people and businesses engage online. Similarweb and the AI revolution The AI revolution is accelerating, and we are already seeing clear traction across key use cases. As a leading supplier of digital data, the AI revolution presents significant opportunities. High quality, comprehensive, actionable and trusted data, like Similarweb’s, is a critical and foundational component for every AI and LLM tech stack. We remain focused on the three high-impact opportunities we discussed in the past and they are showing sustained traction: data for LLM training. GenAI Intelligence and AI agents. We are excited by the opportunities provided by our partnerships with new AI driven players and our recently launched AI-Studio which democratizes access to our data. Similarweb’s AI Studio - revolutionizing access to our data A few weeks ago, we launched Similarweb’s AI Studio, a new AI agent–based product that represents a step-change in how customers access and extract value from Similarweb’s Digital Data. AI Studio introduces a conversational interface that sits on top of all our 8 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 proprietary datasets, allowing users to ask business questions in plain language and instantly receive comprehensive insights, dashboards, and analyses. AI Studio unifies web traffic, search, app, and shopper intelligence into a single experience, removing the historical learning curve associated with advanced analytics platforms. Instead of navigating complex workflows or building reports manually, users can move from question to insight in seconds. This simplicity dramatically expands the number of active users within customer accounts and accelerates time-to-value across teams. Strategically, AI Studio strengthens our competitive moat by combining Similarweb’s unmatched proprietary data with AI purpose-built to understand and operate on that data—an advantage competitors cannot easily replicate. It also marks the foundation of our enterprise-grade AI offering, creating a new entry point for larger customers and enabling expanded adoption, cross-sell, and monetization opportunities over time. We believe AI Studio positions Similarweb at the forefront of AI-powered market intelligence and meaningfully enhances our long-term growth trajectory. Similarweb Partners with Manus In January 2026, we announced an exciting collaboration with Manus, a rapidly scaling autonomous AI agent platform, that opens a new distribution and monetization channel for Similarweb’s digital intelligence. By enabling Manus AI agents to access Similarweb’s proprietary web traffic and engagement data, we extend our datasets into agent-driven 9 Similarweb Q4 2025 Shareholder Letter

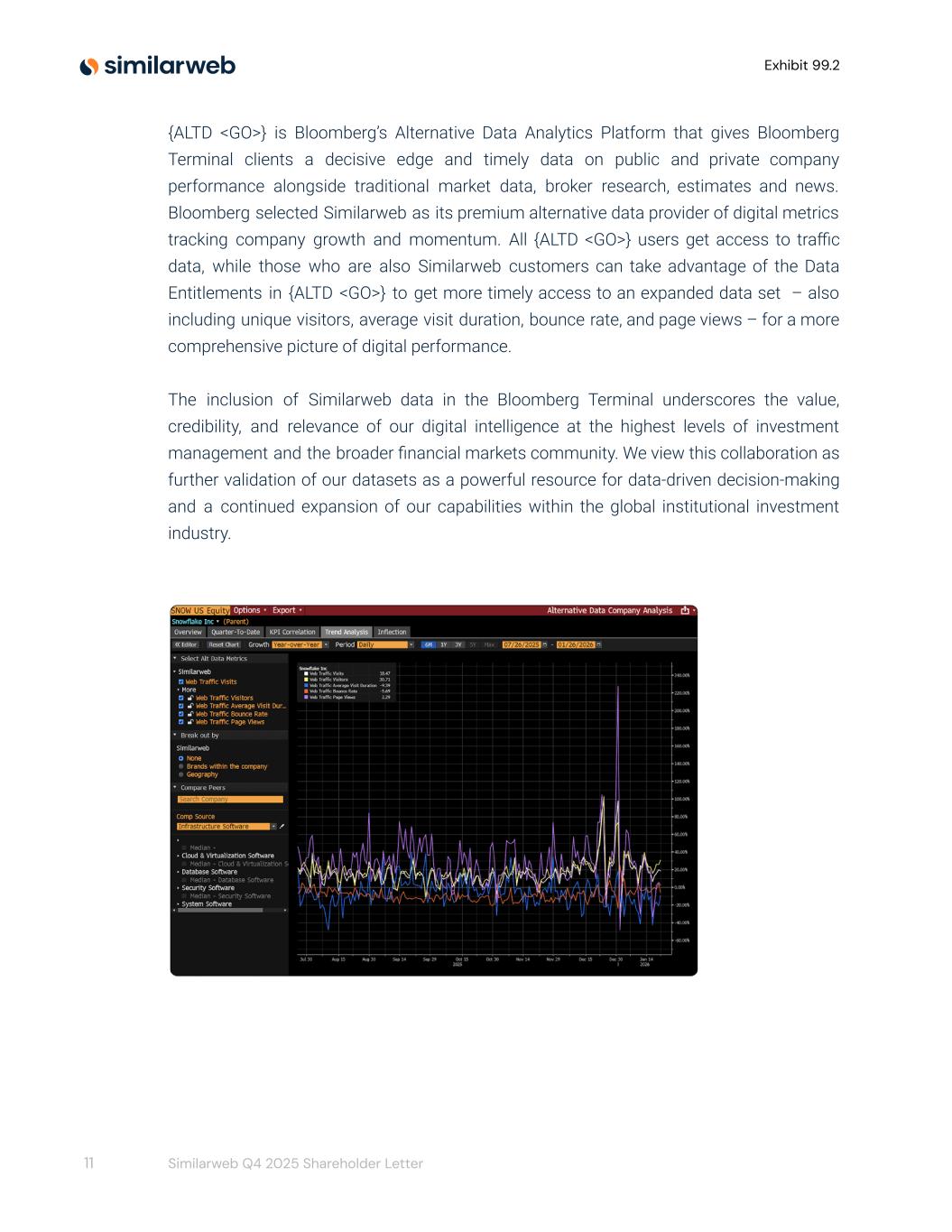

Exhibit 99.2 workflows where AI systems actively execute marketing analysis, competitive assessment, and strategic planning on behalf of users. Manus surpassed $100 million in annual recurring revenue less than nine months after launch, highlighting the pace at which agent-based AI platforms are being adopted. This partnership positions Similarweb as a core data provider for this emerging category and enables monetization through data access and expanded entitlements. We believe integrations like this represent an important growth vector, embedding Similarweb data directly into third-party AI ecosystems and creating incremental revenue opportunities beyond our traditional platform. Kipp Bodnar, Hubspot’s CMO and a director on our board, recently discussed how corporate marketing executives can leverage the context Similarweb’s data provides to build market research reports and presentations on Hubspot’s “Marketing Against the Grain” podcast available here: This AI Tool Works Like a $300,000 McKinsey Consultant Bloomberg deepens integration of Similarweb alternative on the Terminal In January 2026, Bloomberg expanded Similarweb datasets our mutual customers can see in the Bloomberg Terminal with its {ALTD <GO>} investment research solution for alternative data. This supports advanced use cases including faster KPI nowcasting, deeper company and peer benchmarking, and more timely identification of performance inflection points ahead of earnings that may differ from consensus expectations. 10 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 {ALTD <GO>} is Bloomberg’s Alternative Data Analytics Platform that gives Bloomberg Terminal clients a decisive edge and timely data on public and private company performance alongside traditional market data, broker research, estimates and news. Bloomberg selected Similarweb as its premium alternative data provider of digital metrics tracking company growth and momentum. All {ALTD <GO>} users get access to traffic data, while those who are also Similarweb customers can take advantage of the Data Entitlements in {ALTD <GO>} to get more timely access to an expanded data set – also including unique visitors, average visit duration, bounce rate, and page views – for a more comprehensive picture of digital performance. The inclusion of Similarweb data in the Bloomberg Terminal underscores the value, credibility, and relevance of our digital intelligence at the highest levels of investment management and the broader financial markets community. We view this collaboration as further validation of our datasets as a powerful resource for data-driven decision-making and a continued expansion of our capabilities within the global institutional investment industry. 11 Similarweb Q4 2025 Shareholder Letter

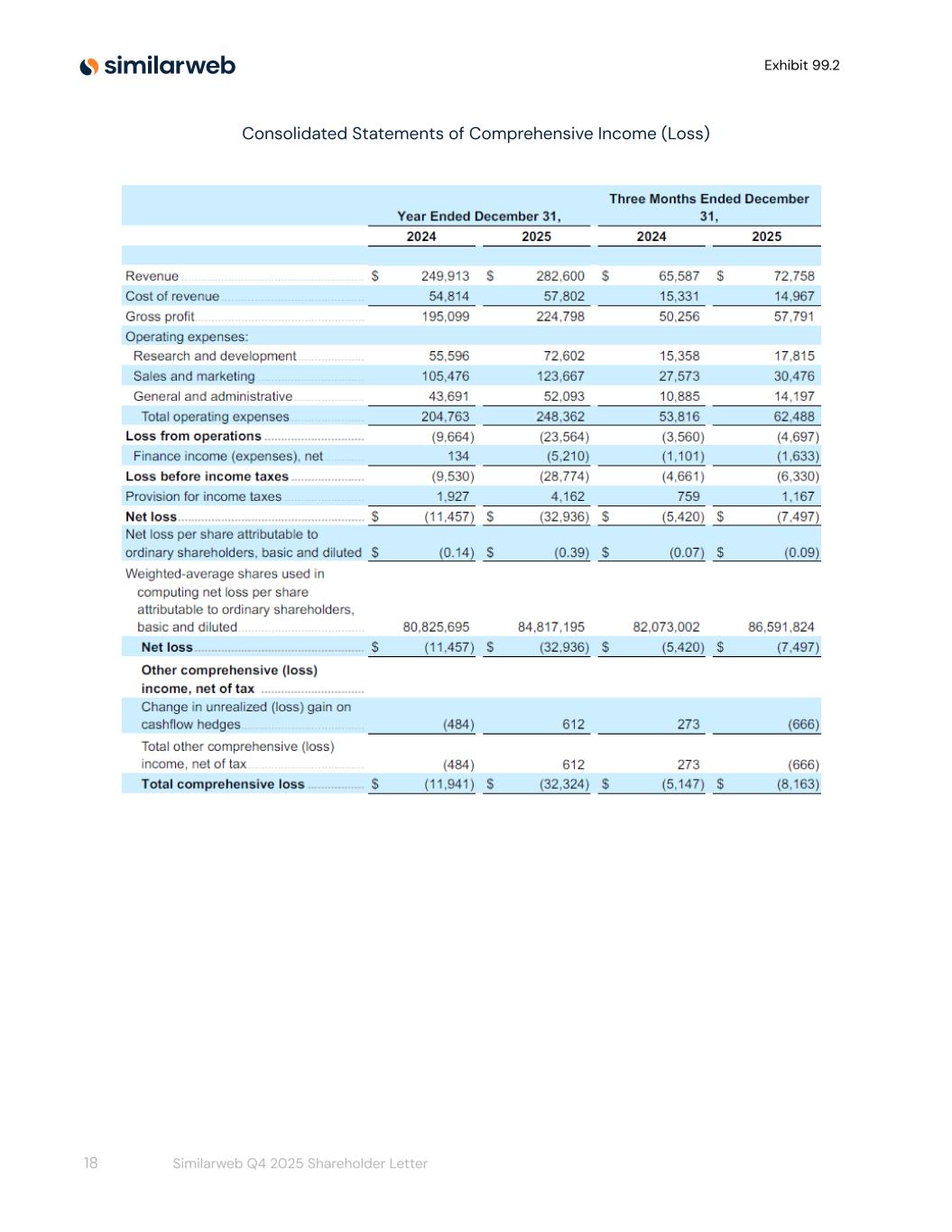

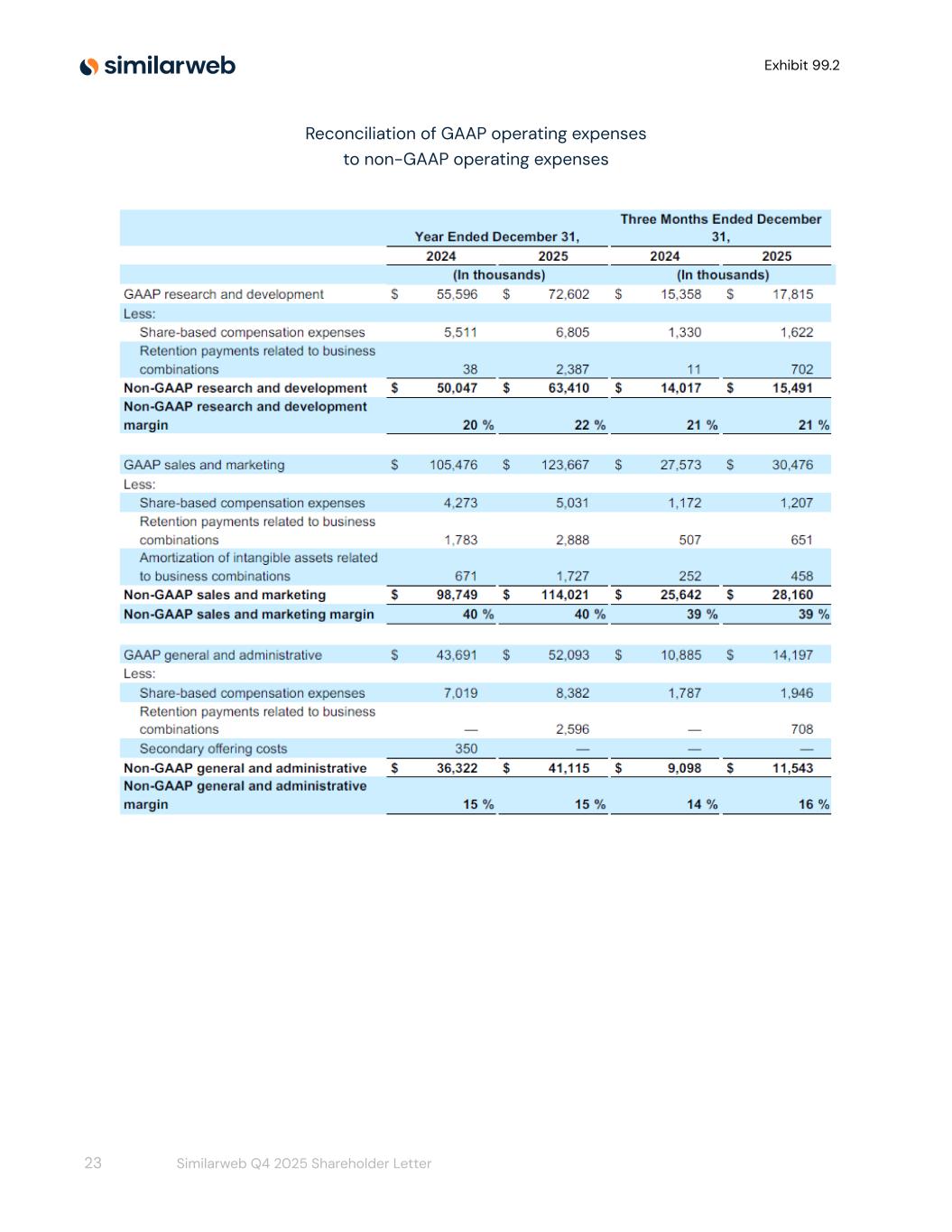

Exhibit 99.2 Financial Results When examining our financial results, please note that references to expenses and operating results (other than revenue) are presented both on a GAAP and on a non-GAAP basis below, and that all non-GAAP results are reconciled to the most directly comparable GAAP results in the financial statements exhibits presented at the end of this letter. Revisiting our top-line results, in Q4-25 we delivered revenue of $72.8 million, reflecting 11% growth as compared to Q4-24, driven primarily by an increase in the number of customers as well as increased revenue from some of the new products we launched over the last year, including App Intelligence and Gen AI Intelligence, as discussed above. Our GAAP gross profit totaled $57.8 million and our non-GAAP gross profit totaled $58.6 million in Q4-25, compared to $50.3 million and $51.3 million in Q4-24, respectively. Non-GAAP gross margin increased to 81% in Q4-25, versus 78% in Q4-24. Our GAAP operating expenses increased to $62.5 million and our non-GAAP operating expenses increased to $55.2 million in Q4-25 from $53.8 million and $48.8 million in Q4-24, respectively. As a percentage of revenue, non-GAAP operating expenses increased to 76% in Q4-25, compared to 74% in Q4-24. Specific components of our fourth quarter 2025 operating expenses: GAAP research and development investment increased to $17.8 million and our non-GAAP research and development investment increased to $15.5 million in Q4-25, from $15.4 million and $14.0 million in Q4-24, respectively. As a percentage of revenue, non-GAAP research and development expenses remained 21% in Q4-25, as in Q4-24. We expect non-GAAP research and development expenses to increase in absolute dollars as we continue to invest in our data moat and innovation and expand our R&D team. GAAP sales and marketing expenses increased to $30.5 million and non-GAAP sales and marketing expenses increased to $28.2 million in Q4-25, from $27.6 million and $25.6 million in Q4-24, respectively, driven primarily by the increased investment in our sales force. As a percentage of revenue, non-GAAP sales and marketing expenses remained at 39% in Q4-25, as in Q4-24. 12 Similarweb Q4 2025 Shareholder Letter

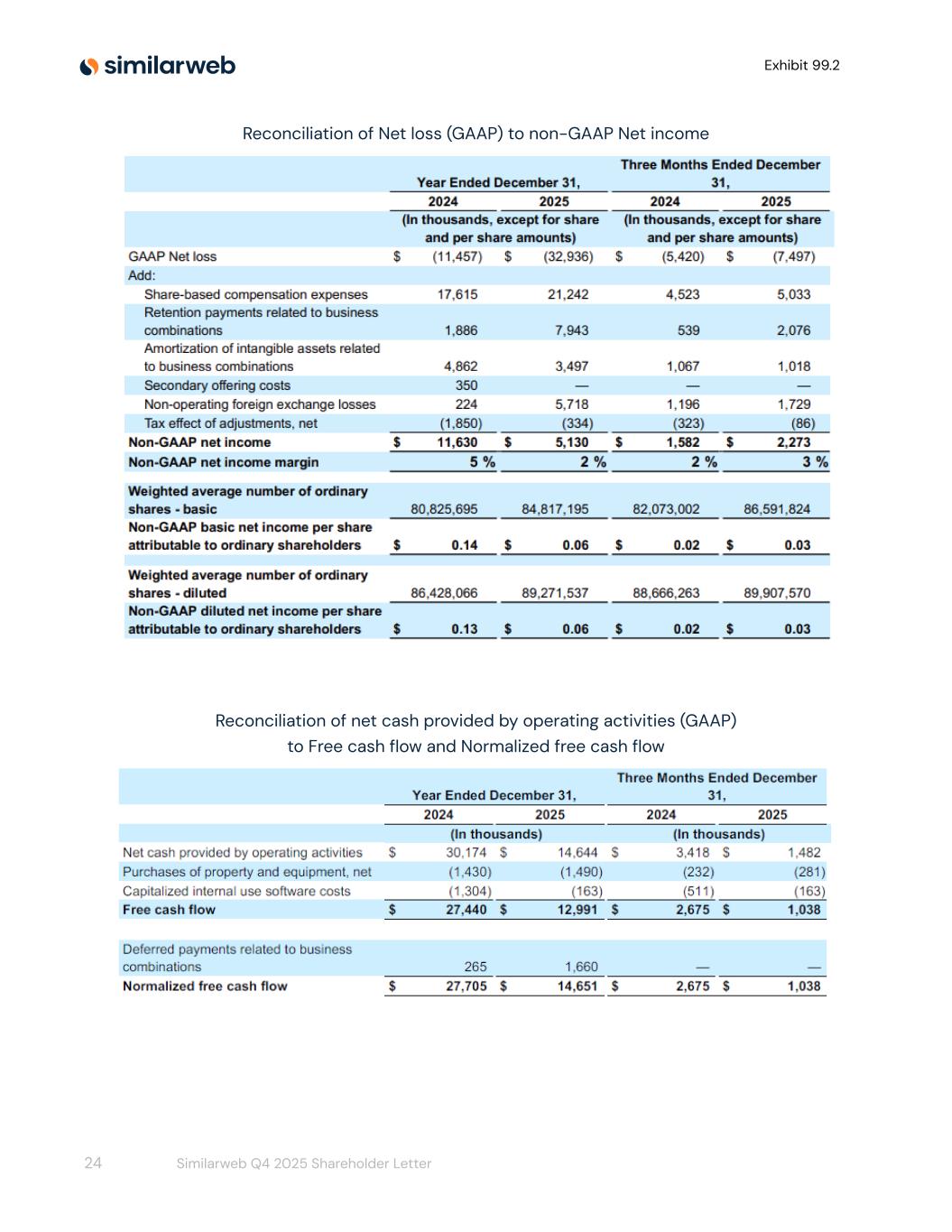

Exhibit 99.2 GAAP general and administrative costs increased to $14.2 million from $10.9 million in Q4-24, and our non-GAAP general and administrative costs increased to $11.5 million in Q4-25 from $9.1 million in Q4-24. As a percentage of revenue, non-GAAP general and administrative expenses increased to 16% in Q4-25, from 14% in Q4-24. * non-GAAP Q4-25 GAAP operating loss was ($4.7) million or (6%) of revenue, compared to ($3.6) million or (5%) of revenue for the fourth quarter of 2024. Q4-25 non-GAAP operating profit was $3.4 million or 5% of revenue, compared to a non-GAAP operating profit of $2.6 million or 4% of revenue for Q4-24 . We expect to sustain positive non-GAAP operating profit in 2026. GAAP net loss was ($7.5) million compared to ($5.4) million for Q4-24. Non-GAAP net income was $2.3 million or 3% of revenue, compared to $1.6 million or 2% of revenue in the prior-year period. GAAP net loss per share was ($0.09), compared to ($0.07) for the fourth quarter of 2024. Non-GAAP basic and diluted income per share was $0.03, an improvement relative to $0.02 for the fourth quarter of 2024. Our Remaining Performance Obligations (RPO) totaled $288.8 million at the end of Q4-25, up 17% YoY from $246.0 million at the end of Q4-24. We expect to recognize approximately 69% of total Q4-25 RPO as revenue over the next 12 months. We ended the fourth quarter with $72.4 million in cash and cash equivalents and no outstanding debt. Net cash generated from operating activities was $1.5 million in Q4-25, 13 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 compared to $3.4 million in Q4-24. Non-GAAP normalized free cash flow was $1.0 million in Q4-25, compared to $2.7 million in Q4-24. Importantly, Q4-25 is the ninth consecutive quarter of positive free cash flow, which we aim to sustain going forward. Our Business Outlook For the full year of 2026, we expect total revenue in the range of $305.0 million to $315.0 million, representing approximately 10% YoY growth at the midpoint of the range. In the first quarter of 2026, we expect total revenue in the range of $72.0 million to $74.0 million, representing approximately 9% YoY growth at the midpoint of the range. For the full year of 2026, we expect non-GAAP operating profit to be between $16.0 million and $19.0 million. We expect non-GAAP operating profit for the first quarter of 2026, to be in the range of $0.5 million to $2.5 million. Our Focus on Profitable Growth At the beginning of 2025, we shared with you our three strategic objectives for the year and are pleased with the progress that we made during 2025: (1) To expand our investment to enhance our Digital Data to provide our customers with the tools and capabilities to compete and win in the rapidly evolving digital world. During 2025 we launched a series of new products, including Gen AI Intelligence, App Intelligence and Ad Intelligence, as part of our efforts to provide the most comprehensive view of the digital world. We are super pleased with the adoption of these products by our customers. (2) Expand our GTM teams and land additional enterprise customers as we continue to expand the existing enterprise customer base. We are encouraged by the 11% YoY increase in total customer accounts and 12% YoY growth in $100,000 customers that account for 63% of revenues. The increase in multi-year customers as a percentage of ARR to 60% is also encouraging and provides increased visibility during a volatile economic environment. 14 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 (3) To operate efficiently. 2025 was our second consecutive year of positive non-GAAP operating profit, and positive free cash flow. Q4-25 was our ninth consecutive quarter of positive free cash flow. We are proud of these operational achievements during a challenging period. In 2026, we plan to remain profitable on a non-GAAP basis and cash-generative on a quarterly basis. We believe that our culture of disciplined execution will continue to create opportunities for us to perform well in the future. We remain focused on working to become a “Rule of 40” company on an annual basis over time. As we turn our attention to 2026 we intend to increase our investment to capitalize on the significant market opportunities while remaining focused on generating profitable growth on an annual basis. First, In 2026, we will focus on accelerating the opportunities and monetizing the benefits that the AI revolution provides. The AI world is evolving rapidly and we continue to identify additional opportunities. We plan to expand the supply of our proprietary Digital Data to support LLM training, while scaling sales and adoption of our GenAI Intelligence products across existing and new customers. We will continue to roll out AI agents across specific workflows to reduce time-to-value and increase utilization of our data. In parallel, we will invest in scaling AI Studio through tighter product integration and focused go-to-market execution to broaden access, drive usage, and accelerate monetization. Second, we will focus on improving our go-to-market execution to sell effectively in a rapidly evolving, AI-driven market. We are investing in upskilling our go-to-market teams to address new buyer needs, longer and more complex sales cycles, and emerging AI-focused use cases. This includes dedicated enablement around GenAI Intelligence, AI Studio, and data partnerships, as well as the continued build-out of specialized teams selling to LLM and AI-native customers. We are also encouraging our GTM teams to actively adopt AI tools in their daily workflows to improve prospecting, deal execution, and customer engagement. By aligning product, pricing, and sales motions to this new environment, we aim to improve deal velocity, increase win rates on AI-related opportunities, and more consistently convert pipeline into contracted ARR. Lastly, we will continue to operate efficiently. Q4-25 was our ninth consecutive quarter of positive free cash flow and we reported positive non-GAAP operating profit, exceeding our 15 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 expectations. We believe that our culture of disciplined execution will continue to create opportunities for us to perform well in the future. We remain focused on working to become a “Rule of 40” company on an annual basis over time. As we shared with you in the past, global macroeconomic conditions may continue to present challenges for our business and for our customers, but we believe that much of what we believe is needed to achieve our strategic objectives is within our control. New Chief Financial Officer We are excited that Ran Vered has joined Similarweb at this junction in our journey. Ran shares our conviction that the Digital Data powerhouse that Or and the team have built is a unique asset that is well positioned to succeed in the AI era. We continue to make significant progress towards our long-term profit and free cash flow margin targets and look forward to sharing our progress with you. As we like to say, we are still “just getting started”. Thank you for your continued support as a shareholder. Sincerely, Or Offer Founder and Chief Executive Officer Ran Vered Chief Financial Officer 16 Similarweb Q4 2025 Shareholder Letter

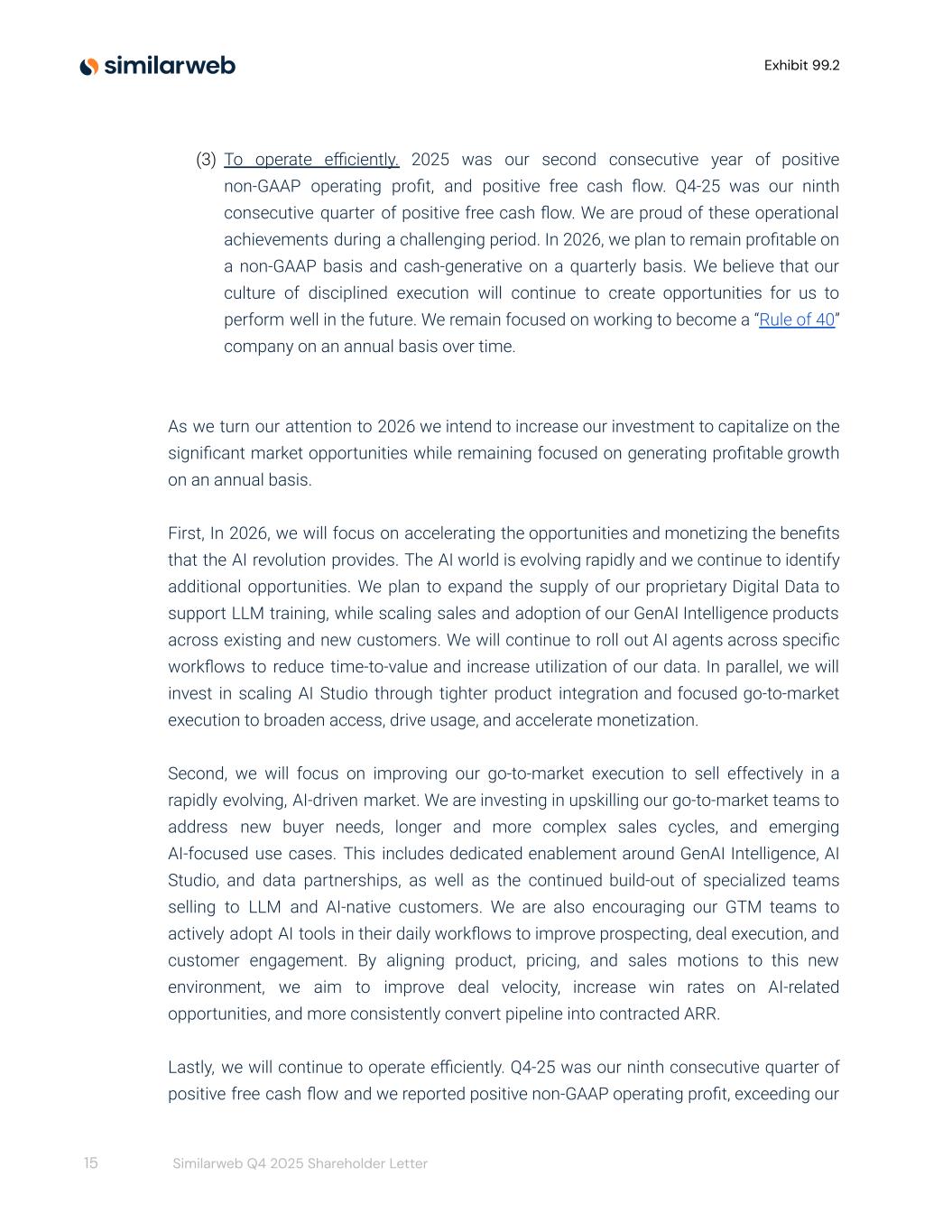

Exhibit 99.2 Consolidated Balance Sheets 17 Similarweb Q4 2025 Shareholder Letter

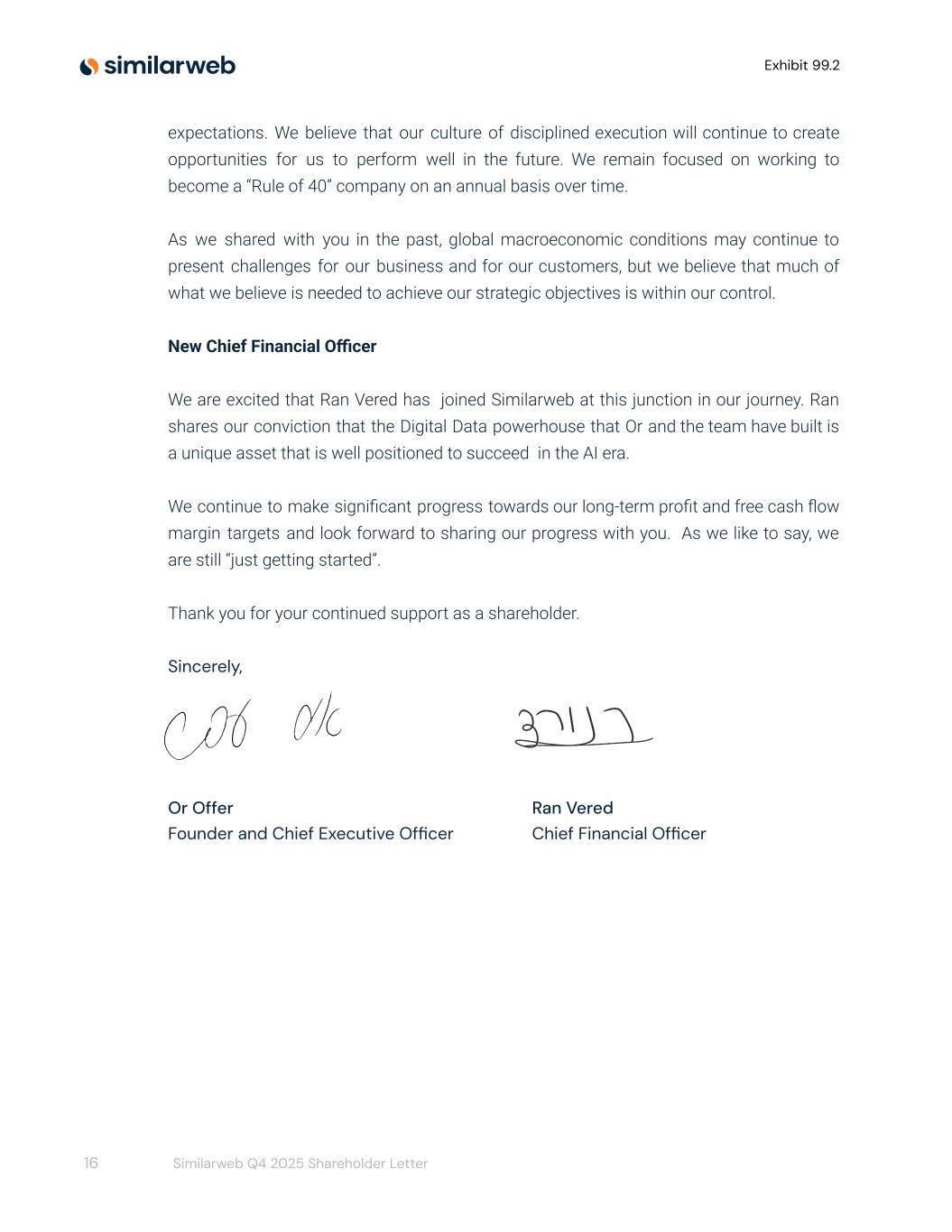

Exhibit 99.2 Consolidated Statements of Comprehensive Income (Loss) 18 Similarweb Q4 2025 Shareholder Letter

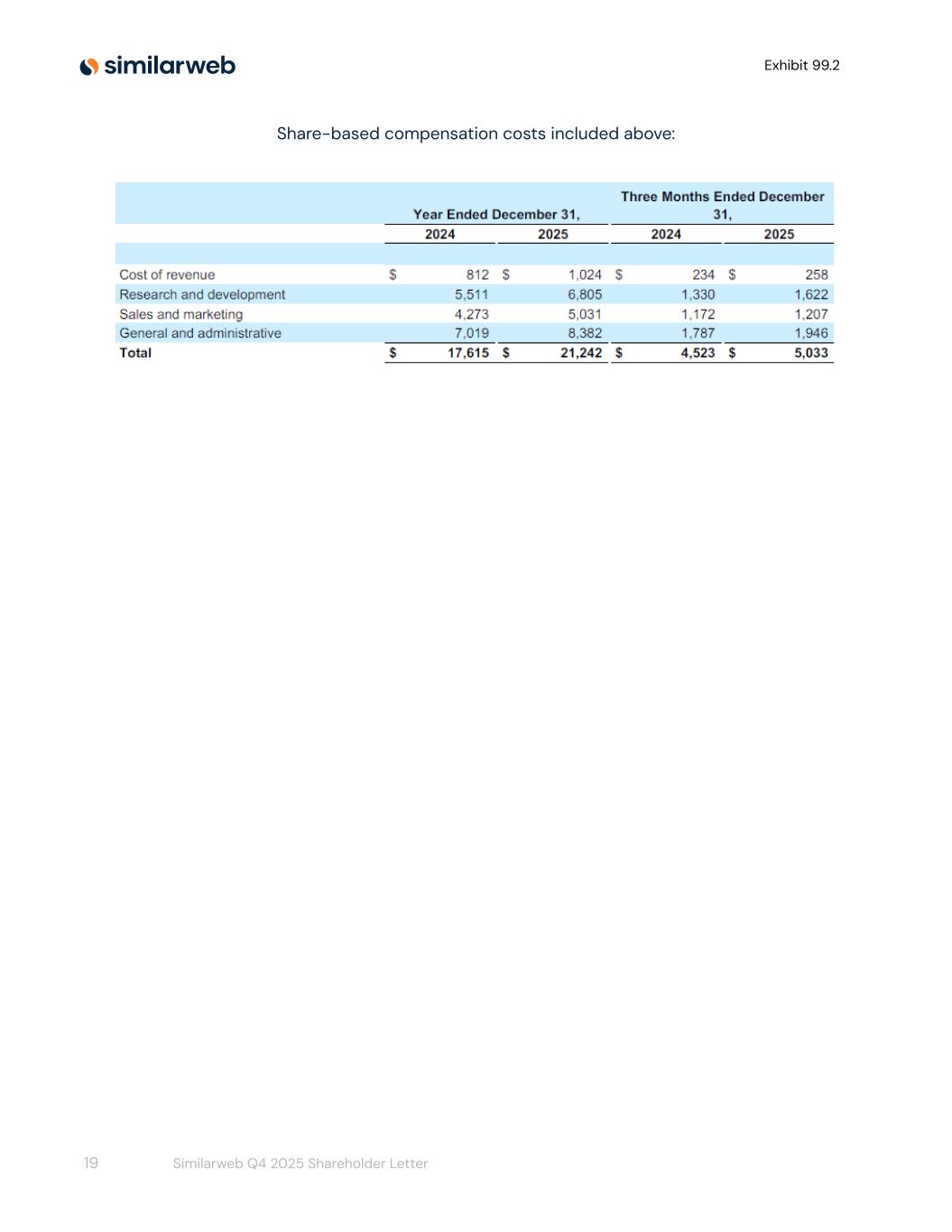

Exhibit 99.2 Share-based compensation costs included above: 19 Similarweb Q4 2025 Shareholder Letter

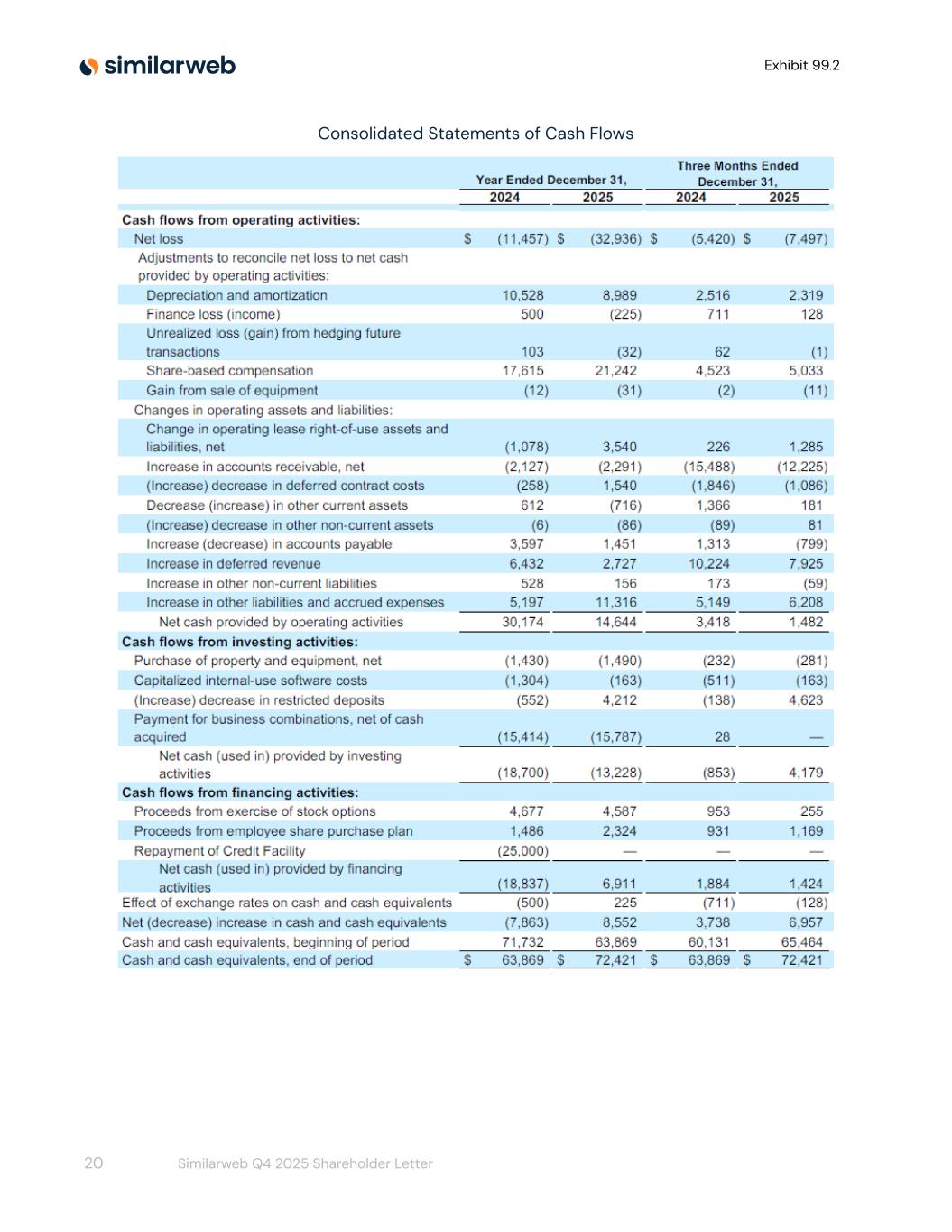

Exhibit 99.2 Consolidated Statements of Cash Flows 20 Similarweb Q4 2025 Shareholder Letter

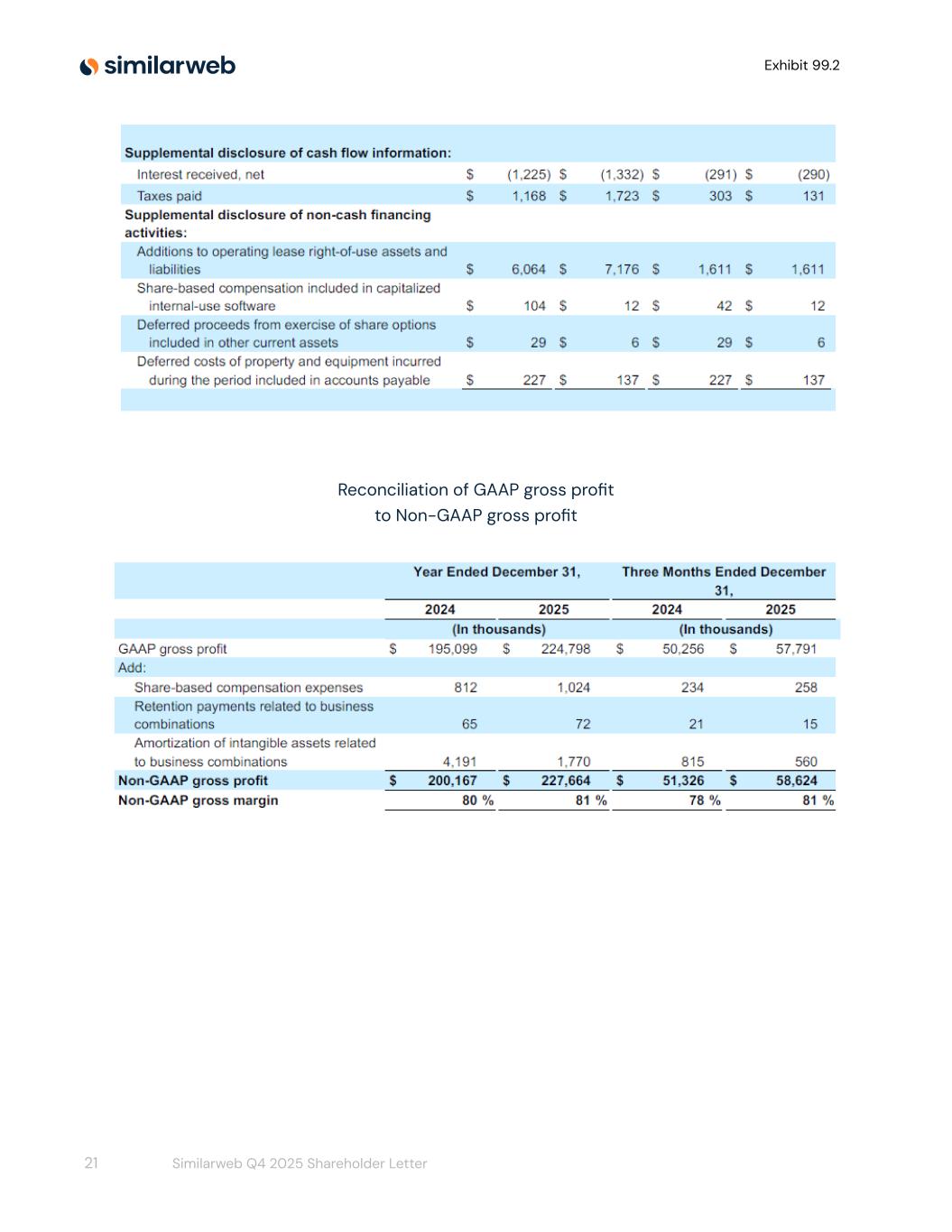

Exhibit 99.2 Reconciliation of GAAP gross profit to Non-GAAP gross profit 21 Similarweb Q4 2025 Shareholder Letter

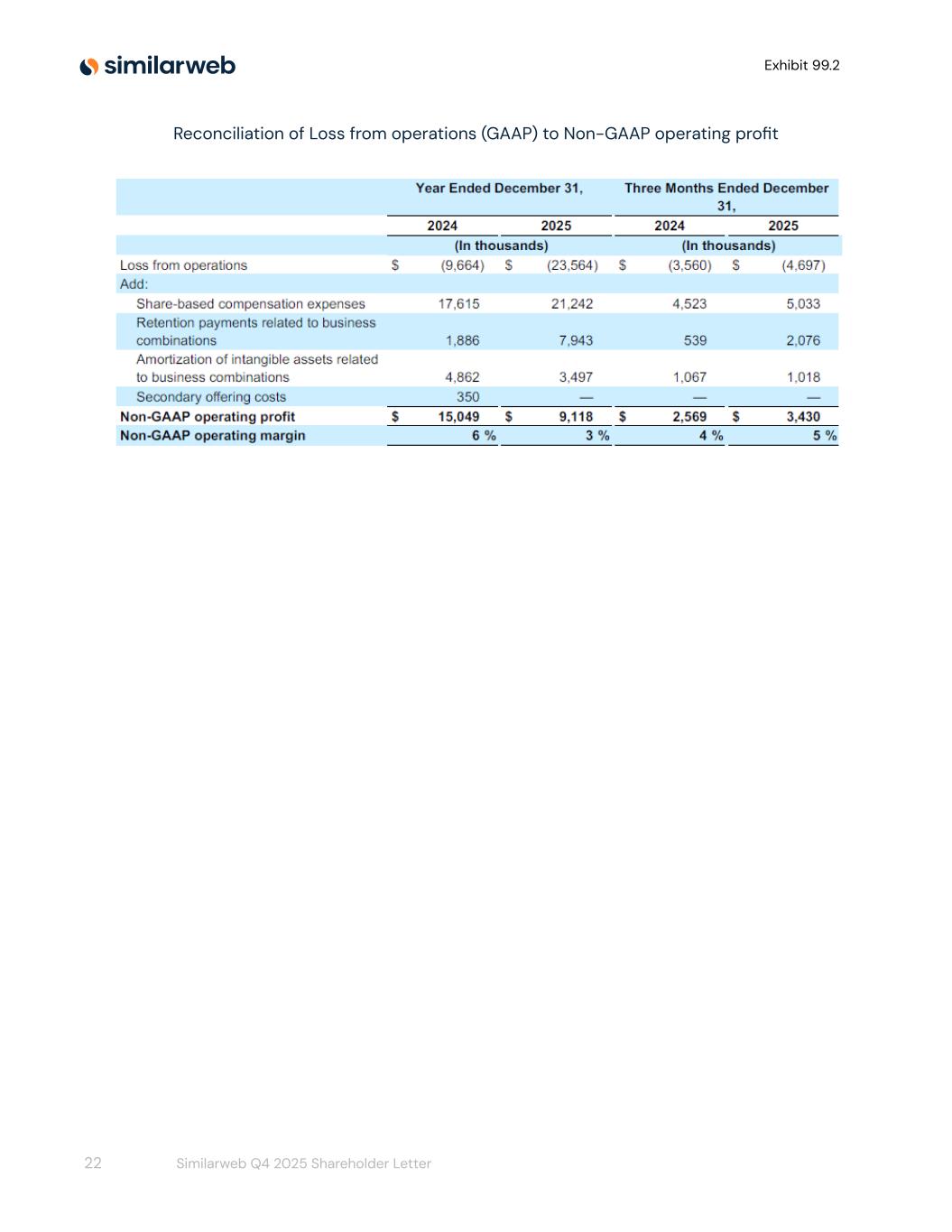

Exhibit 99.2 Reconciliation of Loss from operations (GAAP) to Non-GAAP operating profit 22 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 Reconciliation of GAAP operating expenses to non-GAAP operating expenses 23 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 Reconciliation of Net loss (GAAP) to non-GAAP Net income Reconciliation of net cash provided by operating activities (GAAP) to Free cash flow and Normalized free cash flow 24 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 Forward-Looking Statements This letter to shareholders contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to our guidance for 2026 described under "Business Outlook,” the expected performance of our business, future financial results, strategy, long-term growth and overall future prospects, and our acquisitions and our offerings, our customers’ continued investment in digital transformation and reliance on digital intelligence, our products and solutions and the size of, and our ability to capitalize on, our market opportunity and our plans to invest in sales and R&D. Forward-looking statements include all statements that are not historical facts. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. These forward-looking statements reflect our current views regarding our intentions, products, services, plans, expectations, strategies and prospects, which are based on information currently available to us and assumptions we have made. Actual results may differ materially from those described in such forward-looking statements and are subject to a number of known and unknown risks, uncertainties, other factors and assumptions that are beyond our control. Such risks and uncertainties include, without limitation, risks and uncertainties associated with: (i) our expectations regarding our revenue, expenses and other operating results; (ii) our ability to acquire new customers and successfully retain existing customers; (iii) our ability to successfully develop and market AI solutions and to increase usage of our solutions and upsell and cross-sell additional solutions; (iv) our ability to sustain profitability; (v) anticipated trends, growth rates, changes in currency exchange rates, rising interest rates, rising global inflation and current macroeconomic conditions, and challenges in our business and in the markets in which we operate, and the impact of Israel's war with Hamas and other terrorist organizations, including those in Lebanon and Yemen, and potential hostilities with Iran, Lebanon, and/or other countries in the Middle East on geopolitical and macroeconomic conditions or on our company and business; (vi) future investments in our business, our anticipated capital expenditures and our estimates regarding our capital requirements; (vii) the costs and success of our sales and marketing efforts and our ability to promote our brand; (viii) our reliance on key personnel and our ability to identify, recruit and retain skilled personnel; (ix) our ability to effectively manage our growth, including continued international expansion; (x) our reliance on certain third party platforms and sources for the collection of data necessary for our solutions; (xi) our ability to protect our intellectual property rights and any costs associated therewith; (xii) our ability to identify and complete acquisitions that complement and expand our reach and platform; (xiii) our ability to comply or remain in compliance with laws and regulations that currently apply or become applicable to our business, including in Israel, the United States, the European Union, the United Kingdom and other jurisdictions where we elect to do business; (xiv) our ability to compete effectively with existing competitors and new market entrants; and (xv) the growth rates of the markets in which we compete. 25 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 These risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Form 20-F filed with the Securities and Exchange Commission on February 27, 2025, and subsequent reports that we file with the Securities and Exchange Commission. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Forward-looking statements represent our beliefs and assumptions only as of the date of this letter. Except as required by law, we undertake no duty to update any forward-looking statements contained in this letter as a result of new information, future events, changes in expectations, or otherwise. Certain information contained in this letter relates to or is based on studies, publications, surveys, and other data obtained from third-party sources and the Company's own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this letter, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy, or completeness of any information obtained from third-party sources. In addition, all of the market data included in this letter involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source. Non-GAAP Financial Measures This letter to shareholders contains certain financial measures that are expressed on a non-GAAP basis. We use these non-GAAP financial measures internally to facilitate analysis of our financial and business trends and for internal planning and forecasting purposes. We believe these non-GAAP financial measures, when taken collectively, may be helpful to investors because they provide consistency and comparability with past financial performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. However, non-GAAP financial measures have limitations as an analytical tool and are presented for supplemental informational purposes only. They should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP and should not be considered a measure of liquidity. Free cash flow represents net cash provided by operating activities, less capital expenditures and capitalized internal-use software costs. Normalized free cash flow represents free cash flow less capital investments related to the Company's headquarters, payments received in connection with these capital investments and deferred payments related to business combinations. Non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP gross profit, non-GAAP gross margin, 26 Similarweb Q4 2025 Shareholder Letter

Exhibit 99.2 non-GAAP research and development expenses, non-GAAP research and development margin, non-GAAP sales and marketing expenses, non-GAAP sales and marketing margin, and non-GAAP general and administrative expenses, non-GAAP net income (loss) and non-GAAP income (loss) per share represent the comparable GAAP financial figure operating income (loss) or expense, less share-based compensation, adjustments and payments related to business combinations, amortization of intangible assets and certain other non-recurring items, non-operating foreign exchange gains or losses and the relevant net tax effect as applicable and indicated in the above tables. Other Metrics Customer acquisition costs (CAC) represent the portion of sales and marketing expenses allocated to acquire new customers. Customer retention costs (CRC) represent the portion of sales and marketing expenses allocated to retain existing customers and to increase existing customers’ subscriptions. CAC payback period is the estimated time in months to recover CAC in terms of incremental gross profit that newly acquired customers generate. Net retention rate (NRR) represents the comparison of our ARR from the same set of customers as of a certain point in time, relative to the same point in time in the previous year, expressed as a percentage. We define Annual Recurring Revenue (ARR) as the annualized subscription revenue we would contractually expect to receive from customers assuming no increases or reductions in their subscriptions. A contract is included in ARR for a particular period if it is active at the end of the applicable period and is excluded if it is not active at the end of the applicable period. Multi-year contracts are annualized by dividing the total committed contract value by the number of months in the subscription term and then multiplying by 12. ARR excludes non-recurring revenues, non-subscription revenues, revenues that are one-time in nature or revenues from subscriptions to our offerings for a period that is less than an annual subscription term. ARR is an operational measure that management uses to evaluate the scale of our annual subscription contracts. While ARR is useful in assessing the scale of our contracted subscription business, it is not necessarily indicative of future GAAP revenue, which is subject to factors such as customer renewals, expansions, contractions, churn and upsell or cross-sell opportunities. Since ARR is not a defined measure under GAAP, investors should not consider ARR as a substitute for revenue recognized under GAAP or for other GAAP-related measures such as remaining performance obligations or deferred revenue. ARR differs from revenue recognized in accordance with GAAP because GAAP revenue is recognized as performance obligations are satisfied, includes non-recurring revenues, such as revenue that is one-time in nature, subscriptions with less than an annual term, non-subscription revenue and the effects of contract modifications. 27 Similarweb Q4 2025 Shareholder Letter